CrowdStrike’s CRWD Falcon Flex model continues to grow quickly and is becoming a central part of the company’s expansion strategy. In the third quarter of fiscal 2026, Annual Recurring Revenue (ARR) from Falcon Flex customers reached $1.35 billion, more than triple last year’s level. Management said Falcon Flex is now one of the most common ways customers choose to buy and expand on the Falcon platform.

Falcon Flex helps customers adopt new modules without long contract steps, which leads to faster platform usage. This is also driving strong re-Flex activity. More than 200 customers expanded their Falcon Flex contracts in the third quarter, and some doubled their original spending. According to the company, this shows customers see value quickly and are willing to increase their usage once they start with Flex.

Falcon Flex is also supporting growth in key product areas like Next-Generation Security Information and Event Management, cloud security, identity security, and endpoint protection. Because Falcon Flex reduces procurement friction, customers can consolidate more of their security needs into one platform. This strengthens customer relationships and increases the likelihood of multi-module adoption.

The above factors demonstrate how Falcon Flex can remain a major growth engine over time. For now, Falcon Flex is lifting ARR, increasing deal sizes, and deepening platform use. If these patterns continue, Falcon Flex could remain one of CrowdStrike’s most important growth drivers through fiscal 2026 and beyond. The Zacks Consensus Estimate for both fiscal 2026 and 2027 revenues indicates a year-over-year increase of around 21%.

How Competitors Fare Against CRWD

Competitors like Palo Alto Networks PANW and SentinelOne S are also gaining ground through platform expansion and AI innovation.

In the first quarter of fiscal 2026, Palo Alto Networks saw robust growth in its Next-Gen Security Annual Recurring Revenues (ARR), which increased 29% year over year. The growth was driven by increased customer adoption of PANW’s advanced cybersecurity offerings, including its AI-driven XSIAM platform, SASE and software firewalls.

Though comparatively a small competitor, SentinelOne posted third-quarter fiscal 2026 year-over-year growth of 23% in its ARR. The growth was fueled by the rising adoption of SentinelOne’s AI-first Singularity platform and Purple AI.

CRWD’s Price Performance, Valuation and Estimates

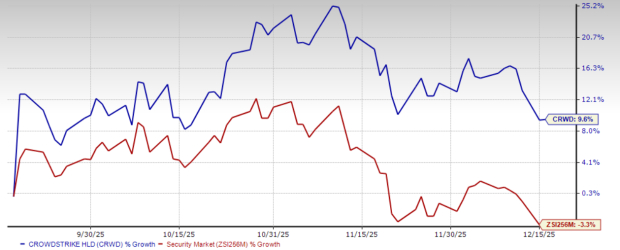

Shares of CrowdStrike have gained 9.6% in the past three months against the Zacks Security industry’s decline of 3.3%.

CRWD 3-Month Price Return Performance

Image Source: Zacks Investment Research

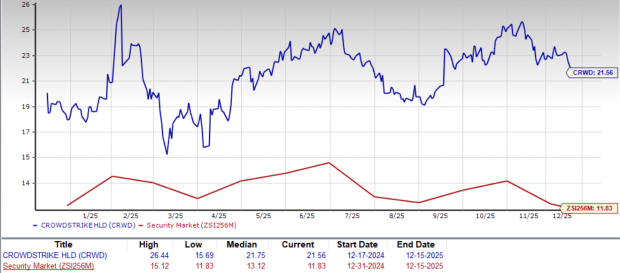

From a valuation standpoint, CrowdStrike trades at a forward price-to-sales ratio of 21.56, way higher than the industry’s average of 11.83.

CRWD Forward 12-Month P/S Ratio

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for CrowdStrike’s fiscal 2026 earnings implies a year-over-year decline of 5.6%, while the same for fiscal 2027 earnings indicates year-over-year growth of 28.8%. The estimates for fiscal 2026 and 2027 have been revised upward by 4 cents and 3 cents, respectively, over the past 30 days.

Image Source: Zacks Investment Research

CrowdStrike currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in the coming year. While not all picks can be winners, previous recommendations have soared +112%, +171%, +209% and +232%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>SentinelOne, Inc. (S) : Free Stock Analysis Report

Palo Alto Networks, Inc. (PANW) : Free Stock Analysis Report

CrowdStrike (CRWD) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.