Credo Technology Group Holding Ltd CRDO will report its first-quarter fiscal 2026 results on Sept. 3.

The Zacks Consensus Estimate for the bottom line in the to-be-reported quarter is pegged at 35 cents compared with 4 cents reported in the prior year quarter. The estimate has remained unchanged in the past 60 days. The consensus estimate for total revenues is pinned at $190 billion, implying a 218.2% year-over-year increase.

For the fiscal first quarter, CRDO expects revenues between $185 million and $195 million.

Image Source: Zacks Investment Research

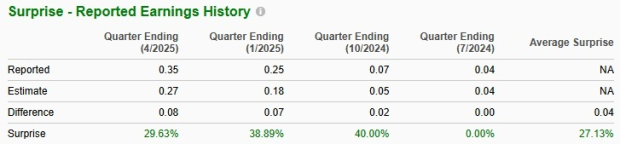

Credo beat the Zacks Consensus Estimate for earnings in three of the trailing four quarters, while matching in the remaining quarter, with an average earnings surprise of 27.1%.

What Our Model Predicts for CRDO’s Q1

Our proven model does not conclusively predict an earnings beat for CRDO this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. But that is not the case here. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

CRDO has an Earnings ESP of 0.00% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Factors to Focus on Ahead of CRDO’s Q1 Earnings

Amid exponential data growth and rapid AI proliferation, market demand for faster and energy-efficient connectivity solutions continues to increase. This bodes well for Credo. Strong portfolio consisting of active electrical cables (AECs), optical DSPs and retimers is likely to witness strong gains as hyperscalers scale up production of their AI platforms.

Expansion beyond intra-rack into rack-to-rack use cases is driving AEC momentum further. The demand for AECs is increasing as ZeroFlap AECs offer more than 100 times improved reliability than laser-based optical solutions. This made AECs an increasingly attractive option for data center applications, contributing to the new expansion of AEC usage and further solidifying Credo Technology’s position in the market.

Another bright spot is Credo's Optical DSP business. CRDO anticipates expansion of customer diversity across lane rates, port speeds and applications to accelerate revenue growth going ahead for this segment. In the last reported quarter, CRDO had launched ultra-low-power 100-gig per lane optical DSPs built on 5-nanometer technology. CRDO highlighted that this particular suite, including full DSP and linear receive optics or LRO variants, sets “new industry benchmarks for power efficiency”. Increasing adoption of PCIe Retimers is likely to have acted as a tailwind.

Credo Technology Group Holding Ltd. Price and EPS Surprise

Credo Technology Group Holding Ltd. price-eps-surprise | Credo Technology Group Holding Ltd. Quote

Operating leverage from rapid top-line growth is likely to cushion margin performance. In the last reported quarter, non-GAAP gross margin reached 67.4%, exceeding the high end of guidance, while operating income surged to $62.5 million, up from $42.4 million in the prior quarter. For the current quarter, CRDO expects non-GAAP gross margin to be between 64% and 66%.

Nonetheless, increasing market competition and macroeconomic uncertainties remain concerns. Credo competes with semiconductor giants like Broadcom Inc. AVGO and Marvell Technology, Inc. MRVL. R&D spend is likely to ramp up as CRDO focuses on product innovation. Increasing costs can become a problem if the revenue growth does not keep pace. Credo’s non-GAAP operating expenses in the fiscal fourth quarter surged 19% sequentially to $52 million, primarily due to higher headcount. It expects non-GAAP operating expenses to be between $54 million and $56 million in the to-be-reported quarter.

Overreliance on a few clients for revenue growth is an additional headwind. In the last reported quarter, three hyperscalers each contributed more than 10% of total revenues. This intense customer concentration risk can impact revenues as the company becomes highly vulnerable to the loss of business from those clients.

CRDO Stock Skyrockets

CRDO shares have surged 116.2% in the past three months, significantly outperforming its Electronics - Semiconductors industry, Zacks Computer and Technology sector and S&P 500 composite’s gains of 19.9%, 15.5% and 10.1%, respectively.

Price Performance

Image Source: Zacks Investment Research

The company has outperformed its peers, like Broadcom, Marvell and Astera Labs ALAB, which have gained 27.2%, 17.8% and 108.5%, respectively.

Is CRDO's Lofty Valuation a Concern?

Credo Technology stock is also not so cheap, as its Value Style Score of F suggests a stretched valuation at this moment. In terms of the forward 12-month Price/Sales ratio, CRDO is trading at 26.02, higher than the Electronic-Semiconductors sector’s multiple of 8.83.

Image Source: Zacks Investment Research

In comparison, Broadcom trades at a forward 12-month P/S multiple of 19.85, while Astera Labs and Marvell Technology are trading at a multiple of 34.65 and 7.34, respectively.

CRDO Stock: Hold Before Q1

CRDO is witnessing strong momentum, owing to a differentiated portfolio, spanning active AECs, optical DSPs, and PCIe retimers, which places it at the center of the AI infrastructure buildout.

That said, investors should weigh several risks before chasing the stock further. Risks like customer concentration, elevated expenses, and competitive pressures from larger players, such as Broadcom and Marvell, present meaningful execution risks.

CRDO’s stretched valuation as evidenced by a high forward P/S ratio of 26.02, is another concern. Consequently, investors should wait for a better entry point. However, existing investors can hold the stock as its long-term growth prospects remain intact.

Zacks Names #1 Semiconductor Stock

This under-the-radar company specializes in semiconductor products that titans like NVIDIA don't build. It's uniquely positioned to take advantage of the next growth stage of this market. And it's just beginning to enter the spotlight, which is exactly where you want to be.

With strong earnings growth and an expanding customer base, it's positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $971 billion by 2028.

See This Stock Now for Free >>Marvell Technology, Inc. (MRVL) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

Credo Technology Group Holding Ltd. (CRDO) : Free Stock Analysis Report

Astera Labs, Inc. (ALAB) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.