Vistra Corp.’s VST aggressive share repurchase initiative is central to its long-term value creation strategy. Since November 2021, the company has repurchased shares worth $5.2 billion of its own shares through May 2, 2025. With $1.5 billion still authorized and expected to be executed by 2026, this program significantly enhances shareholder value by improving key per-share metrics — most notably earnings per share (EPS) and free cash flow per share — even as overall net income grows at a moderate pace.

These buybacks are fueled by Vistra’s strong free cash flow generation rather than debt, underscoring the financial discipline behind its capital return strategy. In 2025, the company expects its adjusted FCFbG to be between $3.0 billion and $3.6 billion, supported by its strong liquidity. This ensures that Vistra can continue repurchasing shares while simultaneously investing in high-return opportunities across clean energy, including nuclear assets, solar and storage development, and full ownership of Vistra Vision.

The repurchase strategy also complements Vistra’s transition to a low-carbon portfolio. As the company consolidates renewable and nuclear operations, it is seeing robust EBITDA and cash flow growth. Prioritizing repurchases over idle cash balances reflects management’s conviction in Vistra’s valuation and prospects.

Vistra’s share buyback program reinforces shareholder confidence, improves capital efficiency and strengthens its growth trajectory, making it a key pillar of its long-term investment thesis.

Utilities Increase Shareholders’ Value Through Buybacks

Share buybacks help utilities with stable cash flows to enhance shareholder value by reducing the number of outstanding shares, increasing earnings per share and signaling the companies’ financial stability.

NextEra Energy NEE is executing share repurchase programs. NextEra has used buybacks to complement its dividend policy. The current authorization allows NextEra to buy back 180 million shares.

Constellation Energy CEG is also buying back shares to increase shareholders’ value. CEG’s board of directors has authorized the repurchase of up to $3 billion in shares. As of March 31, 2025, CEG had 841 million remaining authority to repurchase shares.

VST’s Earnings Estimate Moving Up

The Zacks Consensus Estimate for Vistra’s 2025 and 2026 earnings per share indicates an increase of 3.53% and 2.84%, respectively, in the past 60 days.

Image Source: Zacks Investment Research

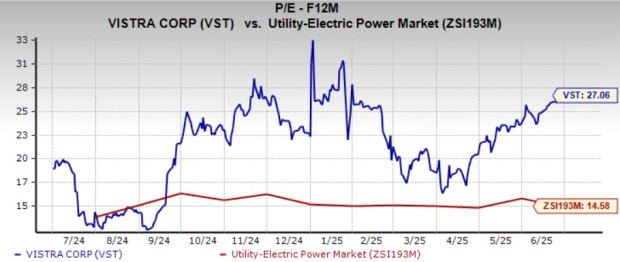

Vistra Stock Trading at a Premium

Vistra is currently trading at a premium valuation compared with the industry, with its forward 12-month price-to-earnings ratio of 27.06X. The industry is currently trading at 14.58X.

Image Source: Zacks Investment Research

VST’s Price Performance

Shares of Vistra have risen 41.4% in the past six months compared with the Zacks Utility- Electric Power industry’s growth of 8%.

Price Performance (Six Months)

Image Source: Zacks Investment Research

VST’s Zacks Rank

Vistra currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Names #1 Semiconductor Stock

It's only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it's positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>NextEra Energy, Inc. (NEE) : Free Stock Analysis Report

Constellation Energy Corporation (CEG) : Free Stock Analysis Report

Vistra Corp. (VST) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.