Amicus Therapeutics FOLD has been making meaningful progress with its lead product, Galafold (migalastat), which has been driving the majority of the company’s revenues. The drug has remained a key top-line driver for Amicus over the past quarters.

Galafold is approved for treating Fabry disease in patients who have amenable genetic variants. The drug is approved in several countries across the world, including the United States, the European Union, the United Kingdom and Japan.

In the first nine months of 2025, Galafold generated sales worth $371.5 million, which increased around 12% on a year-over-year basis. Our model estimates for Galafold sales suggest a CAGR of 10.4% over the next three years.

Galafold sales have been rising steadily, owing to commercial execution in all markets and strong compliance and the momentum is likely to continue in the future quarters heading into 2026. The drug also has a strong IP portfolio in the United States, providing patent protection through 2038.

Meanwhile, in October 2024, Amicus signed a licensing agreement with Teva Pharmaceuticals TEVA, resolving the patent lawsuit that it had filed earlier. The litigation arose after Teva submitted an abbreviated new drug application seeking approval to sell a generic version of Amicus' Galafold 123 mg capsules before the related patents expired.

Per the settlement terms, TEVA will not be able to sell its generic version of Galafold in the United States until January 2037.

Besides Galafold, Amicus is also making good progress with Pombiliti (cipaglucosidase alfa) + Opfolda (miglustat), a two-component therapy, which is approved for treating adults with late-onset Pompe disease.

During the first nine months of 2025, the combo drug generated sales worth $77.5 million, up around 61.5% on a year-over-year basis. The approval of Pombiliti + Opfolda helped FOLD tap into a market with a significant commercial opportunity.

FOLD’s Competition in the Target Market

Though Amicus is riding on the success of Galafold, the company’s heavy reliance on the drug for revenues remains a concern. Rising competition in the target market also remains a headwind, as several companies currently market and sell products for treating lysosomal storage disorders, including Fabry disease.

Sanofi SNY markets Fabrazyme, which is approved for treating Fabry disease. Japan-based Takeda Pharmaceuticals’ Replagal is also indicated for long-term enzyme replacement therapy in patients with a confirmed diagnosis of Fabry Disease.

Sanofi also markets its Pompe disease drugs, Myozyme/Lumizyme, as well as Nexviazyme. Stiff competition from established players in the Pompe disease market also remains a concern for Amicus, whose resources are limited compared with a large drug maker like SNY.

FOLD’s Price Performance, Valuation and Estimates

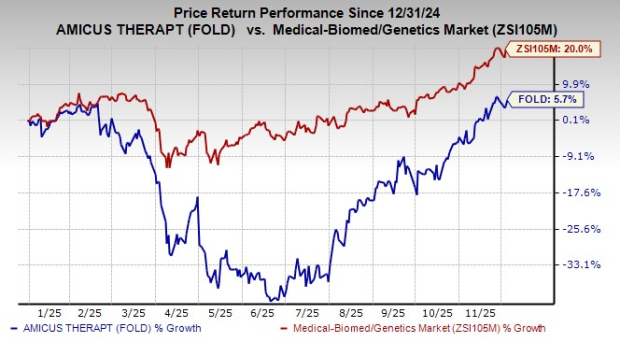

Year to date, shares of Amicus have risen 5.7% compared with the industry’s growth of 20%.

Image Source: Zacks Investment Research

From a valuation standpoint, Amicus is trading at a premium to the industry. Going by the price-to-sales (P/S) ratio, the company’s shares currently trade at 5.16, higher than 2.49 for the industry. The stock is trading below its five-year mean of 9.06.

Image Source: Zacks Investment Research

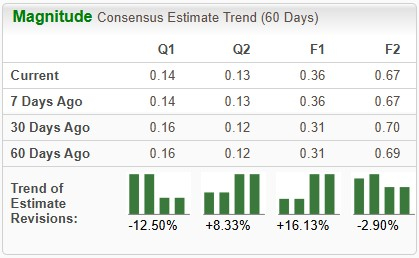

The Zacks Consensus Estimate for 2025 earnings per share (EPS) has increased from 31 cents to 36 cents over the past 60 days. During the same time frame, EPS estimates for 2026 have declined from 69 cents to 67 cents.

Image Source: Zacks Investment Research

FOLD’s Zacks Rank

Amicus currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpSanofi (SNY) : Free Stock Analysis Report

Teva Pharmaceutical Industries Ltd. (TEVA) : Free Stock Analysis Report

Amicus Therapeutics, Inc. (FOLD) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.