Opendoor Technologies Inc. OPEN is pushing a wider product expansion strategy that aims to make the home buying and selling journey simpler, faster and more direct. The company is introducing tools that focus on convenience, digital access and a smoother experience across different stages of a transaction. This approach is not only about adding features. It is about turning the platform into a more complete ecosystem that can reach more users in 2026 by removing friction from the process.

The company has launched Opendoor Checkout, allowing customers to tour a home and place an offer online without agent dependency. New AI-supported home scoping, automated title and escrow processes, and a builder trade-in tool are meant to simplify transitions between homes. The Opendoor Key app supports structured assessments, while Buyer Peace of Mind and multilingual digital support tools aim to improve confidence and clarity. Direct purchase flows have reopened, SEO capabilities have been strengthened and USDC payment acceptance has been introduced to enable faster digital payments.

In the third quarter of 2025, the company reported softer unit metrics as it worked through older inventory, but the quarter also marked the beginning of this product reset and platform rebuilding effort. The company also emphasized accountability tools so progress can be tracked openly. These steps indicate that the company is not relying only on macro improvement but on product reach, platform depth and user experience upgrades to support relevance in 2026. If execution continues, this expansion strategy may help Opendoor connect with more customers and strengthen platform engagement going forward.

How OPEN Stacks Up Against Competitors

Opendoor faces rising competition from Zillow Group ZG and Offerpad Solutions OPAD, both of which are intensifying their use of AI to streamline residential transactions.

Zillow, mentioned repeatedly as Opendoor’s closest peer, is leveraging advanced AI-driven valuation models and integrated mortgage tools to strengthen its platform efficiency and user engagement. In home discovery and pricing accuracy, Zillow’s scale and data network provide a distinct edge.

Meanwhile, Offerpad continues to refine its operational model with predictive analytics and automation to enhance offer precision and resale speed. Offerpad’s focus on smaller, high-velocity markets mirrors Opendoor’s strategy but with a leaner asset footprint, making its AI-driven scalability a real competitive threat.

OPEN Stock’s Price Performance, Valuation & Estimates

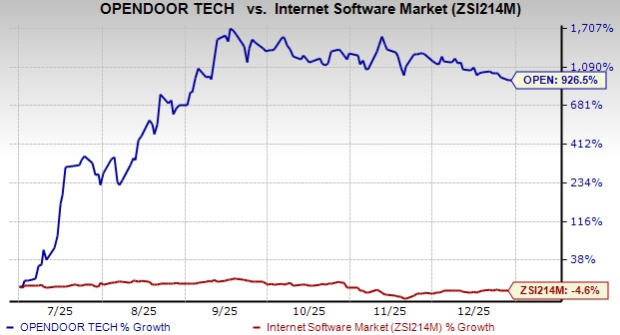

Shares of Opendoor have skyrocketed 926.5% in the past six months against the industry’s decline of 4.6%.

OPEN 6-Month Price Performance

Image Source: Zacks Investment Research

From a valuation standpoint, OPEN trades at a forward price-to-sales (P/S) multiple of 0.91, significantly below the industry’s average of 4.81.

P/S (F12M)

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for OPEN’s 2026 loss per share has narrowed to 13 cents in the past seven days, as shown below. Also, the estimated figure indicates a narrower loss from the year-ago estimated loss of 23 cents per share.

Image Source: Zacks Investment Research

OPEN currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Naming Top 10 Stocks for 2026

Want to be tipped off early to our 10 top picks for the entirety of 2026? History suggests their performance could be sensational.

From 2012 (when our Director of Research Sheraz Mian assumed responsibility for the portfolio) through November, 2025, the Zacks Top 10 Stocks gained +2,530.8%, more than QUADRUPLING the S&P 500’s +570.3%.

Now Sheraz is combing through 4,400 companies to handpick the best 10 tickers to buy and hold in 2026. Don’t miss your chance to get in on these stocks when they’re released on January 5.

Be First to New Top 10 Stocks >>Opendoor Technologies Inc. (OPEN) : Free Stock Analysis Report

Zillow Group, Inc. (ZG) : Free Stock Analysis Report

Offerpad Solutions Inc. (OPAD) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.