Rigetti Computing’s RGTI latest technical milestone—demonstrating its 36-qubit Ankaa system with two-qubit gate fidelity of 99.5%—marks a clear step forward in its roadmap to build commercially useful quantum processors. The company claims this is the highest fidelity ever demonstrated on one of its quantum systems, and it serves as validation of its modular architecture and fabrication improvements. However, despite the strength of these performance metrics, Rigetti has yet to show a clear path toward meaningful revenue growth. While its systems continue to improve on benchmarks that matter in the scientific community, the financial results still reflect a business in the early stages of customer adoption and product-market fit.

At the core of the challenge is the disconnect between quantum hardware performance and monetizable use cases. Rigetti has participated in several government-backed programs and partnerships, but most of these remain in research or pilot phases. The company plans to launch its 36-qubit system on Aug. 15, 2025, and remains on track to release a 100+ qubit chiplet-based system—targeting 99.5% median two-qubit gate fidelity—before the end of 2025. These systems mark significant technical progress, but the real test will be whether they translate into broader commercial traction. Until those signs appear, Rigetti’s revenue trajectory remains subdued, with continued losses and a reliance on its cash reserves to fund ongoing R&D and platform development.

Peers Updates

Peer company D-Wave Quantum QBTS has taken a different approach by doubling down on annealing-based quantum systems and building early-stage commercial relationships in optimization-heavy industries like logistics and supply chain. While annealing is not considered as broadly capable as gate-based quantum systems, D-Wave’s focus on problem-specific solutions has helped it generate more consistent top-line results from paying customers.

On the other hand, Quantum Computing Inc. QUBT continues to bet on a software-centric model through its Qatalyst platform. Positioned as hardware-agnostic, the platform aims to abstract quantum complexity for end users, though adoption has so far been limited. The company’s commercialization remains in early innings, and like Rigetti, it faces the uphill task of proving real-world value in a market still dominated by experimental deployments.

Rigetti’s Price Performance, Valuation and Estimates

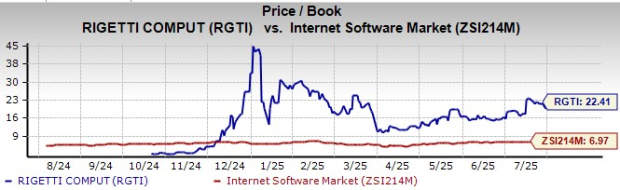

Shares of RGTI have gained 3.6% in the year-to-date period compared with the industry’s growth of 21.5%.

Image Source: Zacks Investment Research

From a valuation standpoint, Rigetti trades at a price-to-book ratio of 22.41, above the industry average. RGTI carries a Value Score of F.

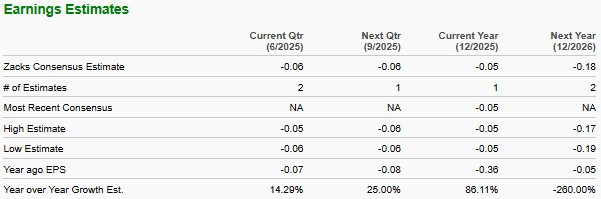

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for Rigetti’s 2025 earnings implies a significant 86.1% rise from the year-ago period.

Image Source: Zacks Investment Research

The company currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Beyond Nvidia: AI's Second Wave Is Here

The AI revolution has already minted millionaires. But the stocks everyone knows about aren't likely to keep delivering the biggest profits. Little-known AI firms tackling the world's biggest problems may be more lucrative in the coming months and years.

See "2nd Wave" AI stocks now >>Quantum Computing Inc. (QUBT) : Free Stock Analysis Report

Rigetti Computing, Inc. (RGTI) : Free Stock Analysis Report

D-Wave Quantum Inc. (QBTS) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.