Quanta Services, Inc. PWR has generated impressive earnings momentum since the start of 2025, with earnings per share (EPS) rising 22.4% in the third quarter following even stronger year-over-year growth of 30.5% and 26.2% in the first and second quarters, respectively. This performance is anchored by robust revenue growth and a record backlog of $39.2 billion, which underpins multi-year revenue visibility, supporting sustained EPS growth into 2026 and beyond.

The company’s Electric Infrastructure Solutions segment remains the primary growth engine, benefiting from accelerating investment in grid modernization, power generation, renewable energy and data-center-related infrastructure. The Electric segment revenue posted strong organic growth in 2025, while backlog continued to expand, reflecting rising demand from utilities and large-load customers. Importantly, Quanta noted that recently announced large power-generation and grid projects are not yet fully reflected in backlog, suggesting additional upside as awards convert into contracted work.

Strategically, the launch of Quanta’s Total Solutions power generation platform broadens its addressable market and deepens customer relationships by offering integrated, end-to-end solutions. This model reduces execution risk, improves project economics and supports margin stability, which is critical for sustaining double-digit EPS growth as revenue scales.

Financially, Quanta enters 2026 with a solid balance sheet, investment-grade credit profile and healthy free cash flow generation. Management expects 2025 adjusted EPS of $10.33–$10.83 and has explicitly guided toward another year of double-digit adjusted EPS growth in 2026, citing backlog momentum and favorable end-market trends. Since the beginning of 2025, Quanta has consistently increased its earnings outlook, supported by its self-perform craft labor model, execution certainty and disciplined project selection and risk management, reinforcing its profile as a durable, long-term EPS compounder.

Overall, record backlog visibility, steady project conversion and disciplined execution support Quanta’s ability to sustain double-digit EPS growth in 2026, with additional upside from the Total Solutions Power Generation platform over the longer term.

Competitive Landscape: MYR Group and MasTec

When assessing whether Quanta can sustain double-digit EPS growth in 2026, comparisons with MYR Group MYRG and MasTec MTZ are particularly relevant.

MYR Group is a leading specialty contractor focused on electric transmission, distribution and substation work, placing MYR Group squarely in the path of grid modernization and utility capital spending. MYR Group benefits from long-term utility programs, but its narrower scale and heavier exposure to project timing can introduce earnings volatility. As a result, MYR Group’s EPS growth can be solid, yet less predictable than Quanta’s diversified model.

MasTec also competes closely with Quanta in energy and utility infrastructure. MasTec has meaningful exposure to renewables, power delivery and communications, positioning MasTec to benefit from elevated infrastructure spending. However, MasTec’s margins are more sensitive to execution risk and mix shifts. Compared with MYR Group and MasTec, Quanta’s broader solutions platform and record backlog provide stronger visibility to sustained double-digit EPS growth.

PWR’s Price Performance, Valuation & Estimates

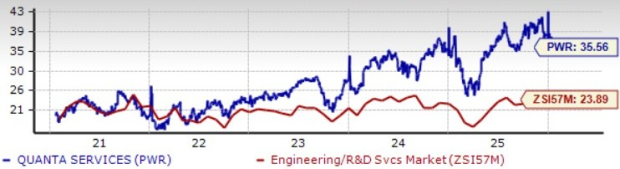

Shares of Quanta have gained 14.9% in the past six months compared with the Zacks Engineering - R and D Services industry’s growth of 2.9%.

PWR 6-Month Performance

Image Source: Zacks Investment Research

From a valuation standpoint, PWR trades at a forward 12-month price-to-earnings ratio of 35.56X, up from the industry’s 23.89X, as shown below.

PWR Valuation

Image Source: Zacks Investment Research

Quanta’s earnings estimate for 2026 has increased in the past 60 days. This indicates expected earnings growth of 2% year over year on projected revenue growth of 11.6%.

Image Source: Zacks Investment Research

PWR’s Zacks Rank

Quanta currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Just Released: Zacks Top 10 Stocks for 2026

Hurry – you can still get in early on our 10 top tickers for 2026. Handpicked by Zacks Director of Research Sheraz Mian, this portfolio has been stunningly and consistently successful.

From inception in 2012 through November, 2025, the Zacks Top 10 Stocks gained +2,530.8%, more than QUADRUPLING the S&P 500’s +570.3%.

Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2026. You can still be among the first to see these just-released stocks with enormous potential.

See New Top 10 Stocks >>Quanta Services, Inc. (PWR) : Free Stock Analysis Report

MYR Group, Inc. (MYRG) : Free Stock Analysis Report

MasTec, Inc. (MTZ) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.