HSBC Holdings HSBC is undergoing a strategic transformation, shifting its focus toward Asia while restructuring key parts of its global operations.

Let’s have a look at the bank’s strategic plan and then decipher whether HSBC stock deserves a place in your portfolio.

HSBC’s Strategic Business Overhaul Plan

In February 2025, HSBC announced a $1.5 billion cost-saving program from the organizational simplification efforts by 2026. The company is likely to incur nearly $1.8 billion in total severance and other upfront charges by the end of next year to implement business simplification efforts.

Separately, the bank announced plans to redeploy an additional $1.5 billion from the strategic reallocation of costs from non-strategic or low-returning activities into its core strategy, where it has competitive strength. In sync with this, HSBC is winding down its mergers and acquisitions and equity capital markets operations in the U.K., Europe and the United States while maintaining a more focused presence in Asia and the Middle East. The company is also set to close its business banking division in the United States.

The bank is also progressing with divestments in Germany, South Africa, Bahrain and France and has begun a strategic review of its business in Malta. Apart from these, HSBC completed the sale of its businesses in the United States, Canada, New Zealand, Greece, Russia, Argentina and Armenia, as well as the retail banking operations in France and Mauritius.

HSBC’s Asia-Centric Bet

HSBC is undertaking measures to bolster its performance, focusing on building operations across Asia. The company intends to position itself as a top bank for high-net-worth and ultra-high-net-worth clients in the region, constituting more than half of its operations.

HSBC plans to grow by strengthening its transaction banking, expanding internationally and building the wealth business, especially in Asia. It is focused on growing in the core markets, Hong Kong and the U.K., by supporting small and medium businesses, improving digital services and offering better products.

HSBC is rapidly expanding its wealth business in mainland China by launching large, lifestyle-integrated wealth centers in major cities. It aims to deepen market presence through acquisitions (Citigroup’s retail wealth management portfolio in China), digital investments and hiring. With a focus on affluent clients, HSBC is enhancing services across Premier Banking, Private Banking and Asset Management to support long-term growth in Asia’s largest affluent market.

Further, HSBC is eyeing expansion in the lucrative Indian market. In January, it received approval from the Reserve Bank of India to open 20 new bank branches in major cities. At present, it operates 26 branches in 14 Indian cities. India's wealth market is growing rapidly, with ultra-high net worth individuals expected to soar 50% by 2028. In response, the company is expanding its services by launching Global Private Banking in 2023, acquiring L&T Investment Management in 2022 and enhancing Premier Banking in 2024.

Other Factors at Play for HSBC

Strong Balance Sheet Position: Despite the uncertain macroeconomic environment, HSBC’s capital position remains solid. As of March 31, 2025, the company’s capital ratios were strong, driven by steady capital generation. Further, it has investment-grade long-term ratings of A+, A3 and A- from Fitch, Moody’s and Standard and Poor’s, respectively.

Given the solid capital position and lower debt-equity ratio compared with the industry, the company has been rewarding its shareholders consistently. In 2024, HSBC returned $26.9 billion to the shareholders through dividends and repurchases, while in 2023, it was $20.8 billion. The company expects a dividend payout ratio of 50% for 2025.

On April 25, HSBC completed the $2 billion share buyback plan announced with its full-year 2024 results in February. The company has initiated a new share repurchase program of up to $3 billion. The plan commenced after May 2 and will be completed by July 30, 2025.

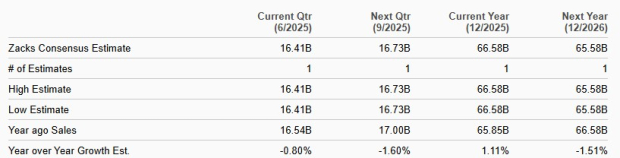

Subdued Revenue Performance: Revenue generation at HSBC has been muted over the past several quarters. While the interest rate environment across the world improved, the financial impact of the challenging macroeconomic backdrop continues to weigh on the company’s top-line growth.

Though revenues were stable in 2024 and increased in 2023, the metric recorded a negative CAGR of 2.7% over the three years ended 2022. Not-so-impressive loan demand and a tough macroeconomic environment in many of its markets are major headwinds. Hence, top-line performance is expected to remain weak in the near term.

HSBC Sales Estimates

Image Source: Zacks Investment Research

HSBC Stock’s Price Performance & Valuation Analysis

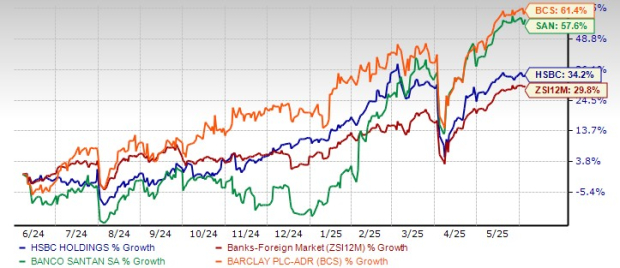

HSBC shares have rallied 34.2% in the past year compared with the industry’s growth of 29.8%. Meanwhile, its peers, Barclays BCS and Banco Santander, S.A. SAN, have performed impressively in the same time frame.

HSBC One-Year Price Performance

Image Source: Zacks Investment Research

Now, let’s take a look at the value HSBC offers investors at current levels.

At present, HSBC is trading at 1.07X 12-month trailing price/tangible book (P/TB), above its five-year median of 0.75X. Meanwhile, the industry has P/TB TTM of 2.32X. Hence, the stock looks inexpensive compared with the industry average.

HSBC P/TB TTM

Image Source: Zacks Investment Research

Further, Barclays has a P/TB TTM of 0.75X, and Banco Santander’s P/TB TTM is 1.35X. So, HSBC is trading at a massive premium compared with Barclays, while its shares are cheaper than Banco Santander.

Is HSBC Stock Worth Considering?

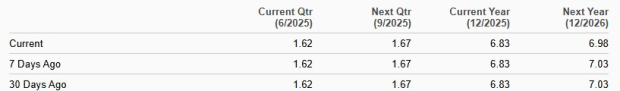

Over the past seven days, the Zacks Consensus Estimate for 2025 earnings has remained unchanged at $6.83, while for 2026, it has moved lower to $6.98.

Earnings Estimate Revision Trend

Image Source: Zacks Investment Research

The projected figures imply a rise of 5.1% and 2.3% for 2025 and 2026, respectively.

HSBC’s business simplification and restructuring initiatives, along with its cost savings plan, are expected to drive growth in the upcoming period. Also, the cheap valuation makes the stock an attractive investment option.

Nonetheless, HSBC’s subdued revenue growth expectations are concerning. Further, investors must keep an eye on the progress of the company’s strategic actions to drive earnings. The impact of macroeconomic factors must also be carefully evaluated before buying HSBC stock. Those who already own the stock can hold onto it because it is less likely to disappoint over the long term.

HSBC currently carries a Zacks Rank #3 (Hold). You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Zacks' Research Chief Names "Stock Most Likely to Double"

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is among the most innovative financial firms. With a fast-growing customer base (already 50+ million) and a diverse set of cutting edge solutions, this stock is poised for big gains. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpBarclays PLC (BCS) : Free Stock Analysis Report

Banco Santander, S.A. (SAN) : Free Stock Analysis Report

HSBC Holdings plc (HSBC) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.