CoreWeave, Inc. (CRWV) is well-positioned to capitalize on surging enterprise adoption, fueled by heightened demand across cloud, AI and data-centric workloads. The company has rapidly expanded its footprint, benefiting from product innovations, deep customer engagements, strategic hyperscaler ties and federal-sector opportunities roll out. The number of clients generating more than $100 million in annual revenue has tripled, as AI-native companies and enterprises across sectors turn to CoreWeave to drive innovation, productivity and growth.

Recently at Fal. Con Europe 2025, CrowdStrike (CRWD) and CoreWeave announced a global partnership to deliver a secure AI cloud foundation for the agentic era and accelerate progress toward secure AGI. The alliance pairs CRWV’s AI Cloud with the CrowdStrike Falcon platform’s security to protect and speed up the advanced computing workloads behind modern AI development. In addition, Rakuten is leveraging CRWV’s platform to enhance its visual language models, improving transparency, reproducibility and execution speed. It also expanded across a broader enterprise base, adding major wins that include a top software design platform and a large U.S. telecom operator.

Furthermore, CRWV is expanding into the public sector with the launch of CoreWeave Federal, designed to meet the government’s high-performance and security needs. NASA is already using the platform at the Jet Propulsion Lab to support advanced scientific work. This initiative solidifies America’s AI infrastructure, empowering agencies to accelerate innovation and tackle critical missions. These lucrative wins highlight its enterprise readiness, backed by increasing customer engagements across diverse industries and global markets.

However, CRWV continues to face a strict supply-constrained environment where demand for its AI cloud platform greatly exceeds available capacity, limiting its ability to serve customers fully. Delays in powered-shell delivery from a data center provider are likely to adversely impact its performance in the fourth quarter. Although temporary and with the customer agreeing to adjust the schedule to preserve full contract value, these setbacks have prompted management to lower its 2025 outlook. The company now expects revenue of $5.05–$5.15 billion, down from $5.15–$5.35 billion, and adjusted operating income of $690–$720 million, below the previous $800–$830 million range.

Also, tough competition from tech behemoths like Microsoft (MSFT) and emerging AI players like Nebius Group N.V. (NBIS) weighs on its growth prospects. Like CRWV, these companies are also plagued by supply headwinds amid booming AI and enterprise demand.

How CRWV’s Key Rivals are Faring in the AI Space

Microsoft is capitalizing on AI business momentum fueled by strong Copilot adoption and the rapid expansion of its Azure cloud infrastructure. Recently, it announced plans to increase total AI capacity by more than 80% in 2025 and roughly double the total data center footprint over the next two years. For the fiscal second quarter, MSFT expects Azure revenue to grow about 37% in constant currency, as demand continues to far exceed available capacity. Even with accelerated build-outs, Microsoft now anticipates being capacity-constrained through the end of its fiscal year. Growth may also show quarterly volatility due to the timing of capacity additions and contract mix, adding further uncertainty to near-term results. However, revenues are anticipated in the $79.5-$80.6 billion band, implying growth of 14% to 16% driven by solid AI platform adoption and record cloud bookings.

To reach larger enterprise customers, Nebius has launched its enterprise-ready cloud platform, Aether 3.0, and its new inference platform, Nebius Token Factory. With more software and services in development and strong demand, the company targets to reach $7–$9 billion in ARR by the end of 2026. Also, its mega-deals with Microsoft and Meta are expected to begin contributing late in the fourth quarter, with the majority of related revenue ramping up throughout 2026. Nebius has improved its full-year group revenue outlook to a range of $500-$550 million from $450-$630 million. However, capacity remains NBIS’ biggest bottleneck. Every deployment is immediately sold out, and demand keeps far exceeding supply. In the near term, power constraints and supply-chain hurdles are likely to hold back any meaningful capacity expansion.

CRWV Price Performance, Valuation and Estimates

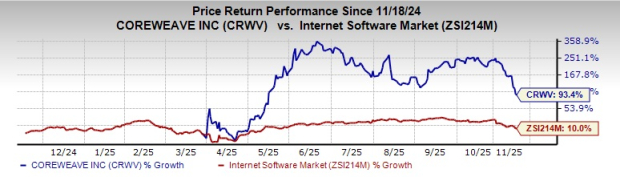

Shares of CoreWeave have gained 93.4% in the past year compared with the Internet Software industry’s growth of 10%.

Image Source: Zacks Investment Research

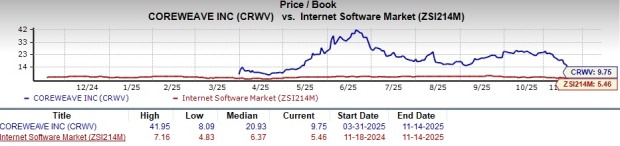

In terms of Price/Book, CRWV’s shares are trading at 9.75X, way higher than the Internet Software Services industry’s 5.46X.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for CRWV’s earnings for 2025 has been revised north over the past 60 days.

Image Source: Zacks Investment Research

CRWV currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

Radical New Technology Could Hand Investors Huge Gains

Quantum Computing is the next technological revolution, and it could be even more advanced than AI.

While some believed the technology was years away, it is already present and moving fast. Large hyperscalers, such as Microsoft, Google, Amazon, Oracle, and even Meta and Tesla, are scrambling to integrate quantum computing into their infrastructure.

Senior Stock Strategist Kevin Cook reveals 7 carefully selected stocks poised to dominate the quantum computing landscape in his report, Beyond AI: The Quantum Leap in Computing Power.

Kevin was among the early experts who recognized NVIDIA's enormous potential back in 2016. Now, he has keyed in on what could be "the next big thing" in quantum computing supremacy. Today, you have a rare chance to position your portfolio at the forefront of this opportunity.

See Top Quantum Stocks Now >>Microsoft Corporation (MSFT) : Free Stock Analysis Report

CrowdStrike (CRWD) : Free Stock Analysis Report

Nebius Group N.V. (NBIS) : Free Stock Analysis Report

CoreWeave Inc. (CRWV) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.