Fintel reports that Commonwealth Equity Services, Llc has filed a 13G/A form with the SEC disclosing ownership of 0.15MM shares of Tortoise Pipeline & Energy Fund, Inc. (TTP). This represents 6.73% of the company.

In their previous filing dated December 7, 2022 they reported 0.12MM shares and 5.57% of the company, an increase in shares of 21.00% and an increase in total ownership of 1.16% (calculated as current - previous percent ownership).

Fund Sentiment

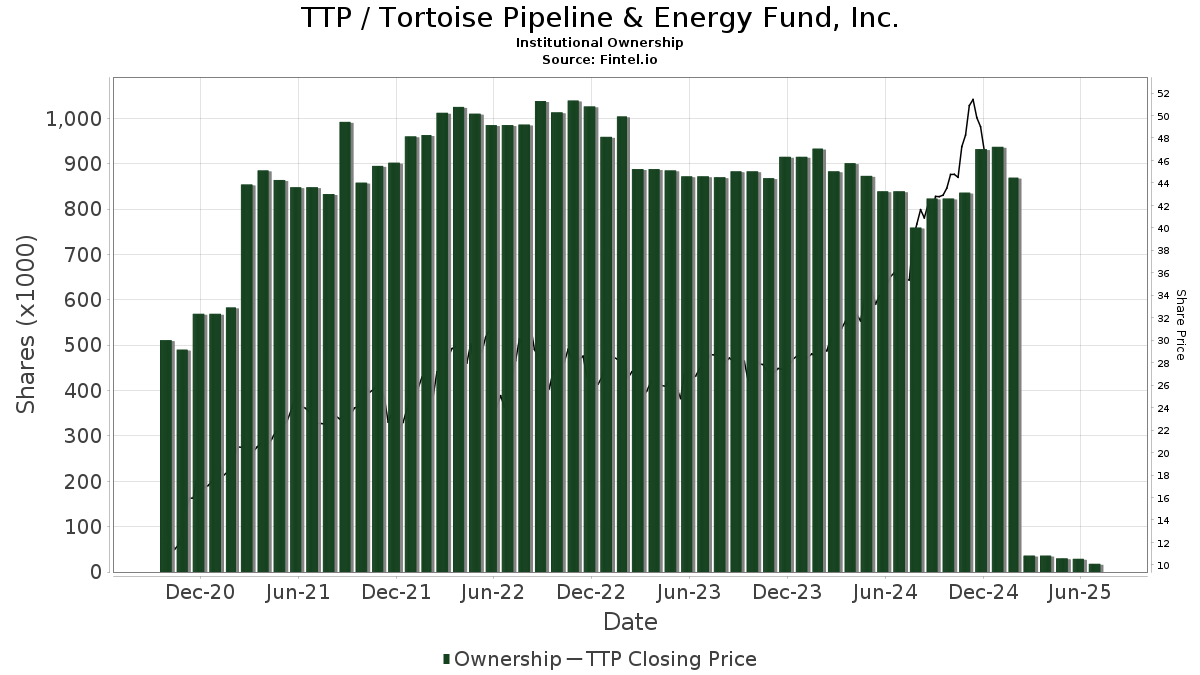

There are 30 funds or institutions reporting positions in Tortoise Pipeline & Energy Fund, Inc.. This is a decrease of 1 owner(s) or 3.23%.

Average portfolio weight of all funds dedicated to US:TTP is 0.1520%, an increase of 2.7469%. Total shares owned by institutions decreased in the last three months by 0.90% to 995K shares.

What are large shareholders doing?

Saba Capital Management, L.P. holds 180,840 shares

Bard Associates Inc holds 180,294 shares

Lincoln National Corp holds 163,302 shares

Aristides Capital LLC holds 84,439 shares

Sit Investment Associates Inc holds 80,664 shares

Tortoise Pipeline & Energy Fund Declares $0.59 Dividend

Tortoise Pipeline & Energy Fund said on November 8, 2022 that its board of directors declared a regular quarterly dividend of $0.59 per share ($2.36 annualized). Shareholders of record as of November 22, 2022 received the payment on November 30, 2022. Previously, the company paid $0.14 per share.

At the most recent share price of $28.66 / share, the stock's dividend yield was 8.23%.

Tortoise Pipeline & Energy Fund Inc Background Information

(This description is provided by the company.)

Tortoise focuses on energy & power infrastructure and the transition to cleaner energy. Tortoise's solid track record of energy value chain investment experience and research dates back more than 20 years. As one of the earliest investors in midstream energy, Tortoise believes it is well-positioned to be at the forefront of the global energy evolution that is underway. With a steady wins approach and a long-term perspective, Tortoise strives to make a positive impact on clients and communities.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.