Snowflake SNOW is positioned to benefit from accelerating demand for cloud-based data platforms. SNOW’s AI Data Cloud unifies structured and unstructured data with governance, while Snowpark and Dynamic Tables expand developer use cases and enable real-time analytics. These capabilities strengthen Snowflake’s role in helping enterprises scale workloads on cloud-native infrastructure.

The outlook for the cloud analytics market supports this trajectory. Per Grand View Research projects the market to expand from $35.39 billion in 2024 to $130.63 billion by 2030, reflecting a 25.5% CAGR. This expansion is expected to be driven by enterprises transitioning from legacy infrastructure and investing in scalable platforms to manage growing data volumes and real-time analytics requirements. Snowflake’s unified architecture and consumption-based model directly align with this trend, creating opportunities for greater adoption across industries.

The Zacks Consensus Estimate for second-quarter fiscal 2026 product revenues are pegged at $1.04 billion, up from $829.3 million in the year-ago quarter. The projection reflects expectations that Snowflake will convert expanding cloud analytics demand into greater platform consumption through its AI Data Cloud, Snowpark and Dynamic Tables. With market momentum strengthening, Snowflake’s positioning is expected to drive sustained growth and potential upside in the stock.

SNOW Faces Stiff Competition

The cloud data analytics market is highly competitive, with MongoDB MDB and ORACLE ORCL emerging as key rivals to Snowflake.

MongoDB has scaled its Atlas platform beyond database management into analytics, emphasizing developer-friendly interfaces and distributed architectures that overlap with Snowflake’s ease-of-use positioning. Oracle, through its Cloud Infrastructure and Autonomous Database, integrates analytics and machine learning to deliver end-to-end enterprise solutions. While MongoDB targets agile development and modern workloads, Oracle leverages long-standing enterprise trust and bundled services.

Both players continue to capture share in cloud analytics, creating competitive pressure on Snowflake across multiple segments.

SNOW’s Share Price Performance, Valuation and Estimates

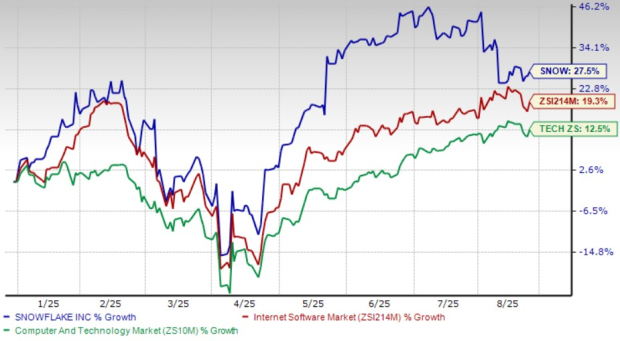

Snowflake shares have appreciated 27.5% year to date, outperforming the broader Zacks Computer & Technology sector’s return of 12.5% and the Zacks Internet Software industry’s increase of 19.3%.

SNOW's YTD Price Performance

Image Source: Zacks Investment Research

Snowflake stock is trading at a premium, with a forward 12-month Price/Sales of 12.93X compared with the industry’s 5.72X. SNOW has a Value score of F.

SNOW's Valuation

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for SNOW’s second-quarter fiscal 2026 earnings is pegged at 26 cents per share, unchanged over the past 30 days. The figure indicates a 24.91% increase year over year.

Snowflake Inc. Price and Consensus

Snowflake Inc. price-consensus-chart | Snowflake Inc. Quote

The Zacks Consensus Estimate for SNOW’s fiscal 2026 earnings is pegged at $1.06 per share, unchanged over the past 30 days. The figure indicates a 27.71% increase year over year.

Snowflake currently carries a Zacks Rank #3 (Hold). You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in the coming year. While not all picks can be winners, previous recommendations have soared +112%, +171%, +209% and +232%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Oracle Corporation (ORCL) : Free Stock Analysis Report

Snowflake Inc. (SNOW) : Free Stock Analysis Report

MongoDB, Inc. (MDB) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.