Vistra Corp. VST is well-positioned to benefit from a declining interest rate environment, particularly as a competitive power producer with a diversified generation portfolio spanning nuclear, natural gas, renewables and energy storage. Lower interest rates tend to support broader economic growth and accelerate power demand, especially from data centers, electrification and industrial activity. Increasing demand for clean electricity can further boost the long-term prospects of Vistra.

Multiple rate hikes by the Federal Reserve took the benchmark rate to the 5.25-5.50% range, adversely impacting capital-intensive utility operators like Vistra. The U.S. Federal Reserve has gradually lowered the benchmark rate by 175 basis points, bringing down rates to a range of 3.50-3.75%. The Federal Reserve is expected to lower interest rates further in 2026. The capital-intensive operation of Vistra will benefit from the Fed’s decision to reduce interest rates.

Vistra already has a strong and well-defined capital expenditure plan focused on expanding zero-carbon nuclear output, growing solar and battery storage capacity and optimizing its natural gas fleet to meet peak demand. The company plans to invest $2.2 billion in 2026, after spending nearly the same amount in 2025.

Falling interest rates directly enhance Vistra’s financial profile by reducing borrowing costs and interest expense. As a capital-intensive energy company, Vistra stands to benefit meaningfully from refinancing opportunities and lower-cost funding for future investments.

How Other Utilities Benefit From Interest Rate Decline?

Lower interest rates help utilities by cutting borrowing costs, making projects more profitable, increasing asset values, allowing more investment in infrastructure, improving cash flows, strengthening the balance sheet and supporting better long-term returns for shareholders.

Utilities such as NextEra Energy NEE and Duke Energy DUK have well-chalked-out long-term capital investment plans and will benefit from falling interest rates through lower financing costs and improved project returns.

NextEra leveraged cheaper capital to expand renewables and storage, while Duke used lower rates to fund grid modernization and clean energy investments, strengthening cash flows and balance sheet flexibility.

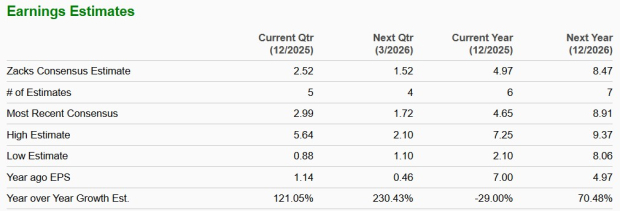

VST’s Earnings Estimates

The Zacks Consensus Estimate for Vistra’s 2025 earnings per share indicates a year-over-year decline of 29%, while the same for 2026 implies an increase of 70.48%.

Image Source: Zacks Investment Research

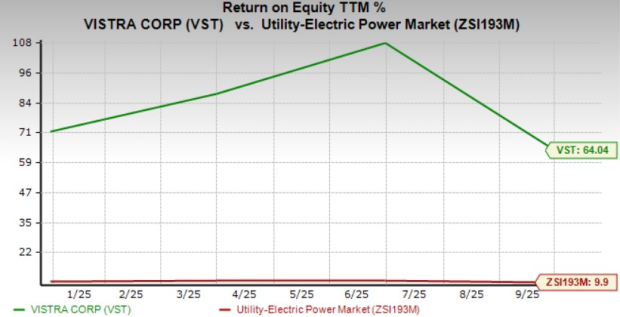

VST Stock’s ROE Is Higher Than Its Industry

VST’s trailing 12-month return on equity (“ROE”) is 64.4%, way ahead of its industry average of 9.9%. ROE, a profitability measure, indicates how effectively a company is utilizing its shareholders’ funds in operations to generate income.

Image Source: Zacks Investment Research

VST’s Price Performance

Shares of Vistra have risen 20.4% in the past year compared with the industry’s growth of 21.4%.

Price Performance (One Year)

Image Source: Zacks Investment Research

VST's Zacks Rank

Vistra currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Naming Top 10 Stocks for 2026

Want to be tipped off early to our 10 top picks for the entirety of 2026? History suggests their performance could be sensational.

From 2012 (when our Director of Research Sheraz Mian assumed responsibility for the portfolio) through November, 2025, the Zacks Top 10 Stocks gained +2,530.8%, more than QUADRUPLING the S&P 500’s +570.3%.

Now Sheraz is combing through 4,400 companies to handpick the best 10 tickers to buy and hold in 2026. Don’t miss your chance to get in on these stocks when they’re released on January 5.

Be First to New Top 10 Stocks >>NextEra Energy, Inc. (NEE) : Free Stock Analysis Report

Duke Energy Corporation (DUK) : Free Stock Analysis Report

Vistra Corp. (VST) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.