Over the years, International Business Machines Corporation’s IBM Software segment has recorded healthy profit growth backed by a strong focus on product innovation and a growing adoption of its hybrid cloud services. The Software segment includes Hybrid Cloud (previously reported as Red Hat), Automation, Data and Transaction Processing businesses. The addition of cutting-edge products has significantly improved IBM Software’s ability to help organizations optimize IT spending, reduce cloud costs and boost overall efficiency through automation.

With a surge in traditional cloud-native workloads and associated applications, along with a rise in generative AI deployment, there is a radical expansion in the number of cloud workloads that enterprises are currently managing. This has resulted in heterogeneous, dynamic and complex infrastructure strategies, which have led firms to undertake a cloud-agnostic and interoperable approach to highly secure multi-cloud management, leading to a healthy demand for the hybrid cloud services of IBM. The company is witnessing healthy hybrid cloud adoption by clients and solid demand trends across automation and generative AI offerings like watsonx. This, in turn, has led to sustainable growth through advanced technology and deep consulting expertise.

The buyout of HashiCorp has further augmented IBM’s capabilities to assist enterprises in managing complex cloud environments. Leveraging HashiCorp’s cloud software capabilities and indigenous tool sets, IBM has significantly strengthened its multi-cloud approach. The buyouts of StreamSets and webMethods have brought together additional capabilities in integration, API management and AI data automation and ingestion. Complementing IBM DataStage and Databand platform with a hybrid and multi-cloud approach, the buyouts have enabled IBM to develop comprehensive application and data integration platforms in the industry.

Tech Firms Riding on Hybrid Cloud Traction

Amazon.com, Inc. AMZN enjoys a key position in the cloud-computing market, particularly in the IaaS space, thanks to Amazon Web Services (“AWS”), which is one of its high-margin-generating businesses. AWS is the world’s most comprehensive and widely adopted on-demand cloud computing platform, serving a large number of business enterprises, government entities and startups. It reportedly offers the widest variety of databases that are purpose-built for different kinds of applications to enable subscribers to choose the right tool for the job for faster agility at a relatively low cost.

Microsoft Corporation MSFT has doubled down on the cloud computing opportunity. Azure’s increased availability in more than 60 announced regions globally has strengthened Microsoft's competitive position in the cloud computing market. Operating via a massive network of global data centers that ensure high availability and reliability for applications, Azure offers seamless access to all services included in the portal once customers subscribe to it. Subscribers can use these services for creating cloud-based resources, such as virtual machines and databases, which can be assembled into running environments used to host workloads and store data.

IBM’s Price Performance, Valuation and Estimates

IBM has surged 33.4% over the past year compared with the industry’s growth of 60.2%.

Image Source: Zacks Investment Research

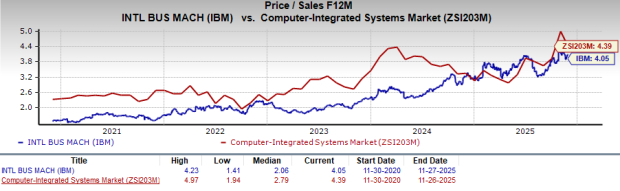

From a valuation standpoint, IBM trades at a forward price-to-sales ratio of 4.05, below the industry tally of 4.39.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for IBM’s earnings for 2025 has increased over the past 60 days.

Image Source: Zacks Investment Research

IBM currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpAmazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

International Business Machines Corporation (IBM) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.