Coinbase Global COIN has paused some of its Argentina operations. The crypto leader has suspended buying or selling the USDC stablecoin using Argentine pesos, effective Jan. 31, 2026. However, crypto-to-crypto trading functionalities will remain unaffected. COIN had launched operations in Argentina on Jan. 28, 2025, after receiving approval from the National Securities Commission (CNV) to operate as a Virtual Asset Service Provider there.

The company earlier noted that about 87% of Argentinians view cryptocurrency as a path to financial independence, while 79% expressed openness to receiving salaries or payments in digital assets, as per cryptonews. Also, these figures underline the country’s growing interest in digital currencies as a solution to financial instability, according to media reports. Thus, entering Argentina is a strategic move to expand internationally to capitalize on the opportunities. Though this is a temporary move, COIN intends to review operations and come back with solid offerings.

Last month, COIN encountered another hurdle. It became inaccessible in the Philippines as regulators blocked Coinbase over licensing rules.

Despite these short-term hurdles, Coinbase is poised for a strong 2026. COIN’s strategic focus areas include real-world asset (RWA) perpetuals, specialized exchanges and trading terminals, next-generation DeFi infrastructure and the integration of AI and robotics. With these initiatives, Coinbase aims to build a comprehensive product and service ecosystem and solidify its position as the industry’s premier “everything exchange.”

What About its Peers?

Robinhood Markets HOOD stays focused on accelerating growth through rapid product innovation and global expansion. Robinhood has been engaging in opportunistic acquisitions to deepen its footprint and expand its product reach within the United States and globally. Robinhood also noted that AI features and fast rollouts are increasing engagement, premium monetization and retention, while stronger tools attract both retail and advanced traders.

Interactive Brokers IBKR continues to explore growth opportunities in the emerging markets of Taiwan, Mexico and India. Given the rapid growth of its European business, Interactive Brokers has substantially expanded its operations there. Interactive Brokers has been undertaking several measures to enhance its global presence.

COIN’s Price Performance

Shares of COIN have lost 3.7% in a year, outperforming the industry.

Image Source: Zacks Investment Research

COIN’s Expensive Valuation

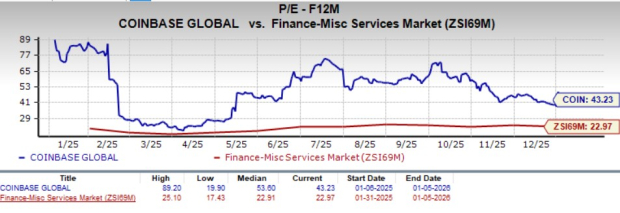

COIN trades at a price-to-earnings value ratio of 43.23, significantly above the industry average of 22.97. It carries a Value Score of F.

Image Source: Zacks Investment Research

Estimates for COIN

The Zacks Consensus Estimate for COIN’s fourth-quarter 2025 and first-quarter 2026 EPS has witnessed no revision in the past seven days. The same holds true for full-year 2025 and 2026 EPS estimates.

Image Source: Zacks Investment Research

The consensus estimate for COIN’s 2025 and 2026 revenues indicates year-over-year increases. Though the consensus estimate for the company’s 2025 EPS indicates a year-over-year increase, the same for 2026 indicates a decline.

COIN stock currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Just Released: Zacks Top 10 Stocks for 2026

Hurry – you can still get in early on our 10 top tickers for 2026. Handpicked by Zacks Director of Research Sheraz Mian, this portfolio has been stunningly and consistently successful.

From inception in 2012 through November, 2025, the Zacks Top 10 Stocks gained +2,530.8%, more than QUADRUPLING the S&P 500’s +570.3%.

Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2026. You can still be among the first to see these just-released stocks with enormous potential.

See New Top 10 Stocks >>Interactive Brokers Group, Inc. (IBKR) : Free Stock Analysis Report

Coinbase Global, Inc. (COIN) : Free Stock Analysis Report

Robinhood Markets, Inc. (HOOD) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.