Chevron Corporation CVX reinforced its long-standing commitment to the Gulf of Mexico with a strong performance in the latest U.S. offshore oil and gas lease sale, totaling $279 million in winning bids. The company secured 22 tracts with $33 million in high bids, highlighting its confidence in the region’s deepwater potential and its disciplined, long-term growth strategy. Chevron’s highest bid, nearly $18.6 million for a block in the Keithley Canyon area, reflects its focus on assets that align with its technical expertise and operational strengths.

Although the auction generated less in total revenues than the 2023 sale, competition for high-quality acreage was strong, with bids per acre reaching the highest levels seen since 2017. Chevron benefited from this environment by selectively targeting proven areas where it has decades of experience and established infrastructure.

The Gulf of Mexico remains a core region for Chevron, offering scale and the lowest carbon intensity assets in its global portfolio. Advances in technology, efficient development timelines and a strong safety record continue to support the basin’s appeal. A more predictable offshore leasing schedule and a lower royalty rate also provide regulatory clarity, enabling better long-term planning for capital-intensive offshore projects.

While offshore production has lagged onshore shale growth, deepwater resources remain critical to meeting future U.S. energy demand. Chevron’s results in the sale underscore its commitment to responsibly developing domestic energy resources while delivering value to shareholders.

Other Competitors in the Gulf of Mexico Oil Lease Sale

BP p.l.c. BP emerged as the top winner in the latest Gulf of Mexico lease sale, securing 50 tracts and committing about $61 million in high bids, the largest total among all participants. The strong showing highlights BP’s continued focus on deepwater Gulf assets as a core part of its strategy to grow U.S. energy production. Company officials described the auction as reinforcing BP’s commitment to expanding its global oil and natural gas portfolio through long-life offshore resources.

Shell plc SHEL also delivered a strong showing in the Gulf lease sale, securing 12 tracts with high bids totaling about $16.2 million, following Woodside Energy, which emerged as the third-largest bidder, totaling roughly $38 million. The strong showing underscores its focus on responsible resource development and a lower-carbon future.

The Zacks Rundown on Chevron

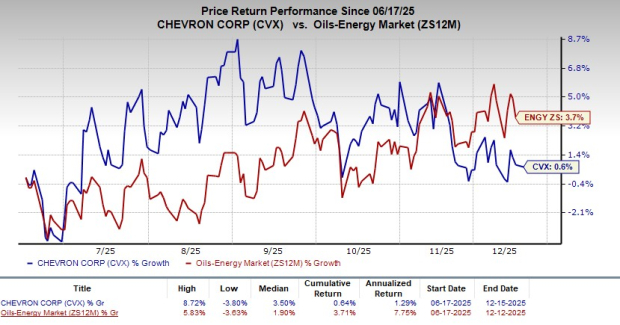

Shares of Chevron have gained 0.6% in the past six months, lagging behind the Oil/Energy sector’s 3.7% growth.

Image Source: Zacks Investment Research

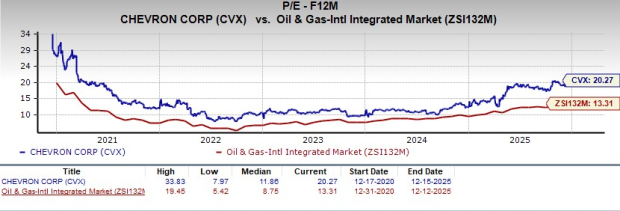

From a valuation perspective — in terms of forward price-to-earnings ratio — Chevron is trading at a premium compared with the industry average. The stock is also trading above its five-year mean of 11.86.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for Chevron’s 2025 earnings has been revised about 1.2% upward over the past 30 days.

Image Source: Zacks Investment Research

The stock currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Naming Top 10 Stocks for 2026

Want to be tipped off early to our 10 top picks for the entirety of 2026? History suggests their performance could be sensational.

From 2012 (when our Director of Research Sheraz Mian assumed responsibility for the portfolio) through November, 2025, the Zacks Top 10 Stocks gained +2,530.8%, more than QUADRUPLING the S&P 500’s +570.3%.

Now Sheraz is combing through 4,400 companies to handpick the best 10 tickers to buy and hold in 2026. Don’t miss your chance to get in on these stocks when they’re released on January 5.

Be First to New Top 10 Stocks >>BP p.l.c. (BP) : Free Stock Analysis Report

Chevron Corporation (CVX) : Free Stock Analysis Report

Shell PLC Unsponsored ADR (SHEL) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.