Devon Energy’s DVN ongoing debt reduction strengthens its financial position and enhances financial flexibility. As the companies operating in the Zacks Oil and Gas - Exploration and Production - United States industry are impacted by cyclical commodity prices and capital-intensive operations, maintaining a healthy balance sheet is essential. Devon’s planned debt reduction not only lowers its financial leverage but also builds resilience to navigate oil and gas price volatility more effectively.

In July 2024, Devon announced plans to reduce its outstanding debt by $2.5 billion and $500 million has been retired. Devon plans to accelerate the retirement of its $485 million senior notes maturing in December 2025. The planned debt reduction will lower Devon’s annual interest payment burden by $100 million.

Lowering debt reduces interest expenses, improving Devon’s free cash flow profile. The savings generated can be redeployed toward new drilling projects, shareholder distributions or strategic acquisitions, thereby compounding returns. With a reduced debt burden, Devon gains the flexibility to sustain capital investments in core assets, maintaining its competitive edge while strengthening production and efficiency.

Lower debt enhances credit ratings, reduces refinancing risks and provides greater financial optionality for growth initiatives. Investors are expected to reward Devon’s disciplined approach, as it ensures a balance between growth, shareholder returns and financial stability.

Courtesy of Devon’s planned debt reduction, its total debt to capital is pegged at 36.73%, lower than the industry average of 49.06%. This indicates Devon is using much less debt than its peers to operate the business.

Oil and Gas Companies Gain From Debt Reduction

Debt reduction increases the financial flexibility of oil and gas companies by cutting interest expenses, boosting cash flow, improving creditworthiness and funding growth while effectively managing market volatility.

Debt reduction has proven beneficial for several oil and gas companies beyond Devon. Occidental Petroleum OXY lowered its debt after the Anadarko acquisition, reducing interest costs and improving financial flexibility. Likewise, ConocoPhillips COP prioritized debt repayment, which strengthened its balance sheet. Both companies demonstrate how strategic deleveraging supports long-term growth, stability and resilience amid commodity price fluctuations.

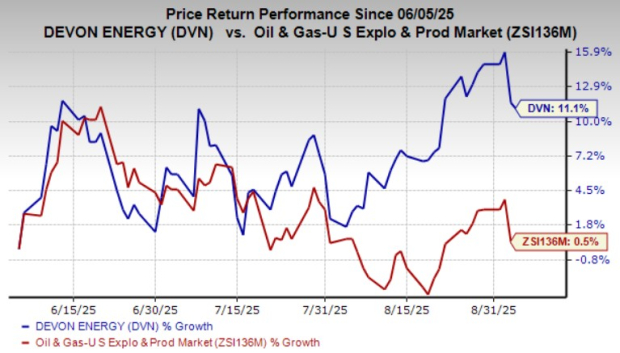

DVN’s Price Performance

Devon’s shares have gained 11.1% in the past three months compared with the industry’s rise of 0.5%.

Image Source: Zacks Investment Research

DVN Stock Returns Better Than Industry

Devon’s return on equity (“ROE”) was better than the industry average in the trailing 12 months. ROE of DVN was 18.59% compared with the industry average of 15.88%.

Image Source: Zacks Investment Research

DVN’s Shares Trading at a Discount

Devon’s shares are inexpensive on a relative basis, with its current trailing 12-month Enterprise Value/Earnings before Interest Tax Depreciation and Amortization (EV/EBITDA TTM) being 3.83X compared with the industry average of 10.98X.

Image Source: Zacks Investment Research

DVN’s Zacks Rank

DVN currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Radical New Technology Could Hand Investors Huge Gains

Quantum Computing is the next technological revolution, and it could be even more advanced than AI.

While some believed the technology was years away, it is already present and moving fast. Large hyperscalers, such as Microsoft, Google, Amazon, Oracle, and even Meta and Tesla, are scrambling to integrate quantum computing into their infrastructure.

Senior Stock Strategist Kevin Cook reveals 7 carefully selected stocks poised to dominate the quantum computing landscape in his report, Beyond AI: The Quantum Leap in Computing Power.

Kevin was among the early experts who recognized NVIDIA's enormous potential back in 2016. Now, he has keyed in on what could be "the next big thing" in quantum computing supremacy. Today, you have a rare chance to position your portfolio at the forefront of this opportunity.

See Top Quantum Stocks Now >>Devon Energy Corporation (DVN) : Free Stock Analysis Report

ConocoPhillips (COP) : Free Stock Analysis Report

Occidental Petroleum Corporation (OXY) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.