Affirm Holdings, Inc. AFRM is deepening its partnership with Google by backing the Agent Payments Protocol (AP2). AP2 is an open standard, payment-agnostic protocol designed to facilitate secure, agent-led transactions across various platforms. By supporting AP2, AFRM isn’t just adding another integration; it is helping embed its flexible and transparent payment options into a whole new era of digital payments.

AFRM’s platform already integrates with Google Pay and Chrome’s autofill feature, and through AP2, its partnership with Google highlights AFRM’s commitment to responsible lending and consumer trust. By providing real-time assessments and instant credit decisions, often with 0% APR, AFRM allows users to access clear, interest-free installment plans without hidden fees. This could open new opportunities for the company to connect with new consumers and merchants.

This collaboration represents a pivotal moment in the world of payment innovation and the rise of agentic commerce. As AI assistants increasingly handle purchase decisions and financial interactions, AFRM’s integration within AP2 ensures its relevance in a fast-changing digital ecosystem. Also, it signals the company’s intent to diversify beyond BNPL and establish itself as a tech-savvy financial partner.

With this integration, AFRM positions itself at the forefront of agent-led payments, where trust, transparency and technology come together to redefine how consumers and AI agents transact securely. If AP2 gains traction, the company could benefit from increased transaction volumes, better brand recognition and stronger relationships with merchants in Google’s extensive ecosystem. AFRM’s total transactions surged 51.8% year over year in the fourth quarter of fiscal 2025.

How Are Competitors Faring?

Some of AFRM’s competitors in the fintech space are PayPal Holdings, Inc. PYPL and Visa Inc. V.

PayPal is making significant strides in the world of AI agents with the launch of its Agent Toolkit, which seamlessly links AI models to its payment APIs. PayPal’s total payment volume increased 6% year over year in the second quarter of 2025.

Visa is advancing rapidly in the world of AI agents with its Intelligent Commerce initiative. It is developing secure frameworks that enable AI agents to seamlessly interact with Visa’s payment APIs, carry out transactions and handle user preferences while ensuring transparency and control. Its processed transactions increased 10% year over year in the third quarter of fiscal 2025.

Affirm’s Price Performance, Valuation & Estimates

In the year-to-date period, AFRM’s shares gained 25.7% compared with the industry’s rise of 20.9%.

Image Source: Zacks Investment Research

From a valuation standpoint, AFRM trades at a forward price-to-sales ratio of 5.97, slightly above the industry average of 5.63. AFRM carries a Value Score of F.

Image Source: Zacks Investment Research

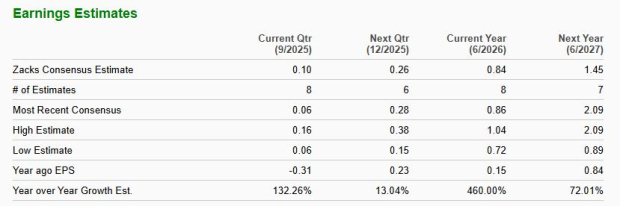

The Zacks Consensus Estimate for Affirm’s fiscal 2026 earnings implies 460% growth from the year-ago period. The consensus mark for fiscal 2026 revenues indicates 23.8% year-over-year growth.

Image Source: Zacks Investment Research

Affirm currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpVisa Inc. (V) : Free Stock Analysis Report

PayPal Holdings, Inc. (PYPL) : Free Stock Analysis Report

Affirm Holdings, Inc. (AFRM) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.