Key Points

Costco's stock price increase is consistent with the rise in Walmart's and Target's stocks.

Investors need to watch Costco's valuation.

- 10 stocks we like better than Costco Wholesale ›

Costco Wholesale (NASDAQ: COST) lost value over the last 12 months, so it might surprise investors to see that the stock has risen 15% since the beginning of the year.

The increase is likely not news-driven. Retail stocks such as Walmart and Target have risen in similar proportions, and the company's earnings for the second quarter of fiscal 2026 do not come out until March 5.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Does this increase mean investors should buy Costco stock? Let's take a closer look.

Image source: Getty Images.

What drives Costco's stock

Costco has long been a popular choice for customers and investors alike. It maintains a membership renewal rate of around 92%, an indicator of its consistently loyal following.

On the investor side, it was a longtime holding in Berkshire Hathaway's when Warren Buffett oversaw its investments, and Buffett partner Charlie Munger sat on Costco's board until his passing in 2023.

Moreover, even though Costco does not grow rapidly, its revenue rose by 6% in the first quarter of fiscal 2026 (ended Nov. 23, 2025), and its $2.0 billion in net income for that quarter surged 11% higher. That was close to its fiscal 2025 results, when revenue increased by 8%, and its $8.1 billion profit was 10% above year-ago levels.

Additionally, Costco's warehouses have succeeded in one key area where most competitors have failed -- international expansion. Costco's approach has resonated both in Europe and Asia, markets where Walmart had little success with brick-and-mortar stores. That has given Costco a much larger addressable market.

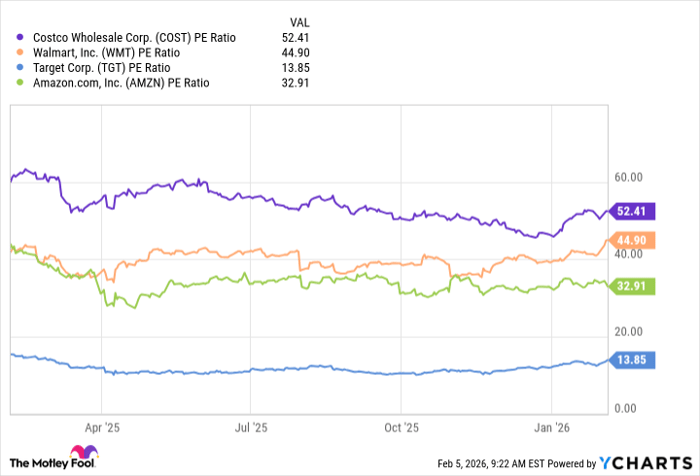

The problem with Costco is its success itself, and it may be too late to buy. Amid the recent rise in the stock price, its P/E ratio is now 52, a level far surpassing Walmart, Target, and even Amazon. Unfortunately, with profits rising in the low double-digits, its growth likely does not justify its valuation.

COST PE Ratio data by YCharts

Furthermore, Berkshire Hathaway closed its Costco position in 2020, in part for this reason. Although Buffett later said that it was "probably a mistake," the valuation has risen since that time, making it more of a concern.

Stand pat on Costco stock

Although long-term investors have good reason to hold Costco stock, investors should not add shares at this time. Indeed, Costco is a high-quality company, and its ability to continue growing its revenue and profits is unlikely to change.

Unfortunately, Costco's success is well known to investors and priced too much into the stock given its valuation. Until its earnings multiple is closer to that of its peers, this stock is probably not a buy.

Should you buy stock in Costco Wholesale right now?

Before you buy stock in Costco Wholesale, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Costco Wholesale wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $443,299!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,136,601!*

Now, it’s worth noting Stock Advisor’s total average return is 914% — a market-crushing outperformance compared to 195% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of February 8, 2026.

Will Healy has positions in Berkshire Hathaway and Target. The Motley Fool has positions in and recommends Amazon, Berkshire Hathaway, Costco Wholesale, Target, and Walmart. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.