For the past few years, small caps have been a frustrating trade, especially compared to tech. However, with lower interest rates on the horizon, small caps are breaking out. Below are some reasons why the breakout may prove to be substantial:

IWM Long Term Technical View

Unlike the S&P 500 Index or the Nasdaq, which tend to slowly trend higher in bull market environments, the Russell 2000 Index ETF (IWM) has a historical tendency to go into deep hibernation, form a massive base structure, and then finally, breakout and play catch-up. The past few times small caps have broken out of multi-year base structures, the IWM has gained 30% or more over the next 1–2-year period. Currently, IWM is attempting to break out of a four-year base structure that began in October 2021.

Image Source: TradingView

The Longer the Base, The Higher in Space

An old Wall Street adage proclaims that, “The longer the base, the higher in space!” An excellent example of the big base phenomenon is the recent breakout in the SPDR Gold Shares ETF (GLD). GLD based for over a decade before breaking out in early 2024. The breakout resulted in gold prices doubling.

Image Source: TradingView

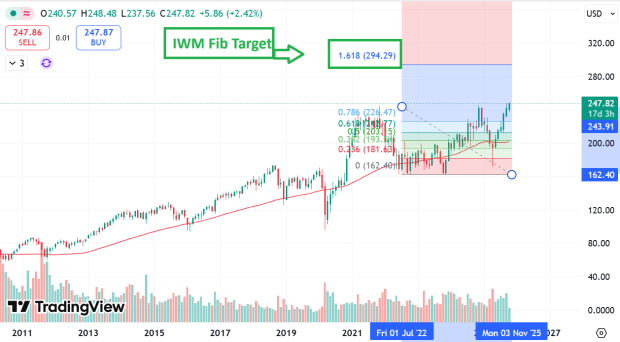

IWM: Fibonacci Levels Suggest $300 is Possible

The Fibonacci extensions provide technicians with a way to calculate breakout targets realistically. IWM Fib extensions suggest that IWM can reach ~$300 (19% higher than current levels).

Image Source: TradingView

Another method of calculating a target is to take the difference between the high and the low of the base and add it to the breakout. This method provides small cap bulls with an even rosier target of ~312.

IWM Exhibits Relative Strength Versus QQQ

IWM’s recent outperformance versus the Nasdaq 100 Index ETF (QQQ) is another signal that IWM may want to take the reins and lead the US equity market. IWM has already retaken Friday’s highs while QQQ is well below them – a subtle sign of relative strength for IWM.

IWM Components Act Well

IWM’s top holdings, such as IonQ (IONQ), Oklo (OKLO), and Credo Technology (CRDO) are performing very strongly currently and could help to propel the breakout.

Bottom Line

After years of lagging behind their large-cap peers, small caps are finally poised for a meaningful move higher. With a multi-year base, improving technical signals, relative strength, and supportive macro conditions, the stage is set for a substantial breakout.

Zacks Names #1 Semiconductor Stock

This under-the-radar company specializes in semiconductor products that titans like NVIDIA don't build. It's uniquely positioned to take advantage of the next growth stage of this market. And it's just beginning to enter the spotlight, which is exactly where you want to be.

With strong earnings growth and an expanding customer base, it's positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $971 billion by 2028.

See This Stock Now for Free >>Invesco QQQ (QQQ): ETF Research Reports

SPDR Gold Shares (GLD): ETF Research Reports

iShares Russell 2000 ETF (IWM): ETF Research Reports

IonQ, Inc. (IONQ) : Free Stock Analysis Report

Credo Technology Group Holding Ltd. (CRDO) : Free Stock Analysis Report

Oklo Inc. (OKLO) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.