Apollo Global Management APO has focused on growth through a strategy of inorganic expansion, acquiring companies and assets across diverse sectors rather than relying solely on organic growth. This approach has enabled Apollo to rapidly increase its assets under management (AUM), diversify revenue streams and strengthen its market position. However, growth through acquisitions carries inherent risks, including integration challenges, high leverage, and exposure to economic and regulatory fluctuations.

Let us delve deeper and discuss whether Apollo’s acquisition-driven strategy can translate into sustainable returns and make its stock a compelling investment choice.

APO’s Inorganic Growth Efforts

Apollo is a high-growth asset management firm with strategies dedicated to investing in companies with solid growth potential.

This month, APO completed its previously announced acquisition of Bridge Investment Group Holdings Inc. The acquisition provides Apollo with immediate scale in real estate equity and enhances its origination capabilities across secular growth areas. Founded in 2009, Bridge manages approximately $50 billion in assets across residential, industrial and niche real estate verticals.

The transaction is expected to be accretive to Apollo’s fee-related earnings and nearly doubles its real estate AUM to more than $110 billion. Bridge’s integration will further strengthen Apollo’s hybrid and equity offerings, particularly for institutional and wealth clients.

In May 2025, Bloomberg reported that Apollo is teaming up with JPMorgan Chase JPM, Goldman Sachs GS, and three other banks to introduce greater liquidity into the rapidly expanding private credit market. Through partnerships with major banks, including JPM and GS, Apollo aims to expand its capacity significantly to originate larger loans more swiftly. This positions APO to tap into the individual investor market, wherein the demand for liquidity and flexibility is typically higher than that of institutional investors. This initiative is a key element of Apollo’s broader strategy to expand its credit trading footprint.

In 2024, APO formed strategic alliances with Citigroup and State Street to expand private credit and broaden wealth access opportunities. In the same year, Apollo and its affiliates announced their partnership with State Street's asset management business, State Street Global Advisors, to enhance investors' accessibility to private market opportunities.

The inorganic expansion will support Apollo’s business by increasing opportunities for fee generation, dealmaking, asset appreciation and strategic exits across its investment platforms. This is expected to accelerate long-term AUM growth and support its goal of scaling a total AUM to $1.5 trillion by 2029.

Other Factors Driving APO’s Growth

Revenue Growth: Apollo has demonstrated strong organic growth, with total GAAP revenues seeing a three-year CAGR of 63.7% through 2024. Although year-over-year growth slowed in the first half of 2025, continued strength in its Asset Management and Retirement Services businesses is expected to support revenue expansion. A key driver has been Apollo’s strategic focus on retail distribution, particularly through its Athene subsidiary, which maintains a leading market share.

By adding distribution partners and expanding retail channels, Apollo is positioned to drive inflows and reinforce its standing in the retail investment market. This, coupled with the company’s financial strength, underlines expectations for robust inflows and sustained growth in 2025.

Strategic Growth Plan: At the Investor Day Conference held on Oct. 1, 2024, APO outlined its business strategy and financial goals for the next five years (ending 2029).

The company expects fee-related earnings to witness 20% average annual growth by 2029, while spread-related earnings are projected to see 10% average annual growth by 2029.

Management projected $15 in after-tax net income per share for 2029. By 2029, Apollo expects to grow its total assets under management (AUM) to $1.5 trillion by scaling its private equity business.

Equity AUM is expected to double in the next five years to reach $270 billion. The company has set a massive new goal to double its $562-billion private lending business in five years.

The company anticipates expanding its Global Wealth Management business to more than $150 billion by 2029. APO’s management has set a five-year target, inclusive of all origination, both debt origination and equity origination, of more than $275 billion.

Solid Liquidity Aid Capital Distribution: As of June 30, 2025, the company had $2.4 billion in cash and cash equivalents, and $4.3 billion in long-term debt. A higher level of liquid assets in the company aids in impressive capital distribution activities.

In May 2025, the company announced a 10.9% increase in its quarterly dividend to 51 cents per share. It has increased its dividends five times in the past five years, with a payout ratio of 30%.

Apart from regular dividend payouts, it has a share repurchase program. In February 2024, the company’s board of directors authorized the repurchase of up to $3 billion of its common shares. As of June 30, 2025, $1.03 billion worth of shares were available under the authorization. Given the decent liquidity position, the company is expected to sustain its capital distribution activities and will keep enhancing shareholder value.

APO’s Price Performance & Estimate Analysis

In the past year, APO shares have gained 24.1%, outperforming the industry and the S&P 500 Index’s 14.1% and 20.4% rallies, respectively.

Price Performance

Image Source: Zacks Investment Research

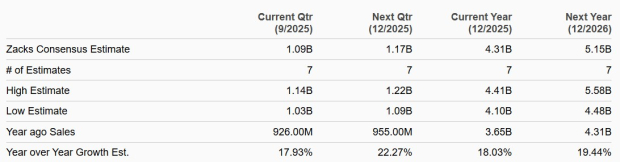

The Zacks Consensus Estimate for Apollo’s 2025 and 2026 sales implies year-over-year rallies of 18% and 19.4%, respectively.

Sales Estimates

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for Apollo’s 2025 and 2026 earnings indicates year-over-year increases of 4.7% and 19.3%, respectively.

Earnings Estimates

Image Source: Zacks Investment Research

Final Thoughts on Apollo

The company’s strategy of combining inorganic acquisitions with strong organic growth will position the firm as a strong player in alternative asset management and private credit. Its recent acquisitions, strategic partnerships, and expansion of retail distribution channels are expected to drive fee growth, increase AUM, and enhance shareholder returns.

Further, supported by solid liquidity, disciplined capital management, and a track record of consistent dividends and share repurchases, Apollo is well-positioned to capitalize on market opportunities. While risks related to integration and leverage remain, the company’s diversified portfolio and robust growth strategy make its stock a potentially attractive option for long-term investors seeking exposure to high-growth alternative investments.

At present, Apollo carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Names #1 Semiconductor Stock

This under-the-radar company specializes in semiconductor products that titans like NVIDIA don't build. It's uniquely positioned to take advantage of the next growth stage of this market. And it's just beginning to enter the spotlight, which is exactly where you want to be.

With strong earnings growth and an expanding customer base, it's positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $971 billion by 2028.

See This Stock Now for Free >>The Goldman Sachs Group, Inc. (GS) : Free Stock Analysis Report

JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

Apollo Global Management Inc. (APO) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.