The electricity producers in the United States are experiencing a surge in demand for clean electricity. The increase in demand was due to AI-based data centers, an increase in domestic manufacturing through the reshoring of some industries, an increase in usage of electric appliances and rapid adoption of electric vehicles. A massive volume of reliable, 24X7 emission-free electricity can come from the nuclear power plants. Constellation Energy CEG and Duke Energy Corporation DUK produce a large volume of electricity from nuclear power plants and have plans to expand their generation volumes.

Nuclear power plants consistently achieve high-capacity factors, allowing them to run at or near full output for extended periods. This makes nuclear energy a dependable source of baseload electricity, especially compared with intermittent renewables. In May 2025, President Trump signed four executive orders aimed at strengthening the nuclear supply chain and accelerating the deployment of new reactors. These initiatives target a substantial expansion of U.S. nuclear capacity, increasing it from roughly 100 gigawatts (“GW”) today to 400 GW by 2050.

Constellation Energy presents a strong investment opportunity as the largest producer of carbon-free nuclear power in the United States. Its fleet of dependable, high-capacity nuclear plants delivers steady baseload electricity, reducing exposure to commodity price swings and enhancing cash flow predictability. As demand grows for clean, around-the-clock power from data centers and industrial electrification, Constellation Energy is positioned to capture value from zero-emission energy. Ongoing reinvestment and supportive policy initiatives further reinforce its long-term growth prospects.

Duke Energy presents an attractive long-term investment supported by a broad clean energy portfolio along with a dependable nuclear fleet. Its nuclear facilities deliver steady baseload generation, contributing to earnings stability and constructive regulatory engagement. Alongside this foundation, Duke Energy continues to scale its solar, wind and battery storage initiatives, strengthening the clean energy strategy. The combination of reliable nuclear output and an expanding renewable platform positions the company for sustainable rate-base growth and durable cash flow performance.

With clean energy demand accelerating, it is worth taking a closer look at the fundamentals of both companies to determine which one presents the stronger investment opportunity.

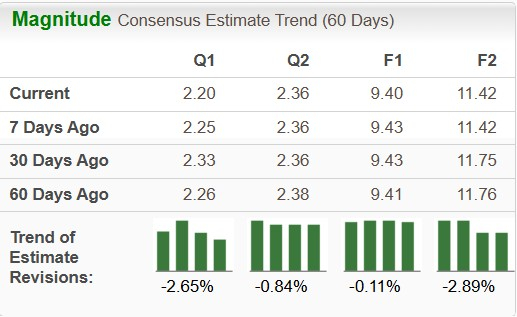

CEG and DUK’s Earnings Estimates

The Zacks Consensus Estimate for Constellation Energy’s 2025 and 2026 earnings per share (EPS) has decreased 0.11% and 2.89%, respectively, in the past 60 days. Long-term (three to five years) earnings growth is currently pegged at 15.42%.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for Duke Energy’s 2025 EPS has remained the same, while 2026 EPS has increased 0.15% in the past 60 days. Long-term (three to five years) earnings growth is currently pegged at 6.87%.

Image Source: Zacks Investment Research

CEG and DUK’s Sales Estimates

The Zacks Consensus Estimate for Constellation Energy’s 2025 sales estimates reflects year-over-year growth of 2.29%. The same for Duke Energy’s 2025 sales estimates reflects year-over-year growth of 4.85%.

CEG & DUK’s Return on Equity

Return on Equity (“ROE”) is an essential financial indicator that evaluates a company’s efficiency in generating profits from the equity invested by its shareholders. It demonstrates how well management is utilizing the capital provided to increase earnings and deliver value.

Constellation Energy’s current ROE is 21.59% compared with Duke Energy’s 9.98%.

CEG & DUK’s Dividend Yield

Electricity producers typically operate within a regulated framework, giving them steady revenue streams and consistent cash flow. This stability enables management to project earnings with confidence and maintain a reliable, long-term dividend policy for shareholders.

The current dividend yield of Constellation Energy is 0.44% and it has raised dividend four times in the past five years. The same for Duke Energy is 3.49% and it has raised dividend five times in the past five years.

Long-Term Investment Plans

Huge capital investment is required to set up the traditional electricity generation plant, including the nuclear plants, where installation of safety measures and safe storage of nuclear waste are essential for smooth operation.

Constellation Energy expects to invest nearly $3 billion and $3.5 billion for 2025 and 2026, respectively. Nearly 35% of projected capital expenditures are for the acquisition of nuclear fuel, which includes additional nuclear fuel to increase inventory levels.

Duke Energy anticipates spending capital worth $190-$200 billion over the next decade, a major portion of which will go to the clean energy transition. Of this, it expects to spend $83 billion during the 2025-2029 period.

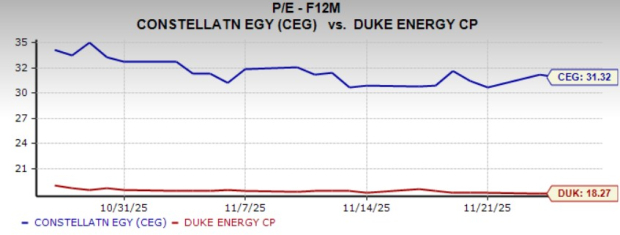

Valuation

Duke Energy currently appears to be trading at a discount compared with Constellation Energy on a forward 12-month Price/Earnings basis.

DUKE is currently trading at 18.27X, while CEG is trading at 31.32X compared with the S&P 500’s 23.15X.

Image Source: Zacks Investment Research

Summing Up

Constellation Energy and Duke Energy are investing steadily to strengthen their infrastructure and provide a high volume of clean electricity to their customers. Both stocks have a lot of potential in the energy sector and can provide investors with significant growth opportunities.

From the above discussion, it is evident that Duke Energy has an edge over Constellation Energy due to its stronger earnings estimates movement, better dividend yield, extensive capital investment plan and a cheaper valuation.

Despite both stocks carrying a Zacks Rank #3 (Hold), considering the above facts, it appears Duke Energy will have better potential than Constellation Energy at present.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Free Report: Profiting from the 2nd Wave of AI Explosion

The next phase of the AI explosion is poised to create significant wealth for investors, especially those who get in early. It will add literally trillion of dollars to the economy and revolutionize nearly every part of our lives.

Investors who bought shares like Nvidia at the right time have had a shot at huge gains.

But the rocket ride in the "first wave" of AI stocks may soon come to an end. The sharp upward trajectory of these stocks will begin to level off, leaving exponential growth to a new wave of cutting-edge companies.

Zacks' AI Boom 2.0: The Second Wave report reveals 4 under-the-radar companies that may soon be shining stars of AI’s next leap forward.

Access AI Boom 2.0 now, absolutely free >>Constellation Energy Corporation (CEG) : Free Stock Analysis Report

Duke Energy Corporation (DUK) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.