Fintel reports that on August 8, 2023, DA Davidson maintained coverage of Envestnet (NYSE:ENV) with a Buy recommendation.

Analyst Price Forecast Suggests 30.65% Upside

As of August 2, 2023, the average one-year price target for Envestnet is 71.40. The forecasts range from a low of 47.47 to a high of $84.00. The average price target represents an increase of 30.65% from its latest reported closing price of 54.65.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Envestnet is 1,328MM, an increase of 9.69%. The projected annual non-GAAP EPS is 2.15.

What is the Fund Sentiment?

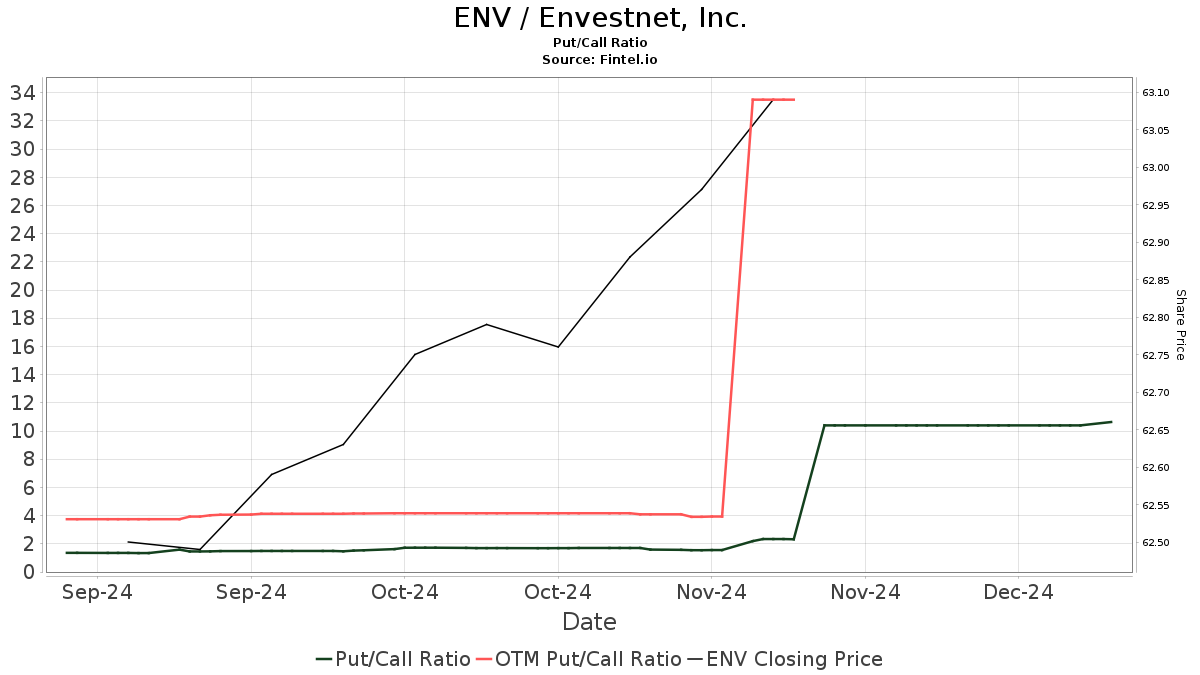

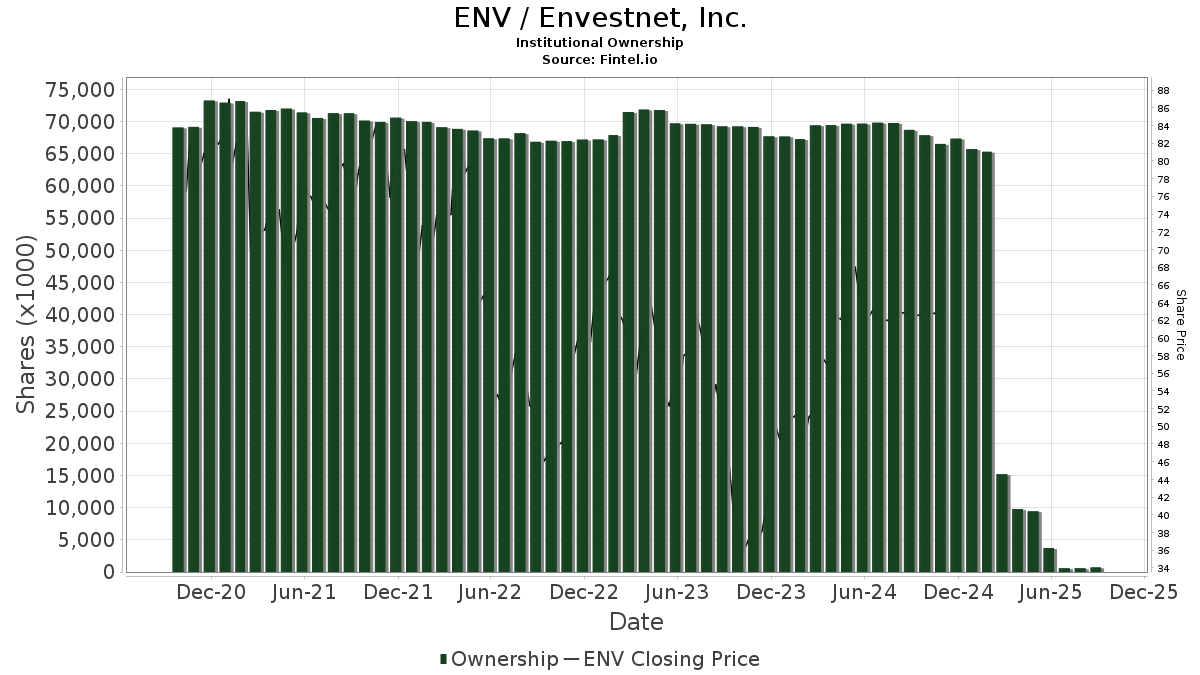

There are 560 funds or institutions reporting positions in Envestnet. This is a decrease of 17 owner(s) or 2.95% in the last quarter. Average portfolio weight of all funds dedicated to ENV is 0.25%, a decrease of 2.75%. Total shares owned by institutions decreased in the last three months by 3.12% to 69,218K shares.  The put/call ratio of ENV is 6.00, indicating a bearish outlook.

The put/call ratio of ENV is 6.00, indicating a bearish outlook.

What are Other Shareholders Doing?

Impactive Capital holds 4,151K shares representing 7.61% ownership of the company. No change in the last quarter.

Jpmorgan Chase holds 3,021K shares representing 5.54% ownership of the company. In it's prior filing, the firm reported owning 3,030K shares, representing a decrease of 0.31%. The firm decreased its portfolio allocation in ENV by 12.41% over the last quarter.

Advent International holds 1,881K shares representing 3.45% ownership of the company. No change in the last quarter.

VTSMX - Vanguard Total Stock Market Index Fund Investor Shares holds 1,707K shares representing 3.13% ownership of the company. In it's prior filing, the firm reported owning 1,676K shares, representing an increase of 1.82%. The firm decreased its portfolio allocation in ENV by 10.57% over the last quarter.

Earnest Partners holds 1,584K shares representing 2.90% ownership of the company. In it's prior filing, the firm reported owning 1,847K shares, representing a decrease of 16.63%. The firm decreased its portfolio allocation in ENV by 16.17% over the last quarter.

Envestnet Background Information

(This description is provided by the company.)

Envestnet, Inc. is transforming the way financial advice and wellness are delivered. Its mission is to empower advisors and financial service providers with innovative technology, solutions, and intelligence to make financial wellness a reality for everyone. Over 106,000 advisors across more than 5,100 companies-including 17 of the 20 largest U.S. banks, 47 of the 50 largest wealth management and brokerage firms, over 500 of the largest RIAs, and hundreds of FinTech companies-leverage the Envestnet platform to grow their businesses and client relationships.

Additional reading:

- Envestnet Reports Second Quarter 2023 Financial Results

- 2Q 2023 Earnings Supplemental Presentation August 3, 2023 © 2023 Envestnet, Inc. All rights reserved. 2 Safe Harbor Disclosure The forward-looking statements made in this presentation concerning, among other things, Envestnet, Inc.’s expected financi

- Envestnet Reports First Quarter 2023 Financial Results

- 1Q 2023 Earnings Supplemental Presentation May 4, 2023 © 2023 Envestnet, Inc. All rights reserved. 2 Safe Harbor Disclosure The forward-looking statements made in this presentation concerning, among other things, Envestnet, Inc.’s expected financial

- Cooperation Agreement, dated March 27, 2023, by and among Impactive Capital LP, Impactive Capital Master Fund LP and Envestnet, Inc.*

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.