Costco Wholesale Corporation’s COST net sales grew 8.3% over the first nine weeks of fiscal 2026, reaching $48.33 billion, reflecting consistent shopper engagement and setting an optimistic tone for the holiday season. October’s performance showed an 8.6% increase in sales, driven by solid total comparable sales gains of 6.6%. The United States remained the main contributor with a 6.6% rise in comparable sales, while Canada and other international markets grew 6.3% and 7.2%, respectively.

Digitally enabled sales surged 21.6% during the nine weeks ended Nov. 2, 2025. This growth indicates that Costco has effectively captured the ongoing shift toward e-commerce and is not solely dependent on warehouse traffic. The company’s ability to leverage bulk purchasing and maintain an efficient supply chain allows it to offer competitive pricing.

Although last year’s October sales were negatively impacted by pull-forward activity related to Hurricane Helene and port strikes in September, current growth appears more organic, with stable underlying demand. This paints a promising outlook for a strong holiday quarter, assuming inflationary pressures and shifts in consumer spending patterns do not derail progress.

As the quarter progresses, focus will shift to basket sizes and category mix as consumers prioritize essentials and select discretionary items. The October and early-quarter sales data provide a positive outlook, as Costco enters the holiday season with strong momentum and a loyal customer base.

What the Latest Metrics Say About Costco

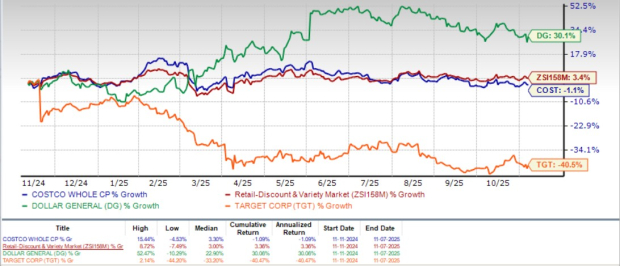

Costco, which competes with Dollar General Corporation DG and Target Corporation TGT, has seen its share decline 1.1% in the past year against the industry’s growth of 3.4%. While shares of Dollar General have rallied 30.1%, Target has dropped 40.5% in the aforementioned period.

Image Source: Zacks Investment Research

From a valuation standpoint, Costco's forward 12-month price-to-earnings ratio stands at 45.43, higher than the industry’s ratio of 29.83. COST carries a Value Score of D. Costco is trading at a premium to Target (with a forward 12-month P/E ratio of 11.49) and Dollar General (15.19).

Image Source: Zacks Investment Research

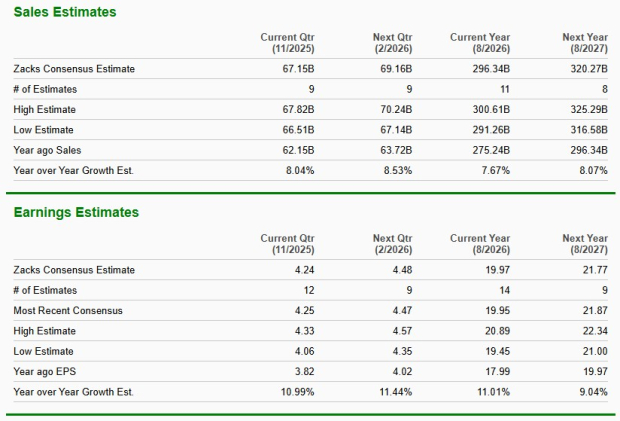

The Zacks Consensus Estimate for Costco’s current financial-year sales and earnings per share implies year-over-year growth of 7.7% and 11%, respectively.

Image Source: Zacks Investment Research

Costco currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the favorite stock to gain +100% or more in the months ahead. They include

Stock #1: A Disruptive Force with Notable Growth and Resilience

Stock #2: Bullish Signs Signaling to Buy the Dip

Stock #3: One of the Most Compelling Investments in the Market

Stock #4: Leader In a Red-Hot Industry Poised for Growth

Stock #5: Modern Omni-Channel Platform Coiled to Spring

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor. While not all picks can be winners, previous recommendations have soared +171%, +209% and +232%.

Download Atomic Opportunity: Nuclear Energy's Comeback free today.Target Corporation (TGT) : Free Stock Analysis Report

Dollar General Corporation (DG) : Free Stock Analysis Report

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.