Credo Technology Group Holding Ltd’s CRDO is witnessing rapid momentum in its optical business, with management projecting that revenues from this business will double once again in fiscal 2026. The company’s optical digital signal processor (DSP) portfolio is designed to meet the soaring connectivity demands of data centers and hyperscale networks in AI-driven infrastructure.

Credo’s portfolio spans both full DSP and linear receive optical (LRO) solutions. These solutions, supporting port speeds up to 1.6 terabits per second, are gaining strong traction among optical module makers and their hyperscale customers. Its comprehensive range of DSPs supports 50G, 100G, 200G, 400G and 800G PAM4 optical interconnects. Using proprietary DSP technology and advanced equalization techniques, Credo effectively compensates for optical impairments, delivering optimal system performance, high signal integrity and energy-efficient operation.

The company is also making significant investments in both copper and optical solutions to further diversify its market presence. Recently, the company introduced its Bluebird DSP, a high-performance, low-power solution for 1.6Tbps optical transceivers that delivers 224Gbps per lane PAM4 data transmission. Bluebird enables transceivers to operate under 20 watts, making them ideal for dense AI and hyperscale data centers. Supporting both full DSP and LRO variants, it offers flexibility for 800G and 1.6T deployments, with ultra-low latency (<40ns), advanced telemetry for real-time monitoring and IEEE-compliant FEC for fiber reaches up to 2 km and beyond.

After a solid performance in fiscal 2025, Credo maintained strong momentum in its optical business in the first quarter of fiscal 2026 as well. Management is on track to achieve its goal of doubling optical revenue in fiscal 2026.

For fiscal 2026, the company anticipates mid-single-digit sequential revenue growth, resulting in roughly 120% year-over-year growth. CRDO had earlier expected revenues to surpass $800 million, implying more than 85% year-over-year growth. Non-GAAP net margin is projected to be around 40% both in the upcoming quarters and for fiscal 2026.

However, increasing market competition and macroeconomic uncertainties amid tariff troubles remain a concern. Credo competes with semiconductor giants like Marvell Technology MRVL and Broadcom AVGO.

Taking a Look at MRVL and AVGO’s Optical DSP Strategies

Marvell is solidifying its leadership in AI interconnect and optical technologies, a critical backbone of next-generation data centers. In the second quarter of fiscal 2026, the company began volume shipments of 200G per lane 1.6T PAM4 DSPs and ramped up its 51.2 Tbps switches while continuing strong demand for its 800G PAM DSPs. Management expects its electro-optics portfolio to deliver double-digit sequential growth in the third quarter, reflecting unmatched positioning in AI interconnect.

In the long term, Marvell is pushing boundaries with 400G per lane PAM technology, enabling 3.2T optical interconnects and future-proofing hyperscaler infrastructure. With leadership across DSPs, silicon photonics and scale-up switching, Marvell is a clear enabler of AI workload expansion and stands to benefit from surging AI cloud investments. For the third quarter, the company expects revenues to be $2.06 billion (+/- 5%).

Broadcom is a dominant force in the optical DSP market, leveraging its scale, deep customer relationships and extensive PAM4 DSP portfolio to maintain a leading position in hyperscale and data center deployments. In March 2025, Broadcom announced the expansion of its portfolio of optical interconnect solutions to enable AI infrastructure. The expansion includes advancements in co-packaged optics (CPO), 200G/lane DSP and SerDes, 400G optics, and PCIe Gen6 over optics. Also, Broadcom announced the expansion of its 200G/lane DSP PHY portfolio with the introduction of Sian3 and Sian2M, optimized for AI/ML cluster connectivity in 800G and 1.6T optical transceivers.

CRDO’s Price Performance, Valuation and Estimates

Shares of CRDO have gained 156.3% year to date compared with the Electronics-Semiconductors industry’s growth of 34.2%.

Image Source: Zacks Investment Research

In terms of the forward 12-month price/sales ratio, CRDO is trading at 28.68, higher than the Electronic-Semiconductors sector’s multiple of 9.35.

Image Source: Zacks Investment Research

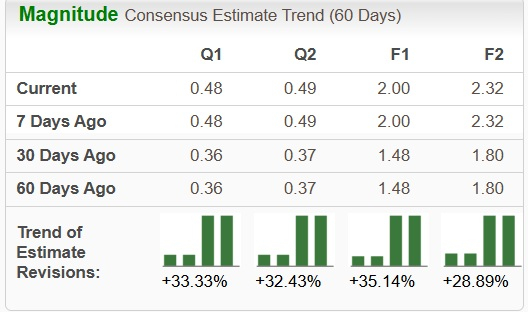

The Zacks Consensus Estimate for CRDO earnings for fiscal 2026 has been revised upward over the past 60 days.

Image Source: Zacks Investment Research

CRDO currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1(Strong Buy) Rank stocks here.

Higher. Faster. Sooner. Buy These Stocks Now

A small number of stocks are primed for a breakout, and you have a chance to get in before they take off.

At any given time, there are only 220 Zacks Rank #1 Strong Buys. On average, this list more than doubles the S&P 500. We’ve combed through the latest Strong Buys and selected 7 compelling companies likely to jump sooner and climb higher than any other stock you could buy this month.

You'll learn everything you need to know about these exciting trades in our brand-new Special Report, 7 Best Stocks for the Next 30 Days.

Download the report free now >>Marvell Technology, Inc. (MRVL) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

Credo Technology Group Holding Ltd. (CRDO) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.