Sterling Infrastructure, Inc. STRL has been hurting from housing market weakness in the United States for some time now, as buyers continue to struggle because of affordability issues, given a high mortgage rate scenario. As a result of this weakness, its Building Solutions segment is witnessing a setback, with revenues declining year over year by 7.6% to $199.3 million in the first half of 2025.

However, this adverse market scenario in the residential market is more than offset by the robust trends across public infrastructure, especially by works related to mission-critical data centers and manufacturing. Sterling’s strategic shift toward large mission-critical projects has been aiding its revenue visibility and profitability structure, resulting in growth in its E-Infrastructure Solutions segment. During the first six months of 2025, revenues in the E-Infrastructure Solutions segment grew year over year by 24.2% to $528.7 million, contributing 51% to the company’s total revenues. Besides, as of June 30, 2025, E-Infrastructure Solutions’ backlog was up year over year by 44% to $1.2 billion, with major contributors being mission-critical projects, including data centers and manufacturing.

Adding to these favorable trends surrounding public infrastructure demand comes STRL’s recent agreement to acquire CEC Facilities Group, LLC (expected to close by the third quarter of 2025). This Texas-based specialty electrical and mechanical contractor is expected to amplify the capabilities of STRL across mission-critical electrical and mechanical services across existing and new markets, like Texas.

The synergies from the acquisition of CEC Facilities, coupled with the robust market trends for public infrastructure demand, are expected to favorably outweigh the housing market softness in 2025 and beyond, boosting STRL’s prospects.

Does Sterling Face Competition Across Public Infrastructure?

Firms like EMCOR Group EME and MasTec Inc. MTZ offer substantial competition to Sterling in the public infrastructure field, including mission-critical infrastructure solutions.

EMCOR offers mechanical and electrical construction, industrial and energy infrastructure, as well as building services for a diverse range of businesses. Through its U.S. Construction and Building segments, EMCOR indulges in comprehensive services for the electric power, renewable energy, technology and communications markets, along with infrastructure and building projects for federal, state and local governmental agencies. As of June 30, 2025, Remaining Performance Obligations (RPOs) were $11.91 billion, indicating 22% organic growth and 32.4% growth after including Miller Electric’s acquisition contribution, year over year.

MasTec is an infrastructure construction company engaging in engineering, building, installation, maintenance and upgrade of energy, communication, utility and other infrastructure. Due to the explosion of AI, cloud computing and high-performance data storage, MasTec is witnessing a significant boost in its backlog, with its diversified business model catalyzing the impact. As of June 30, 2025, the company’s 18-month backlog stood at $16.45 billion, marking a 23.3% increase year over year and a 4% rise sequentially.

STRL Stock’s Price Performance & Valuation Trend

Shares of this Texas-based infrastructure services provider have surged 62.5% so far this year, significantly outperforming the Zacks Engineering - R and D Services industry, the broader Zacks Construction sector and the S&P 500 index.

Image Source: Zacks Investment Research

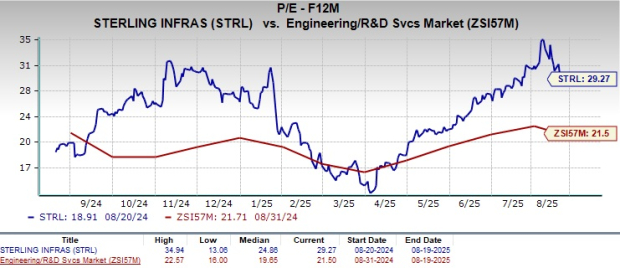

STRL stock is currently trading at a premium compared with the industry peers, with a forward 12-month price-to-earnings (P/E) ratio of 29.27, as evidenced by the chart below. The overvaluation of the stock compared with its industry peers indicates its strong potential in the market, given the favorable trends backing it up.

Image Source: Zacks Investment Research

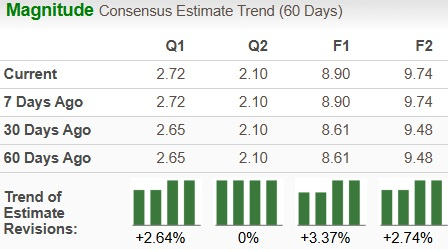

EPS Trend of Sterling

For 2025 and 2026, STRL’s earnings estimates have trended upward in the past 30 days to $8.90 and $9.74 per share, respectively. The revised estimated figures reflect 45.9% and 9.4% year-over-year growth, respectively.

Image Source: Zacks Investment Research

The stock currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

#1 Semiconductor Stock to Buy (Not NVDA)

The incredible demand for data is fueling the market's next digital gold rush. As data centers continue to be built and constantly upgraded, the companies that provide the hardware for these behemoths will become the NVIDIAs of tomorrow.

One under-the-radar chipmaker is uniquely positioned to take advantage of the next growth stage of this market. It specializes in semiconductor products that titans like NVIDIA don't build. It's just beginning to enter the spotlight, which is exactly where you want to be.

See This Stock Now for Free >>EMCOR Group, Inc. (EME) : Free Stock Analysis Report

Sterling Infrastructure, Inc. (STRL) : Free Stock Analysis Report

MasTec, Inc. (MTZ) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.