Credo Technology Group Holding Ltd CRDO is scheduled to report second-quarter fiscal 2026 results on Monday, Dec.1, 2025, after the closing bell.

The Zacks Consensus Estimate for the bottom line for the to-be-reported quarter is pegged at 49 cents, suggesting a 600% year-over-year surge. The estimate has remained unchanged in the past 60 days. The consensus estimate for total revenues is pinned at $235.2 million, implying a 226.6% increase.

For the fiscal second quarter, CRDO expects revenues between $230 million and $240 million, representing a 5% quarter-over-quarter increase at the midpoint.

Image Source: Zacks Investment Research

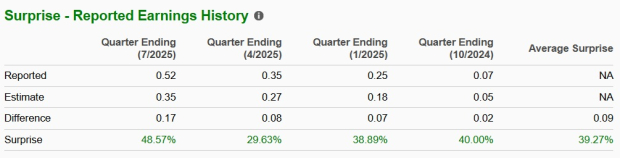

Credo beat the Zacks Consensus Estimate for earnings in each of the trailing four quarters, with an average earnings surprise of 33.5%.

What Our Model Reveals

Our proven model does not conclusively predict an earnings beat for CRDO this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. But that is not the case here. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

CRDO has an Earnings ESP of 0.00% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Key Factors Before CRDO’s Q2

Credo’s fiscal second-quarter performance is likely to have been driven by strong demand for its active electrical cables (AEC) and optical products, along with deeper engagement with hyperscalers. Its technology delivers top-tier connectivity performance, handling speeds up to 1.6 Tbps across a broad range of industry protocols. For the current quarter, CRDO expects non-GAAP gross margin to be between 64% and 66% and Opex at $56-$58 million.

Growing AI infrastructure investments from hyperscalers and data centers are raising the demand for Credo’s high-performance, low-power connectivity solutions. As AI-driven infrastructure expands, the company is positioned to benefit from multiple growth trends, strengthening its role as a key player in next-generation data center networks. Credo reported fiscal first-quarter revenues of $223.1 million, up 31% sequentially and 274% year over year, surpassing guidance. Product revenue increased 279% year over year to $217.1 million, driven by continued double-digit sequential gains in AEC reaching new record levels.

Strategic hyperscaler partnerships continue to fuel Credo’s growth, supported by solutions that cover the entire product development cycle. Its integrated innovation framework—SerDes, IC design and system-level engineering, along with robust software and firmware—enables customers to build faster and achieve higher performance and reliability.

Credo Technology Group Holding Ltd. Price and EPS Surprise

Credo Technology Group Holding Ltd. price-eps-surprise | Credo Technology Group Holding Ltd. Quote

Credo’s optical segment is performing well, keeping it on track to double optical revenues this fiscal year. Its advanced DSPs serve a growing base of customers and hyperscalers, and collaboration with them ensures strong performance, scalability and energy efficiency. Credo is putting a strong focus on optical products as a core strategy. With TAM expanding into copper and optical, the company aims to use its system-level strengths to grow its presence in optical.

Further, it is seeing solid momentum in Ethernet retimers, and its PCIe retimer family is attracting strong customer interest. The solutions deliver long reach and ultra-low latency, and the company expects design wins in 2025 with revenues in 2026. This PCIe expansion boosts Credo’s TAM and sets it up well for the move to 200-gig-per-lane AI networks.

However, tougher competition and an uncertain macro backdrop due to looming tariff shifts continue to pose challenges. Credo competes with semiconductor bigshots like Broadcom Inc. AVGO and Marvell Technology, Inc. MRVL.

Also, heavy reliance on a few customers creates concentration risks, leaving the company exposed to sharp revenue hits if any major client pulls back. In the fiscal first quarter, its top three customers each made up more than 10% of revenue. While customer mix will shift quarter to quarter, the company is continuing to diversify. Credo still expects three to four customers to remain above 10% of revenue in the to-be-reported quarter as existing hyperscalers scale up and two new hyperscaler ramps begin in fiscal 2026.

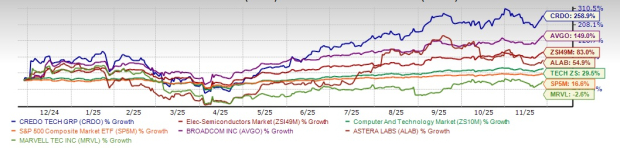

CRDO Stock vs. Industry

CRDO shares have skyrocketed 258.9% in the past year, significantly outperforming its Electronics - Semiconductors industry, Zacks Computer and Technology sector and S&P 500 composite’s gains of 83%, 29.5% and 16.6%, respectively.

Image Source: Zacks Investment Research

The company has outperformed its peers, like Broadcom, Marvell and Astera Labs ALAB. AVGO and ALAB have gained 149% and 54.9%, respectively, while MRVL has lost 2.6% in the same time frame.

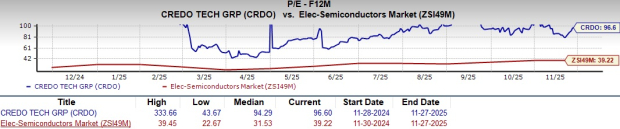

CRDO Trades at a Premium

From a valuation standpoint, CRDO appears to be trading at a premium relative to the industry and is trading well above its mean. Going by the price/earnings ratio, the company shares currently trade at 96.6 forward earnings, higher than 39.22 for the industry and the stock’s mean of 94.29.

Image Source: Zacks Investment Research

In comparison, Broadcom trades at a forward 12-month P/E multiple of 51.24, while Astera Labs and Marvell Technology are trading at a multiple of 120.93 and 34.37, respectively.

Our Viewpoint: Hold CRDO for Now

Credo has grown quickly on the back of AI investment and stands out for its ability to deliver high-speed SerDes. It expects multiple future growth waves from evolving AI network architectures, all requiring advanced connectivity. The company remains on track for continued expansion through fiscal 2026 and beyond. Its cutting-edge AECs are gaining broader traction across the market along with optical solutions.

However, key risks include heavy dependence on a few hyperscalers, which could sharply hurt revenue in case of pullback, macro swings and tariff woes hurting revenue and margins, potential manufacturing ramp issues and vulnerability to shifts in hyperscaler AI spending that could quickly affect orders. Also, cut-throat rivalry from Broadcom and Marvell and a premium valuation might not bode well with investors. CRDO seems to be treading in the middle of the road, and investors could be better off if they trade with caution.

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpMarvell Technology, Inc. (MRVL) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

Credo Technology Group Holding Ltd. (CRDO) : Free Stock Analysis Report

Astera Labs, Inc. (ALAB) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.