Roku’s ROKU rising streaming hours continue to reinforce its position as a core monetization platform in the connected television ecosystem. Streaming hours remain the primary engagement catalyst for Roku, as higher usage directly expands advertising inventory and improves subscription discoverability. As linear television viewing shifts toward streaming, incremental time spent within Roku’s ecosystem supports scalable revenue opportunities.

Content expansion remains a key driver of streaming-hour growth. Roku has broadened its FAST channel lineup with bingeable programming such as The First 48. Additional FAST channels featuring Shark Tank, NYPD Blue and Law & Order have supported longer viewing sessions, with Law & Order becoming the first FAST channel dedicated to a series within the Dick Wolf Universe. Roku Originals add further stickiness, with Honest Renovations renewed for a fourth season following strong audience traction, while upcoming titles such as NFL Hometown Eats extend engagement tied to live sports fandom. Sports content is contributing incrementally, with NFL Zone visits more than tripling year over year during kickoff week, supporting both viewing hours and subscription discovery.

Higher streaming hours are strengthening Roku’s advertising engine by expanding premium inventory and improving demand access. Deeper integrations with Amazon DSP and Trade Desk broaden advertiser reach, while Roku Ads Manager continues to attract small and medium-sized businesses. Platform trust has also improved through Roku’s collaboration with DoubleVerify, which has blocked billions of fraudulent connected television ad requests and expanded measurement across home screen and native formats.

In the third quarter of 2025, Roku generated 36.5 billion streaming hours, up 4.5 billion hours year over year, reflecting continued growth in platform engagement. The Zacks Consensus Estimate for fourth-quarter 2025 streaming hours is pegged at 38.72 billion, indicating 13.55% year-over-year growth. With advertising and subscription monetization tied to viewing time, streaming-hour growth is expected to remain a key driver of Roku’s platform revenues.

ROKU Faces Intensifying Competition

Netflix NFLX leads global streaming hours through premium originals, but Netflix monetizes engagement mainly via subscriptions rather than advertising. Higher viewing time supports retention for Netflix, while on Roku, it directly expands ad inventory. Amazon AMZN, through Fire TV, also emphasizes streaming hours, with Amazon using retail data to enhance advertising effectiveness. However, Roku holds an advantage in the U.S. market, where its platform economics tie viewing hours more directly to platform revenues. For Amazon, engagement supports broader ecosystem value, while for Roku, it remains a core monetization driver.

ROKU’s Share Price Performance, Valuation & Estimates

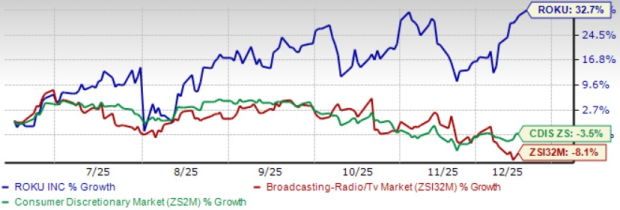

ROKU shares have risen 32.7% in the past six months, outperforming the Zacks Broadcast Radio and Television industry’s decline of 8.1% and the Zacks Consumer Discretionary sector’s plunge of 3.5%.

ROKU’s Price Performance

Image Source: Zacks Investment Research

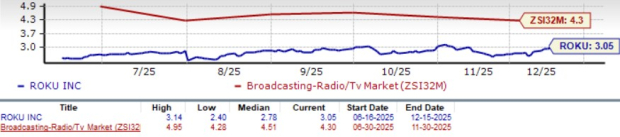

From a valuation standpoint, Roku stock is currently trading at a forward 12-month Price/Sales ratio of 3.05X compared with the industry’s 4.3X. ROKU carries a Value Score of D.

ROKU’s Valuation

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for ROKU’s fourth-quarter 2025 earnings is pegged at 28 cents per share, unchanged over the past 30 days. The earnings figure suggests improvement over the year-ago quarter’s loss of 24 cents per share.

Roku, Inc. Price and Consensus

Roku, Inc. price-consensus-chart | Roku, Inc. Quote

Roku currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Naming Top 10 Stocks for 2026

Want to be tipped off early to our 10 top picks for the entirety of 2026? History suggests their performance could be sensational.

From 2012 (when our Director of Research Sheraz Mian assumed responsibility for the portfolio) through November, 2025, the Zacks Top 10 Stocks gained +2,530.8%, more than QUADRUPLING the S&P 500’s +570.3%.

Now Sheraz is combing through 4,400 companies to handpick the best 10 tickers to buy and hold in 2026. Don’t miss your chance to get in on these stocks when they’re released on January 5.

Be First to New Top 10 Stocks >>Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

Roku, Inc. (ROKU) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.