Candy and flowers are great on Valentine's Day -- or any other time -- but we all have to admit the joy is pretty short-term. You wouldn't want to keep those chocolates or roses hanging around too long. Some stocks are like this too: They might have what it takes to boost your portfolio right now -- but they're likely to spoil or wilt down the road.

That's why, when investing, it's so important to focus on the long term and choose companies with strong prospects. This might be a company with a solid plan for growth, one that's proven its commitment to dividend growth, or a company with a strong pipeline of potential products. Candy and flowers may make you happy right now, but these stocks will keep you smiling over the long term. Let's check out three to buy now.

1. Lululemon Athletica

Lululemon Athletica (NASDAQ: LULU) is the perfect example of a company with a strong growth plan -- and one that looks achievable. That's because the maker of yoga-inspired clothing has done this before. The company launched its Power of Three growth plan prior to the pandemic and has met all of its goals.

The goals included doubling revenue from the men's line, doubling digital sales, and quadrupling international sales. Now, the company aims to do this again by 2026. If it succeeds, Lululemon's annual revenue would double to $12.5 billion.

Why is Lululemon so successful? The company's brand strength and innovation have kept customers coming back. Lululemon also reinforced its online connection with fans during the earlier stages of the pandemic -- inviting them to take part in its online community, Sweatlife. More recently, Lululemon launched a membership program to offer perks like early access to new products.

All of this has translated into earnings strength -- even in a difficult economy. Lululemon recently predicted that fourth-quarter 2022 revenue may come in as high as $2.7 billion, which would be a 27% increase over the same period a year earlier.

Today, Lululemon shares are trading at 27 times forward earnings, down from more than 40 a year ago. Considering potential growth ahead, Lululemon offers investors a sweet deal right now.

2. Abbott Laboratories

Abbott Laboratories (NYSE: ABT) gives investors two gifts every year: a dividend, and growth of that dividend. The healthcare giant has increased the payment for more than 50 consecutive years. That puts it on the list of Dividend Kings.

Why should a new Abbott investor care about past dividend increases? They suggest rewarding shareholders is important to the company, so it will probably continue with the current policy.

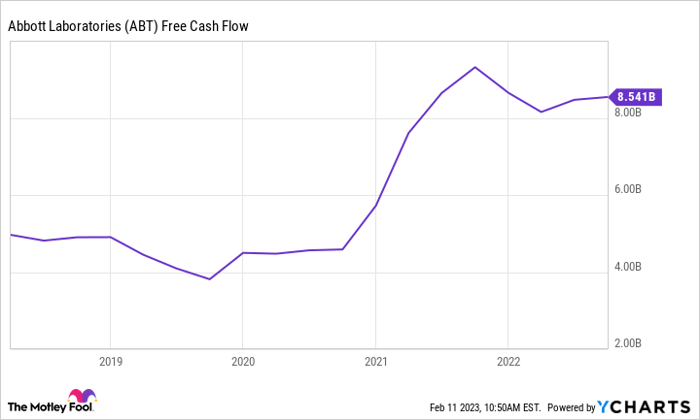

And the company's general growth in free cash flow means it has what it takes to keep boosting payouts:

ABT Free Cash Flow data by YCharts.

Today, Abbott pays an annual dividend of $2.04, currently providing a yield of 1.89%.

Investors will like Abbott for its earnings track record and future prospects too. The company recently reported full-year sales of more than $43 billion, representing a 6.4% increase on an organic basis. Abbott's leading products -- like the FreeStyle Libre continuous glucose monitoring system -- and new launches should keep growth going. And the company's presence in medical devices, diagnostics, nutrition, and established pharmaceuticals is another plus; if one business suffers a setback, the others may compensate.

Abbott shares trade at 27 times trailing-12-month earnings, well below their level of more than 60 just a few years ago. This isn't a lot to pay for all that Abbott offers over time.

3. Moderna

Moderna's (NASDAQ: MRNA) pipeline is a great reason to buy the stock today -- and sit back and wait. The company is working on 48 programs. And three candidates may represent blockbuster opportunities in the next few years: potential vaccines for influenza, respiratory syncytial virus (RSV), and cytomegalovirus (CMV).

Meanwhile, Moderna's coronavirus vaccine sales may decline as we head toward a post-pandemic world -- but they're still likely to remain at blockbuster levels. Moderna might lift the price of its vaccine to as much as $130 per dose from about $25. And the company forecasts aglobal marketsize in the range of $12 billion to $24 billion, as some of the population continues to opt for annual coronavirus boosters -- just as they would go for a flu shot.

So far, Moderna's profits from vaccine sales have helped it build a cash level of more than $18 billion. This will help the company bring product candidates through the pipeline and potentially to market.

It's hard to value Moderna's shares by traditional measures, since the coronavirus vaccine landscape is at a transition point right now. But considering that this billion-dollar product isn't going away and Moderna's pipeline may be set to produce more blockbusters, its shares look like they've got plenty of room to run over the coming years.

10 stocks we like better than Lululemon Athletica

When our award-winning analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now... and Lululemon Athletica wasn't one of them! That's right -- they think these 10 stocks are even better buys.

*Stock Advisor returns as of February 8, 2023

Adria Cimino has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Abbott Laboratories and Lululemon Athletica. The Motley Fool recommends Moderna. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.