Microsoft's MSFT ambitious AI infrastructure expansion faces scrutiny as the company navigates unprecedented capital expenditure demands. The tech giant's latest announcement outlining seven AI trends for 2026 underscores its commitment to building what executives call "flexible, global AI systems" and next-generation linked AI superfactories designed to improve efficiency and reduce costs.

The company's infrastructure strategy centers on densely packed computing power distributed across global networks, moving beyond simply building larger datacenters. This approach aims to maximize every computing cycle while managing the substantial financial burden of AI development. According to Microsoft's first-quarter fiscal 2026 earnings, capital expenditures surged to $34.9 billion, representing a 74% year-over-year increase and significantly exceeding the $30 billion management had projected last quarter. Management now expects fiscal 2026 capital spending growth to surpass fiscal 2025 levels, with sequential increases anticipated throughout the year.

Microsoft reported cash and cash equivalents plus short-term investments totaling approximately $102 billion as of Sept. 30, 2025, against total debt of $97.6 billion. Operating cash flow for the quarter reached $45.1 billion, demonstrating robust cash generation capability. However, the company's aggressive infrastructure buildout raises questions about sustainable returns on these investments.

The announcement reveals multiple resource-intensive initiatives spanning healthcare diagnostics, where AI systems already handle more than 50 million daily health queries through Copilot and Bing, and quantum computing development through the Majorana 1 chip designed for millions of qubits. AI agent proliferation across enterprise environments demands enhanced security infrastructure and computational capacity. GitHub's repository intelligence, processing 43 million monthly pull requests and 1 billion annual commits, requires substantial backend support. While Microsoft frames these investments as competitive differentiators that will redefine computing capabilities, the simultaneous deployment across multiple fronts intensifies capital requirements. The company's debt-to-cash ratio exceeding 2:1 suggests a limited balance sheet cushion, making consistent cash flow generation essential for funding this expansion without increasing leverage or diluting shareholders through equity issuance.

Cloud Rivals AMZN & GOOGL Match Infrastructure Spending Intensity

Amazon AMZN and Alphabet GOOGL-owned Google reported similarly aggressive AI infrastructure investments in their third-quarter 2025 results, positioning all three cloud giants in a parallel spending race. Amazon reported third-quarter capital expenditures of $34.2 billion and raised its full-year 2025 outlook to $125 billion, with expectations for further increases in 2026. Amazon's AWS revenues grew 20% year over year to $33 billion, while the company reported operating cash flow supporting these investments despite total debt of $50.7 billion. Google parent Alphabet raised its 2025 capital expenditure guidance to $91-$93 billion from $85 billion, with management signaling significant increases expected in 2026. Google Cloud revenues surged 34% to $15.2 billion, with an $155 billion backlog demonstrating strong demand. Alphabet reported operating cash flow of approximately $112 billion for the trailing 12 months ending September 2025, supported by cash and marketable securities totaling $98.5 billion against minimal debt. The parallel escalation in infrastructure spending across Microsoft, Amazon and Google underscores the industry-wide conviction that AI infrastructure investments remain essential for maintaining competitive positioning, despite mounting investor scrutiny over near-term returns on these massive capital commitments.

MSFT’s Share Price Performance, Valuation & Estimates

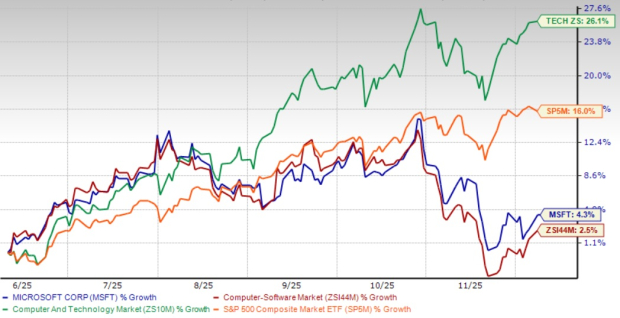

MSFT shares have appreciated 4.3% in the past six-month period compared with the Zacks Computer – Software industry and the Zacks Computer and Technology sector’s growth of 2.5% and 26.1%, respectively.

MSFT’s 6-Month Price Performance

Image Source: Zacks Investment Research

From a valuation standpoint, MSFT stock is currently trading at a forward 12-month Price/Sales ratio of 10.55X compared with the industry’s 7.69X. MSFT has a Value Score of D.

MSFT’s Valuation

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for MSFT’s fiscal 2026 earnings is pegged at $15.59 per share, up 0.3% over the past 30 days. The estimate indicates 14.3% year-over-year growth.

Microsoft Corporation Price and Consensus

Microsoft Corporation price-consensus-chart | Microsoft Corporation Quote

Microsoft currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Radical New Technology Could Hand Investors Huge Gains

Quantum Computing is the next technological revolution, and it could be even more advanced than AI.

While some believed the technology was years away, it is already present and moving fast. Large hyperscalers, such as Microsoft, Google, Amazon, Oracle, and even Meta and Tesla, are scrambling to integrate quantum computing into their infrastructure.

Senior Stock Strategist Kevin Cook reveals 7 carefully selected stocks poised to dominate the quantum computing landscape in his report, Beyond AI: The Quantum Leap in Computing Power.

Kevin was among the early experts who recognized NVIDIA's enormous potential back in 2016. Now, he has keyed in on what could be "the next big thing" in quantum computing supremacy. Today, you have a rare chance to position your portfolio at the forefront of this opportunity.

See Top Quantum Stocks Now >>Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.