CommScope Holding Company, Inc. COMM is benefiting from healthy traction in the Access Network Solutions (“ANS”) segment. The company generated $322 million in revenues from ANS, up 65% year over year, beating the Zacks Consensus Estimate of $251.2 million. Adjusted EBITDA increased a staggering 132% year over year during the quarter.

The growth is primarily driven by the strong deployment of DOCSIS 4.0 amplifier and node products. Moreover, higher license sales also drove the top line. Growing usage of high data-intensive use cases such as cloud gaming, video conferencing and remote work is driving demand for high-capacity networks. Enterprises are rushing to upgrade their infrastructure from legacy DOCSIS 3.1 to advanced DOCSIS 4. CommScope is benefiting from this DOCSIS upgrade lifecycle.

In the DOCSIS amplifier business, the company benefited from Full Duplex deployment with Comcast. Extended Spectrum DOCSIS also secured several customer wins in the second quarter, including with Charter Communications.

The company’s virtual cable modem termination systems (“CMTS”) have also gained multiple customers in the second quarter. Management expects the healthy demand for its virtual CMTS to continue for the remainder of the year.

How Are Competitors Faring?

CommScope’s ANS segment faces competition from Cisco Systems Inc. CSCO and Harmonic Inc. HLIT. In the July quarter, Cisco’s networking revenues rose 12% year over year to $7.6 billion. Double-digit growth is driven by strength in webscale infrastructure, switching, enterprise routing, industrial IoT and servers. Network modernization and automation initiatives for the deployment of AI agents and applications are driving demand for Cisco’s solutions.

Harmonic ended the second quarter with $504.5 million of backlog and deferred revenues. Industry’s transition to DOCSIS 4 is expected to be a major growth driver for the company. Recently, GCI, Alaska’s largest telecommunication company, has selected Harmonic to upgrade its DOCSIS network infrastructure. HLIT’s growing traction in this vertical can pose a threat to CommScope’s competitive edge.

COMM’s Price Performance, Valuation & Estimates

CommScope’s shares have gained 188.1% in the past year compared with the industry’s growth of 93.6%.

Image Source: Zacks Investment Research

From a valuation standpoint, the company’s shares currently trade at 0.63 forward sales, lower than 0.94 for the industry.

Image Source: Zacks Investment Research

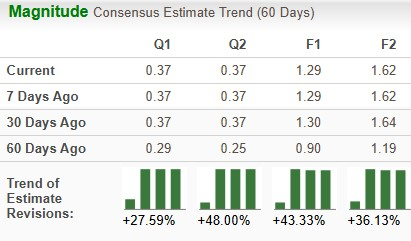

Earnings estimates for 2025 and 2026 have improved over the past 60 days.

Image Source: Zacks Investment Research

COMM currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Radical New Technology Could Hand Investors Huge Gains

Quantum Computing is the next technological revolution, and it could be even more advanced than AI.

While some believed the technology was years away, it is already present and moving fast. Large hyperscalers, such as Microsoft, Google, Amazon, Oracle, and even Meta and Tesla, are scrambling to integrate quantum computing into their infrastructure.

Senior Stock Strategist Kevin Cook reveals 7 carefully selected stocks poised to dominate the quantum computing landscape in his report, Beyond AI: The Quantum Leap in Computing Power.

Kevin was among the early experts who recognized NVIDIA's enormous potential back in 2016. Now, he has keyed in on what could be "the next big thing" in quantum computing supremacy. Today, you have a rare chance to position your portfolio at the forefront of this opportunity.

See Top Quantum Stocks Now >>Cisco Systems, Inc. (CSCO) : Free Stock Analysis Report

Harmonic Inc. (HLIT) : Free Stock Analysis Report

CommScope Holding Company, Inc. (COMM) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.