Although Cisco Systems CSCO stock is hovering near a 52-week high of $74 a share, investors may be wondering if it can fly toward $100 or higher, like other emerging or reemerging tech stocks that have been hot of late, such as Micron Technology MU, Marvell Technology MRVL, and Western Digital WDC.

This possibility is not far-fetched if Cisco Systems' results for its fiscal first quarter are strong enough to give the computer-networking leader another boost when it reports on Wednesday, November 12.

While Cisco Systems doesn’t provide storage solutions like these aforementioned tech peers, AI integration has been critical to its core operations, a similarity it shares with Marvell and Micron Technology.

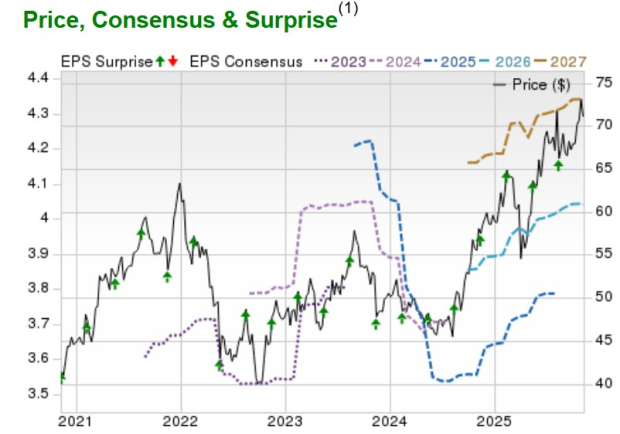

Image Source: Zacks Investment Research

Cisco Systems Q1 Expectations

Based on Zacks' estimates, Cisco Systems’ Q1 sales are thought to have increased nearly 7% year over year to $14.78 billion. Taking advantage of its top line expansion, Cisco Systems' Q1 EPS is expected to be up 7% as well to $0.98.

Furthermore, Cisco Systems has surpassed sales estimates for 13 straight quarters and has reached or exceeded the Zacks EPS Consensus in every quarter dating back to 2012, as partly illustrated by the green arrows in the price, consensus, and surprise chart above.

AI-Driven Operations & Cloud Provider Integration

Like Marvell and Micron Technology, Cisco Systems has used AI to optimize its internal operations, particularly to enhance network performance, automate IT operations, and improve cybersecurity.

Furthermore, Cisco Systems and Marvell Technology both develop high-performance networking chips tailored for AI supercomputers. Similar to the excitement for Marvell Technology’s presence in hyperscale data centers, Cisco Systems' Silicon One chips are being tested by the major cloud providers as well.

CSCO Valuation Comparison

Optimistically, Cisco Systems' stock still trades at a reasonable 17X forward earnings multiple, which is roughly on par with its Zacks Computer-Networking Industry average and a nice discount to the benchmark S&P 500’s 25X. However, CSCO does trade at a noticeable premium of 4X forward sales compared to an industry average of less than 2X, although this is slightly below the S&P 500.

Image Source: Zacks Investment Research

Bottom Line

Cisco Systems could still make the case for being one of the most under-the-radar tech stocks with more upside, considering the company is positioned to serve as a backbone of AI networking infrastructure, including for switches and routers. However, its Q1 report will be crucial to reconfirming these prospects, with Cisco Systems' stock currently landing a Zacks Rank #3 (Hold).

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the favorite stock to gain +100% or more in the months ahead. They include

Stock #1: A Disruptive Force with Notable Growth and Resilience

Stock #2: Bullish Signs Signaling to Buy the Dip

Stock #3: One of the Most Compelling Investments in the Market

Stock #4: Leader In a Red-Hot Industry Poised for Growth

Stock #5: Modern Omni-Channel Platform Coiled to Spring

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor. While not all picks can be winners, previous recommendations have soared +171%, +209% and +232%.

Download Atomic Opportunity: Nuclear Energy's Comeback free today.Cisco Systems, Inc. (CSCO) : Free Stock Analysis Report

Western Digital Corporation (WDC) : Free Stock Analysis Report

Micron Technology, Inc. (MU) : Free Stock Analysis Report

Marvell Technology, Inc. (MRVL) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.