Boot Barn Holdings, Inc. BOOT is executing another year of robust expansion, targeting 15%-unit growth in fiscal 2026 as part of its long-term strategy to deepen market presence across the United States. The company now expects to open about 70 new stores this fiscal year, having opened 59 stores last fiscal, thus maintaining a consistent double-digit pace for the fourth straight year. Management reiterated its commitment to maintaining annual store expansion in the 12%-15% range.

Boot Barn has opened 64 new stores over the last 12 months, which contributed to 18.7% growth in revenues for the second quarter of fiscal 2026. The new stores continue to perform well across geographies, with each expected to generate approximately $3.2 million in annual sales and recover investment within two years. By midyear, the company had already opened 30 of the planned locations, demonstrating steady execution and demand across markets.

Management noted that the total addressable market for the company has expanded to $58 billion from $40 billion. Management seems to be confident, as they believe that the store count in the United States can reach 1200 stores. Additionally, management indicated that the pipeline for fiscal 2027 remains strong, with around 20 projected openings in the first quarter, reinforcing confidence in sustaining its double-digit growth pace beyond this year.

Boot Barn Faces Competition From Buckle & Urban Outfitters

The Buckle, Inc. BKE opened two new stores, completed four full remodels (including one relocation), and closed one store in the second quarter of fiscal 2025. The company expects to open four additional stores and complete 12 more full remodels by the end of the year. Buckle currently operates 443 retail stores in 42 states.

Urban Outfitters, Inc. URBN continues to expand its retail footprint. In the second quarter of fiscal 2026, the company opened 14 new stores – two each Urban Outfitters and Anthropologie Group stores, and 10 Free People Stores. For the full year, Urban Outfitters anticipates opening approximately 69 new stores while closing around 17 locations. This includes plans to open 25 FP Movement stores, 18 Free People stores, and 16 Anthropologie locations, reflecting its focus on growth within core lifestyle brands.

The Zacks Rundown for BOOT

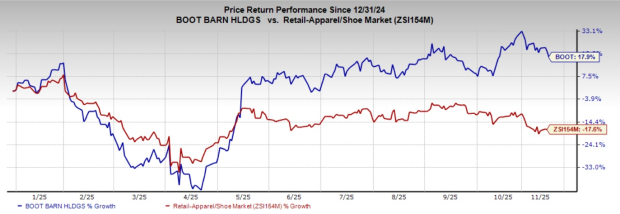

BOOT’s shares have gained 17.9% year to date against the industry’s decline of 17.6%. BOOT carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Image Source: Zacks Investment Research

From a valuation standpoint, BOOT trades at a forward price-to-earnings ratio of 23.5X, higher than the industry’s average 16.24X.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for BOOT’s fiscal 2026 and 2027 earnings implies a year-over-year rise of 20.5% and 13.8%, respectively. BOOT delivered a trailing four-quarter earnings surprise of 5.4%, on average.

Image Source: Zacks Investment Research

#1 Semiconductor Stock to Buy (Not NVDA)

The incredible demand for data is fueling the market's next digital gold rush. As data centers continue to be built and constantly upgraded, the companies that provide the hardware for these behemoths will become the NVIDIAs of tomorrow.

One under-the-radar chipmaker is uniquely positioned to take advantage of the next growth stage of this market. It specializes in semiconductor products that titans like NVIDIA don't build. It's just beginning to enter the spotlight, which is exactly where you want to be.

See This Stock Now for Free >>Urban Outfitters, Inc. (URBN) : Free Stock Analysis Report

Boot Barn Holdings, Inc. (BOOT) : Free Stock Analysis Report

Buckle, Inc. (The) (BKE) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.