Crocs, Inc. CROX is leaning heavily on digital engagement to fuel growth, highlighted by its month-long, 24/7 livestream experiment that boosted follower counts and new customer acquisition. Crocs is leading the U.S. footwear brand on TikTok shop with accelerated adoption among younger customers, as the platform is becoming increasingly popular among younger shoppers. Crocs remains the number one footwear brand on the TikTok Shop in the United States.

In October, Crocs launched continuous live-streaming for both of its brands on TikTok and its website, becoming the first brand to stream 24/7 for an entire month. This initiative successfully boosted engagement, driving an increase in followers and attracting new customers. These initiatives highlight the company’s ability to leverage innovative digital strategies to expand its customer base

The Crocs brand’s DTC sales grew 2% year over year in the third quarter of fiscal 2025. North America revenue declined 8.8% year over year, due to an intentional pullback in discounting, though strong digital marketplace performance helped offset the impact. HEYDUDE DTC revenue dipped 0.5% year over year, influenced by new store additions and continued digital momentum, particularly on TikTok Shop. International DTC revenue surged 25.9% year over year, driven by broad-based strength across both digital channels and retail, underscoring the brand’s expanding global reach.

Overall, Crocs’ accelerating digital momentum, fueled by innovative livestreaming, strong marketplace performance, and robust international DTC growth, positions the company to offset regional softness. If this traction continues, digital channels could become a significant catalyst for revenue growth and deeper customer engagement as the company progresses into 2025, strengthening Crocs’ competitive edge across key markets.

The Zacks Rundown for CROX

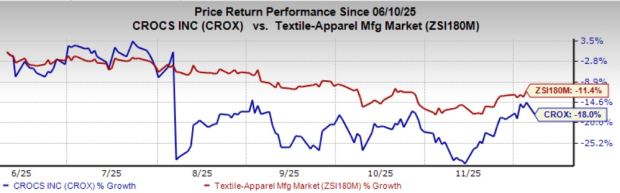

Crocs’ shares have gained 6.2% in the past three months against the industry’s decline of 1.2%. CROX presently sports a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

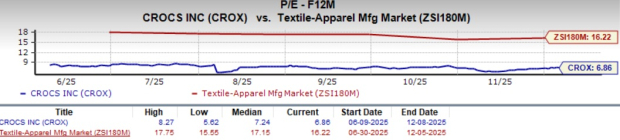

From a valuation standpoint, CROX trades at a forward price-to-earnings ratio of 6.86X, lower than the industry’s average 16.22X.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for CROX’s 2025 earnings implies a year-over-year decline of 7.9%, and the same for 2026 indicates year-over-year growth of 3.9%. CROX delivered a trailing four-quarter earnings surprise of 14.3% on average.

Image Source: Zacks Investment Research

Other Stocks to Consider

Some other top-ranked stocks have been discussed below:

Alto Ingredients, Inc. ALTO produces, distributes, and markets specialty alcohols, renewable fuel, and essential ingredients in the United States. At present, the company flaunts a Zacks Rank of 1. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Alto Ingredients’ current fiscal-year sales implies a decline of 2.7%, and the same for current fiscal-year earnings implies growth of 78.7% from the year-ago figures. ALTO has delivered a trailing four-quarter earnings surprise of 81.7%, on average.

Kontoor Brands, Inc. KTB, a lifestyle apparel company, designs, produces, procures, markets, distributes, and licenses denim, apparel, footwear, and accessories, primarily under the Wrangler and Lee brands. At present, Kontoor Brands holds a Zacks Rank of 2 (Buy).

The consensus estimate for Kontoor Brands’ current fiscal-year sales and earnings implies growth of 19.4% and 12.5%, respectively, from the year-ago figures. RL has delivered a trailing four-quarter earnings surprise of 14 %, on average.

The Beachbody Company Inc. BODI operates as a fitness and nutrition company in the United States, Canada, the United Kingdom, and France. At present, the company holds a Zacks Rank of 2.

The Zacks Consensus Estimate for Beachbody’s current fiscal-year sales implies a decline of 40.4%, and the same for current fiscal-year earnings implies growth of 89.1% from the year-ago figures. BODI has delivered a trailing four-quarter earnings surprise of 76.1%, on average.

Radical New Technology Could Hand Investors Huge Gains

Quantum Computing is the next technological revolution, and it could be even more advanced than AI.

While some believed the technology was years away, it is already present and moving fast. Large hyperscalers, such as Microsoft, Google, Amazon, Oracle, and even Meta and Tesla, are scrambling to integrate quantum computing into their infrastructure.

Senior Stock Strategist Kevin Cook reveals 7 carefully selected stocks poised to dominate the quantum computing landscape in his report, Beyond AI: The Quantum Leap in Computing Power.

Kevin was among the early experts who recognized NVIDIA's enormous potential back in 2016. Now, he has keyed in on what could be "the next big thing" in quantum computing supremacy. Today, you have a rare chance to position your portfolio at the forefront of this opportunity.

See Top Quantum Stocks Now >>Crocs, Inc. (CROX) : Free Stock Analysis Report

Kontoor Brands, Inc. (KTB) : Free Stock Analysis Report

Alto Ingredients, Inc. (ALTO) : Free Stock Analysis Report

The Beachbody Company, Inc. (BODI) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.