Cardiovascular Systems CSII recently announced that the enrollment of 2000 patients for the ECLIPSE coronary trial has been completed. The trial will feature the testing of two treatment strategies for managing one of the most difficult challenges for interventional cardiologists and evaluating economic outcomes as well.

The data from the randomized clinical trial will contribute toward the effective treatment of patients with severely calcified coronary arteries.

Significance of the Study

ECLIPSE is the largest, multi-center, randomized coronary atherectomy trial ever conducted to date. The prospective study will assess nearly 2000 patients with Coronary Artery Disease, which is the most common form of heart disease in the United States.

The likelihood of this life-threatening condition is found in patients suffering from high blood pressure, abnormal cholesterol levels, diabetes or having a family history of early heart disease.

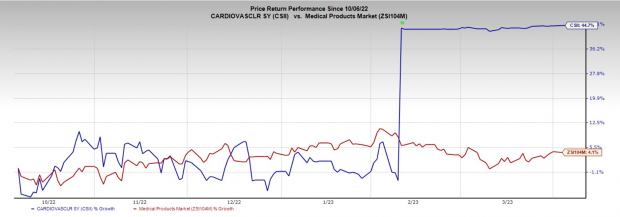

Image Source: Zacks Investment Research

Of the participants, half received orbital atherectomy prior to drug-eluting stent implantation, while other patients received conventional angioplasty, including specialty balloons, followed by DES implantation.

ECLIPSE is powered to demonstrate differences in the primary endpoints of the post-procedural in-stent minimal cross-sectional area and the clinical outcome of target vessel failure in a year.

Results from the ECLIPSE trial are expected to be declared in the fall of 2024.

Industry Prospects

Per a Research report, the global atherectomy device market was valued at $557.7 million in 2018 and is expected to witness a CAGR of 7% by 2026.

The rising prevalence of target diseases is the key driver of the market.

Recent Developments

In February 2023, CSII announced Abbott Laboratories’ $890 million acquisition of the company. Under the terms of the agreement, Abbott will gain an innovative, complementary solution for treating vascular disease through Cardiovascular Systems’ leading atherectomy system, which prepares vessels for angioplasty or stenting to restore blood flow.

In January 2023, CSII initiated the KAIZEN clinical study to assess the safety and efficacy of the peripheral orbital atherectomy system for the treatment of calcified plaque in patients with peripheral artery disease. The study is intended to secure regulatory approval in Japan.

Price Performance

In the past six months, shares of the company have increased 44.7% compared with the industry’s rise of 4.1%.

Zacks Rank and Key Picks

Cardiovascular Systems currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the overall healthcare sector are Lantheus LNTH, Avanos Medical AVNS and Insulet PODD. Lantheus sports a Zacks Rank #1 (Strong Buy), while Avanos Medical and Insulet carry a Zack Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Lantheus’ stock has risen 41.1% in the past year. Earnings estimates for Lantheus have remained constant at $4.79 per share for 2023 and at $5.32 for 2024 in the past 30 days.

LNTH’s earnings beat estimates in all the last four quarters, delivering an average surprise of 50%. In the last reported quarter, it reported an earnings surprise of 42.71%.

Estimates for Avanos Medical in 2023 have remained constant at $1.68 per share in the past 30 days. Shares of the company have declined 11.8% in the past year compared with the industry’s fall of 16.4%.

Avanos Medical’s earnings beat estimates in all the trailing four quarters, the average surprise being 11.01%. In the last reported quarter, AVNS delivered an earnings surprise of 25%.

Insulet’s stock has increased 19.7% in the past year. Its estimates for 2023 have increased from $1.26 per share to $1.29 per share over the past 30 days.

Insulet’s earnings beat estimates in three of the trailing four quarters and missed the same in one, the average surprise being 59.81%. In the last reported quarter, PODD delivered an earnings surprise of 129.17%.

Free Report Reveals How You Could Profit from the Growing Electric Vehicle Industry

Globally, electric car sales continue their remarkable growth even after breaking records in 2021. High gas prices have fueled his demand, but so has evolving EV comfort, features and technology. So, the fervor for EVs will be around long after gas prices normalize. Not only are manufacturers seeing record-high profits, but producers of EV-related technology are raking in the dough as well. Do you know how to cash in? If not, we have the perfect report for you – and it’s FREE! Today, don't miss your chance to download Zacks' top 5 stocks for the electric vehicle revolution at no cost and with no obligation.

>>Send me my free report on the top 5 EV stocksCardiovascular Systems, Inc. (CSII) : Free Stock Analysis Report

Insulet Corporation (PODD) : Free Stock Analysis Report

Lantheus Holdings, Inc. (LNTH) : Free Stock Analysis Report

AVANOS MEDICAL, INC. (AVNS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.