CenterPoint Energy, Inc. CNP recently inked an agreement with Itron involving the latter’s Intelis natural gas ultrasonic smart meters in a bid to further modernize and upgrade its natural gas distribution system.

Per the contract, Itron will provide three million Intelis natural gas ultrasonic smart meters to CenterPoint, which serves more than seven million metered customers across several regions in the United States. Through the deal, CNP aims to boost its distribution system’s reliability and efficiency. Also, the deployment of Itron’s smart natural gas-metering solution enables CenterPoint to provide better services and safety to its customers.

Benefits of the Agreement

Itron’s smart meters will assist CenterPoint with two-way communication for monitoring and billing its natural gas assets. It will also aid in developing intelligence capability across distribution networks.

The Intelis natural gas meter is equipped with a built-in automatic shut-off valve, which aims to curtail the threat of a natural gas explosion in the scenario of a high flow or a high-temperature incident. Moreover, the meters also assist customers in managing their bills by offering access to the natural gas consumption information, thus providing customers a better insight into their usage.

Additionally, these next-generation meters ensure better safety and reliability by providing insight for the company through data and alerts that aid in altering the consequences of a serious problem.

Such smart features naturally ensure and encourage better safety and resiliency for the company to operate efficiently, which, in turn, might attract more customers to choose CenterPoint as their preferred utility.

CenterPoint’s Key Investment Plans

CenterPoint is currently focused on upgrading its infrastructure and improving reliability. The company recently increased its investment plan to $19.2 billion from $18 billion for the 2022-2026 period and also plans to invest $40 billion for a period of 10 years. CenterPoint intends to deploy these funds primarily in maintaining reliability and safety and increasing resiliency. The company’s latest strategy to deploy ltron’s smart meters in its operations seems to be part of this investment plan, returns from which should boost CNP stock’s position in the utility space.

Peer Moves

Utilities in the United States are focusing on strengthening and modernizing their infrastructure in a bid to upgrade the network system for an undisrupted and reliable delivery of energy to consumers. In this context, utilities that have set an impressive investment plan for a stronger and smarter operating system are Duke Energy DUK, Public Service Enterprise Group PEG or PSEG and Ameren Corporation AEE.

Duke Energy remains focused on expanding its scale of operations and implementing modern technologies at its facilities by investing heavily in infrastructure and expansion projects. The company anticipates spending capital worth more than $130 billion over the next decade.

Duke Energy boasts a long-term earnings growth rate of 6.1%. Shares of DUK have returned 15.3% in the past year.

Public Service Enterprise Groupstrongly focuses on enhancing the reliability and resiliency of its transmission and distribution system, meeting customer expectations and supporting public policy objectives by investing capital in transmission and distribution infrastructure. For the 2021-2025 period, PSE&G expects to invest $14 billion to $16 billion.

PSEG’s long-term earnings growth rate is pegged at 4.2%. PEG shares have returned 15.8% in the past year.

Ameren’s growth has been led by its systematic and consistent investments in growth projects and infrastructure upgrades. Ameren expects to spend up to $17.3 billion to support system reliability and infrastructural upgrades in the 2022-2026 period.

Ameren boasts a long-term earnings growth rate of 7.2%. Shares of AEE have rallied 16.5% in the past year.

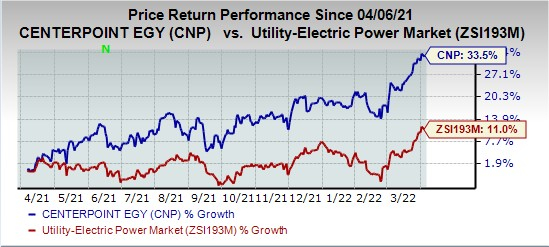

Price Movement

In the past year, shares of CenterPointEnergy have rallied 33.5% compared with the industry’s growth of 11%.

Image Source: Zacks Investment Research

Zacks Rank

CenterPointcurrently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ameren Corporation (AEE): Free Stock Analysis Report

Public Service Enterprise Group Incorporated (PEG): Free Stock Analysis Report

Duke Energy Corporation (DUK): Free Stock Analysis Report

CenterPoint Energy, Inc. (CNP): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.