Fintel reports that on October 30, 2025, DA Davidson maintained coverage of Modine Manufacturing (NYSE:MOD) with a Buy recommendation.

Analyst Price Forecast Suggests 10.13% Upside

As of October 30, 2025, the average one-year price target for Modine Manufacturing is $168.88/share. The forecasts range from a low of $124.67 to a high of $194.25. The average price target represents an increase of 10.13% from its latest reported closing price of $153.35 / share.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Modine Manufacturing is 2,521MM, a decrease of 6.13%. The projected annual non-GAAP EPS is 4.56.

What is the Fund Sentiment?

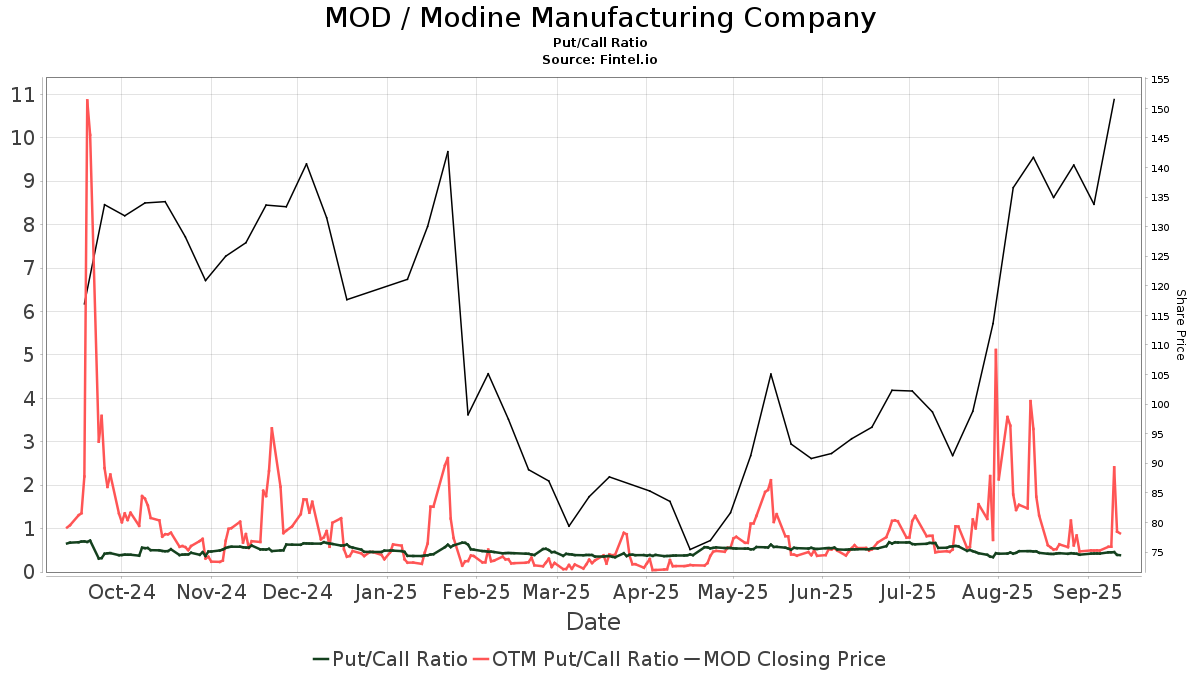

There are 848 funds or institutions reporting positions in Modine Manufacturing. This is an increase of 11 owner(s) or 1.31% in the last quarter. Average portfolio weight of all funds dedicated to MOD is 0.34%, an increase of 19.62%. Total shares owned by institutions decreased in the last three months by 0.09% to 74,905K shares.  The put/call ratio of MOD is 0.44, indicating a bullish outlook.

The put/call ratio of MOD is 0.44, indicating a bullish outlook.

What are Other Shareholders Doing?

Wellington Management Group Llp holds 3,326K shares representing 6.34% ownership of the company. In its prior filing, the firm reported owning 2,469K shares , representing an increase of 25.78%. The firm increased its portfolio allocation in MOD by 63.14% over the last quarter.

SMCWX - SMALLCAP WORLD FUND INC holds 1,808K shares representing 3.45% ownership of the company. In its prior filing, the firm reported owning 1,919K shares , representing a decrease of 6.12%. The firm increased its portfolio allocation in MOD by 5.78% over the last quarter.

Wasatch Advisors holds 1,792K shares representing 3.41% ownership of the company. In its prior filing, the firm reported owning 1,768K shares , representing an increase of 1.34%. The firm increased its portfolio allocation in MOD by 22.06% over the last quarter.

Paradigm Capital Management holds 1,634K shares representing 3.11% ownership of the company. In its prior filing, the firm reported owning 1,648K shares , representing a decrease of 0.86%. The firm increased its portfolio allocation in MOD by 11.66% over the last quarter.

VTSMX - Vanguard Total Stock Market Index Fund Investor Shares holds 1,602K shares representing 3.05% ownership of the company. In its prior filing, the firm reported owning 1,657K shares , representing a decrease of 3.44%. The firm increased its portfolio allocation in MOD by 10.70% over the last quarter.

Fintel is one of the most comprehensive investing research platforms available to individual investors, traders, financial advisors, and small hedge funds.

Our data covers the world, and includes fundamentals, analyst reports, ownership data and fund sentiment, options sentiment, insider trading, options flow, unusual options trades, and much more. Additionally, our exclusive stock picks are powered by advanced, backtested quantitative models for improved profits.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.