Chinese Economy: Self-Inflicted Wounds?

The Chinese economy and equity market have been slumping for months now. China’s real estate market, which was once on fire, is suffering from the undoing of a bubble and the government’s crackdown on speculation, which hurt developers, most notably Evergrande. To make matters worse, the Chinese central bank levied fines on two of China’s largest tech companies, Alibaba Group (BABA) and Tencent Holdings (TCEHY). Earlier this year, the central bank slapped fines of ~$400 million on TenPay (Tencent’s fintech service) and ~$1 billion on Ant Group (Baba’s fintech affiliate. Finally, China’s economy is still recovering from the government’s “Zero Covid” policy, which was one of the strictest Covid lockdowns out of any country.

While the global economy slowed down dramatically in 2022, there is no arguing that the policies of the Chinese government made matters much worse than they had to be. However, 3 signs are emerging that the worst is over for the Chinese equity market, including:

Hints of Economic Stimulus

Monday, China released its Purchasing Managers’ Index (PMI) numbers, which calculates activity in the manufacturing sector. The 49.3 number that was released for July marked the third straight month of contraction and the lowest rate since late last year. While there is no way to spin the numbers in a positive light, there is a silver lining – economic stimulus. The weak data has finally spurred the government into providing economic stimulus.

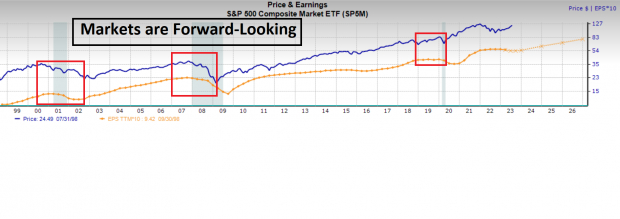

Furthermore, it is essential to remember that equity markets are forward-looking and bottom on bad news, not good news. For example, during the past three recessions in the United States, the major equity indexes bottomed before earnings turned back up.

Image Source: Zacks Investment Research

Back to Business Friendly?

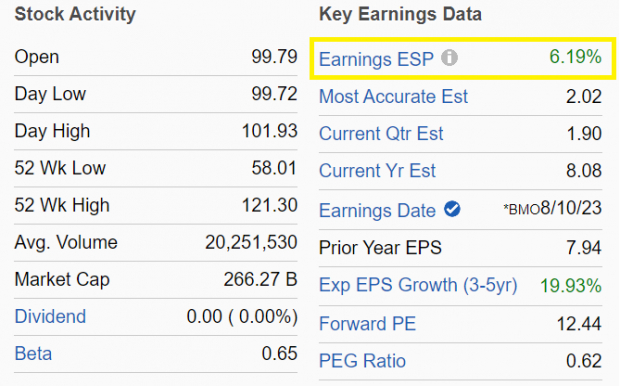

The market views the fines levied on BABA and Tencent as the end of the crackdown. Both stocks have gained ground in the past month, and BABA affiliate Ant Group announced a buyback of shares – signaling confidence in the future. BABA is expected to report earnings results on August 10th. BABA sports a positive Zacks Earnings ESP (Expected Surprise Prediction) score, which suggests that the stock should beat earnings expectations. Stocks with a positive ESP score and a Zacks Rank of 3 or better produce a positive surprise 70% of the time, while they see annual returns of 28.3% on average.

Image Source: Zacks Investment Research

The AI Revolution

One of the factors that helped domestic tech stocks turn the corner from 2022 is the influx of investment and expectations in the AI space. Companies such as Microsoft (MSFT), Alphabet (GOOGL), and Nvidia (NVDA) have benefitted the most. While US companies are leading the way right now, the race in China is just getting started. Chinese search engine giant Baidu (BIDU) is making a big push into the space with its ChatGPT-like competitor “Ernie Bot.” Baidu is also rolling out its Comate tool, which will leverage AI for coding assistance across multiple programming languages. Baidu shares are setting up in a bullish inverse head-and-shoulder pattern ahead of earnings on August 1st.

Image Source: TradingView

Top 5 ChatGPT Stocks Revealed

Zacks Senior Stock Strategist, Kevin Cook names 5 hand-picked stocks with sky-high growth potential in a brilliant sector of Artificial Intelligence. By 2030, the AI industry is predicted to have an internet and iPhone-scale economic impact of $15.7 Trillion.

Today you can invest in the wave of the future, an automation that answers follow-up questions … admits mistakes … challenges incorrect premises … rejects inappropriate requests. As one of the selected companies puts it, “Automation frees people from the mundane so they can accomplish the miraculous.”

Download Free ChatGPT Stock Report Right Now >>Microsoft Corporation (MSFT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Baidu, Inc. (BIDU) : Free Stock Analysis Report

Tencent Holding Ltd. (TCEHY) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.