Carnival Corporation & plc CCL is gaining investor confidence not just from operational momentum but from meaningful progress in strengthening its balance sheet. In the second quarter of fiscal 2025, the cruise giant prepaid $350 million of its $1.4 billion notes due in 2026 and refinanced the remainder with senior unsecured notes maturing in 2031. These refinancing efforts are projected to reduce net interest expense by over $20 million through early 2026.

The company also upsized its euro-denominated floating-rate loan from 200 million to 300 million, locking in an all-in interest rate of under 4%, while extending maturity and improving lending terms. Combined with these moves, Carnival has refinanced nearly $7 billion in debt this year at favorable rates, paving the path for a simpler capital structure. As of May 31, 2025, total debt stood at $27.3 billion, slightly lower than the $27.48 billion reported on Nov. 30, 2024.

Carnival’s focus on deleveraging has yielded results. The company’s net debt-to-EBITDA ratio improved to 3.7x in the fiscal second quarter, down from 4.1x in the fiscal first quarter. Also, it reported credit rating upgrades from agencies. While the upcoming delivery of the Star Princess is likely to temporarily flatten leverage ratios, management expects to continue debt repayments through 2025 and 2026, using cash on hand.

Backed by a well-managed debt maturity schedule through 2026, Carnival plans to accelerate its refinancing strategy in the coming quarters. With EBITDA projected to grow and debt levels trending lower, the company remains confident in its ability to reach investment-grade status, further enhancing financial flexibility and long-term shareholder value.

CCL’s Price Performance, Valuation & Estimates

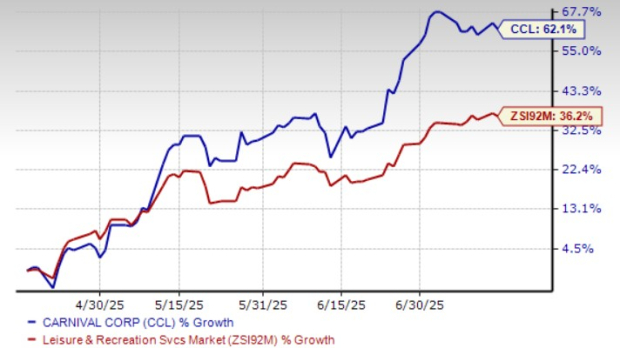

Shares of Carnival have surged 62.1% in the past three months compared with the industry’s growth of 36.2%. In the same time frame, other industry players like Royal Caribbean Cruises Ltd. RCL, Norwegian Cruise Line Holdings Ltd. NCLH and OneSpaWorld Holdings Limited OSW have gained 78.1%, 41.4% and 25.4%, respectively.

CCL Three-Month Price Performance

Image Source: Zacks Investment Research

CCL stock is currently trading at a discount. It is currently trading at a forward 12-month price-to-earnings (P/E) multiple of 13.53X, well below the industry average of 19.88X. Conversely, industry players, such as Royal Caribbean, Norwegian Cruise and OneSpaWorld have P/E ratios of 20.44X, 10.25X and 20.08X, respectively.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for Carnival’s fiscal 2025 earnings per share has been revised upward, increasing from $1.87 to $1.98 over the past 30 days. This upward trend indicates strong analyst confidence in the stock’s near-term prospects.

The company is likely to report solid earnings, with projections indicating a 39.4% rise in fiscal 2025. Conversely, industry players like Royal Caribbean, Norwegian Cruise and OneSpaWorld are likely to witness a rise of 30.9%, 11.5% and 16.5% respectively, year over year in 2025 earnings.

Image Source: Zacks Investment Research

CCL stock currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Only $1 to See All Zacks' Buys and Sells

We're not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent. Thousands have taken advantage of this opportunity.

Thousands did not - they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and more, that closed 256 positions with double- and triple-digit gains in 2024 alone.

See Stocks Now >>Carnival Corporation (CCL) : Free Stock Analysis Report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Norwegian Cruise Line Holdings Ltd. (NCLH) : Free Stock Analysis Report

OneSpaWorld Holdings Limited (OSW) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.