If you follow the large U.S.-based cryptocurrency exchange Coinbase (NASDAQ: COIN), you probably know that the stock has been getting crushed this year. Since going public a little more than a year ago, shares of Coinbase are down more than 80%. The significant decline has made the stock look cheap, now trading at less than seven times earnings.

Let's look at why Coinbase's stock is down so much and whether or not it's a buy.

The crypto connection

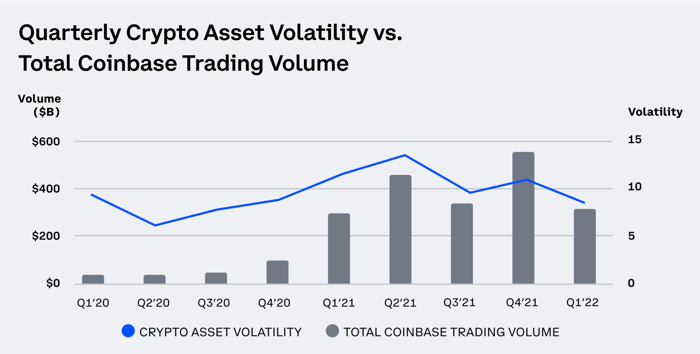

Coinbase makes the bulk of its revenue from transaction fees on crypto trades, and most of its trades are from retail investors, so naturally, there is a strong correlation between crypto trading volume and Coinbase's revenue. In the first quarter of 2022, crypto trading volume slumped as the crypto winter took hold, and the price of cryptocurrencies significantly declined. The world's largest currency, Bitcoin, currently trades for under $30,000.

Image source: Coinbase.

As a result, Coinbase reported $1.16 billion of revenue in the quarter, which is down 27% year over year and 53% from the sequential quarter. Retail transaction revenue of about $966 million is down nearly 34% year over year. While co-founder and CEO Brian Armstrong called the difficult market conditions the "elephant in the room," he also tried to put a positive spin on the current environment.

Despite crypto trading volumes in the macroenvironment being down 44%, we were down about 44% as well. But in the assets that we support, including the core ones like Bitcoin and Ethereum, we actually gained share. There's been a lot of talk in the past about fee compression. But, we've seen in the last few quarters that that hasn't been the case. In fact, our take rate is slightly up over the last few quarters. And there's a lot of new emerging revenue streams like staking and our subscription and services, which grew 169% year over year.

The market is likely worried about crypto appetite in the near term with the Federal Reserve raising interest rates aggressively, which makes safer assets like U.S. Treasury bills yield more. The Fed is also beginning to unwind its nearly $9 trillion balance sheet, which essentially pulls liquidity out of the economy. All of this creates a difficult environment for riskier assets, which includes anything tied to crypto.

Image source: Getty Images.

Is it a buy?

Clearly, being so heavily connected to the crypto market and crypto trading volume makes Coinbase a bit of a hostage to the price of Bitcoin. It's great when crypto is roaring and not so great during crypto winters. I would like to see Coinbase have less of a correlation to this kind of volatility because the market rarely rewards companies with volatile earnings that are difficult to predict.

Coinbase has started to diversify revenue by growing subscription and services revenue, which at $152 million in Q1 was the company's second-highest quarter in this segment and up significantly on a year-over-year basis. Coinbase has also recently rolled out a marketplace for non-fungible tokens, and Armstrong said 54% of active users are doing something on the Coinbase platform other than just trading crypto.

There is likely more volatility ahead for Bitcoin -- and therefore, more volatility for Coinbase -- so investors should be prepared to see Bitcoin go much lower. But Coinbase has built a strong brand, now has a very reasonable valuation, and also holds roughly $6.1 billion of cash on its balance sheet, which equates to roughly a third of its total assets. If you believe like me that crypto is here for the long haul, then I think Coinbase is a good long-term buy at these levels, but expect a bumpy ride.

10 stocks we like better than Coinbase Global, Inc.

When our award-winning analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now... and Coinbase Global, Inc. wasn't one of them! That's right -- they think these 10 stocks are even better buys.

*Stock Advisor returns as of April 7, 2022

Bram Berkowitz has positions in Bitcoin and Ethereum. The Motley Fool has positions in and recommends Bitcoin, Coinbase Global, Inc., and Ethereum. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.