Costco Wholesale Corporation’s COST first-quarter fiscal 2026 performance once again highlighted the strength of the membership business model. Membership income has been one of the company’s most resilient and predictable revenue streams. Membership fees jumped 14% to $1,329 million, gaining from strong renewal rates and the annualized benefit of the recent membership fee increase. Excluding the membership fee increase and FX, membership income rose 7.3% year over year.

Sustained membership growth has been the primary driver of the increase in membership fees. The total number of paid households rose 5.2% to 81.4 million from the prior-year period, while total cardholders grew 5.1% to 145.9 million. A key contributor to membership income was the 9.1% year-over-year increase in executive memberships to 39.7 million. Executive members now represent 74.3% of total sales.

By prioritizing value and quality, the company has built strong customer loyalty, leading to an impressive membership renewal rate of 92.2% in the United States and Canada, and 89.7% worldwide in the quarter. While both renewal rates declined 10 basis points sequentially due to a mix shift toward new online sign-ups, proactive communication efforts aimed at improving retention helped offset some of the pressure.

The quarter highlighted how Costco’s membership income continues to be stable and recurring. The combination of pricing leverage, expanding paid households and executive upgrades reinforces the role of membership fees as a dependable earnings contributor even when the sales environment is not conducive.

BJ’s Wholesale & Walmart Snapshot on Membership Income

BJ’s Wholesale Club Holdings, Inc.’s BJ membership fee income jumped 9.8% to $126.3 million during the third quarter of fiscal 2025, reflecting strength in member acquisition, retention and higher-tier penetration. BJ’s Wholesale highlighted tenured renewal rates of roughly 90% with a strong higher-tier penetration of 41%. BJ’s Wholesale benefits from rising higher-tier membership adoption, which improves the quality and predictability of membership income.

Walmart Inc. WMT reported global membership fee income growth of 17% during the third quarter of fiscal 2026, reflecting momentum across Walmart+ and Sam’s Club. Walmart noted double-digit growth in Walmart+ fee income in the United States, while Sam’s Club delivered growth in member counts, renewal rates and premium Plus membership penetration. As a result, Walmart continues to diversify profit streams by embedding membership income more deeply into its broader omnichannel model, reinforcing its role as a steady and recurring contributor alongside core retail operations.

What the Latest Metrics Say About Costco

Costco stock has declined 10.9% over the past year against the industry’s growth of 1.7%.

Image Source: Zacks Investment Research

From a valuation standpoint, Costco's forward 12-month price-to-earnings ratio stands at 42.99, higher than the industry’s ratio of 30.15. COST carries a Value Score of C.

Image Source: Zacks Investment Research

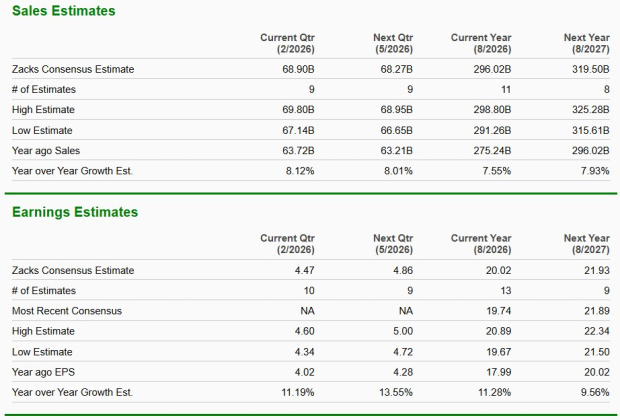

The Zacks Consensus Estimate for Costco’s current financial-year sales and earnings per share implies year-over-year growth of 7.6% and 11.3%, respectively.

Image Source: Zacks Investment Research

Costco currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the favorite stock to gain +100% or more in the months ahead. They include

Stock #1: A Disruptive Force with Notable Growth and Resilience

Stock #2: Bullish Signs Signaling to Buy the Dip

Stock #3: One of the Most Compelling Investments in the Market

Stock #4: Leader In a Red-Hot Industry Poised for Growth

Stock #5: Modern Omni-Channel Platform Coiled to Spring

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor. While not all picks can be winners, previous recommendations have soared +171%, +209% and +232%.

Download Atomic Opportunity: Nuclear Energy's Comeback free today.Walmart Inc. (WMT) : Free Stock Analysis Report

BJ's Wholesale Club Holdings, Inc. (BJ) : Free Stock Analysis Report

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.