Axon Enterprise, Inc. AXON is benefiting from strong momentum in its Connected Devices segment. Healthy demand for its next-generation TASER 10 products, virtual reality training services and counter-drone equipment has been augmenting the segment’s results. The segment’s revenues increased 26% year over year in the first nine months of 2025.

In April 2023, the company introduced its advanced body-worn camera, Axon Body 4. With upgraded features such as a bi-directional communications facility and a point-of-view camera module option, this body camera is experiencing strong orders, boosting the segment’s growth. Shipment of this body camera began in June 2023 and the customer response has been strong since its launch.

In third-quarter 2025, revenues from the company’s TASER product line increased 17% year over year, driven by TASER 10, while those from the Personal Sensors surged 20%, led by Axon Body 4. Also, revenues from Platform Solutions product line soared 71%, supported by counter-drone, virtual reality and fleet. This boosted the Connected Devices segment’s results, with revenues increasing 23.6% year over year to $405.4 million.

Growing instances of terrorism and criminal activities, with concerns related to the ever-increasing fraudulent activities, will augur well for Axon’s Connected Devices unit in the quarters ahead.

Segment Performance of AXON's Peers

Teledyne Technologies Incorporated’s TDY Digital Imaging segment’s third-quarter 2025 revenues increased 2.2% year over year to $785.4 million. The jump was due to higher sales of commercial infrared imaging components and subsystems, unmanned air systems and industrial automation imaging systems. Teledyne generated 51% of its total revenues from this segment in the quarter.

Woodward, Inc.’s WWD Industrial business segment reported net sales of $334 million in the fourth quarter of fiscal 2025, up 10.6% year over year. Woodward generated 33.6% of its total sales from this segment in the quarter. The increase in revenues for Woodward’s segment is primarily attributable to strength across power generation and oil & gas markets.

AXON’s Price Performance, Valuation and Estimates

Shares of Axon have lost 5.4% in the past month compared with the industry’s decline of 1.7%.

Image Source: Zacks Investment Research

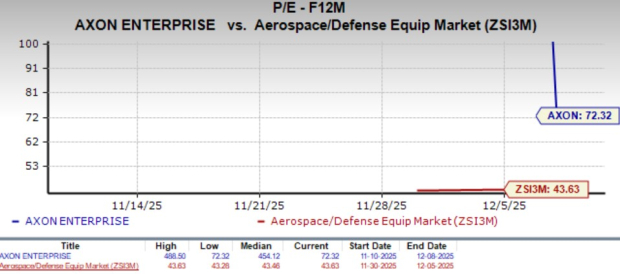

From a valuation standpoint, AXON is trading at a forward price-to-earnings ratio of 72.32X, above the industry’s average of 43.63X. Axon carries a Value Score of F.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for AXON’s 2025 earnings has decreased 8.1% over the past 60 days.

Image Source: Zacks Investment Research

The company currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Radical New Technology Could Hand Investors Huge Gains

Quantum Computing is the next technological revolution, and it could be even more advanced than AI.

While some believed the technology was years away, it is already present and moving fast. Large hyperscalers, such as Microsoft, Google, Amazon, Oracle, and even Meta and Tesla, are scrambling to integrate quantum computing into their infrastructure.

Senior Stock Strategist Kevin Cook reveals 7 carefully selected stocks poised to dominate the quantum computing landscape in his report, Beyond AI: The Quantum Leap in Computing Power.

Kevin was among the early experts who recognized NVIDIA's enormous potential back in 2016. Now, he has keyed in on what could be "the next big thing" in quantum computing supremacy. Today, you have a rare chance to position your portfolio at the forefront of this opportunity.

See Top Quantum Stocks Now >>Teledyne Technologies Incorporated (TDY) : Free Stock Analysis Report

Woodward, Inc. (WWD) : Free Stock Analysis Report

Axon Enterprise, Inc (AXON) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.