China Stocks go Parabolic

The story on Wall Street over the past few days is the breathtaking move in Chinese stocks. Throw a dart at a Chinese ADR (American Depositary Receipt or a foreign company’s stock issued by a U.S. broker), and you will find a chart that looks like the Empire State Building. For example, the iShares China Large Cap ETF (FXI) is up ~30% over the past two months. However, smaller, more high-octane names like Futu Holdings (FUTU) and UP Fintech Holding (TIGR) are up by 63% and 89%!

Image Source: Zacks Investment Research

The Importance of Trade Reviews

Legendary early 20th-century trader Jesse Livermore once lamented, “There is nothing new in Wall Street. There can’t be because speculation is as old as the hills.” Regardless of whether you caught the epic move in Chinese stocks, the move is worth studying so that when a similar opportunity emerges in the future, you can be ready to pounce on it.

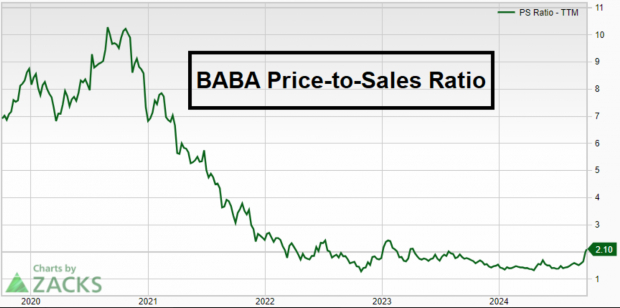

China Stock Valuations Were Historically Low

Valuations in top Chinese stocks were at rock bottom levels before the rally. For instance, the price-to-sale multiple in Chinese e-commerce giant Alibaba (BABA) cratered from 10x in 2021 to the bargain base level of <2x.

Image Source: Zacks Investment Research

Smart Money was Buying Chinese Stocks

Retail investors can get a glimpse into what the brightest investing minds are buying by tracking 13F disclosures. A 13F disclosure requires institutional money managers with $100 million or more in assets under management to submit their stock holdings. Before the ramp in Chinese equities, savvy investors like Michael Burry and David Tepper were acquiring stocks like JD.com (JD). In particular, David Tepper is worth watching because he is well-known for taking leveraged, high-conviction bets that often prove correct.

Central Bank Liquidity: The Spark

With pessimism at a fever pitch, short interest high, and valuations low, the Chinese government announced a comprehensive and much larger stimulus package than Wall Street expected. The rest is history.

Bottom Line

Whether you caught the move in Chinese stocks or not, it is worth reviewing. Low valuations, smart money buying, and a liquidity injection are traits that will be helpful for investors to study into the future.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers "Most Likely for Early Price Pops."

Since 1988, the full list has beaten the market more than 2X over with an average gain of +23.7% per year. So be sure to give these hand picked 7 your immediate attention.

See them now >>iShares China Large-Cap ETF (FXI): ETF Research Reports

JD.com, Inc. (JD) : Free Stock Analysis Report

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report

Futu Holdings Limited Sponsored ADR (FUTU) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.