The AES Corporation AES is emphasizing its role as an early innovator and global leader in battery energy storage systems (“BESS”). The company developed the world’s first utility-scale lithium-ion BESS and, in 2009, installed the first commercial application of this technology in Chile. AES continues to work with partners around the world to deploy award-winning battery systems that improve grid reliability, enhance operational flexibility and strengthen resilience, particularly as renewable energy adoption increases.

Battery energy storage strengthens power system performance by stabilizing both conventional and renewable generation while easing pressure on transmission networks. It enhances grid resilience by enabling a rapid response to sudden disruptions or unforeseen events. In addition, energy storage helps lower electricity costs by storing power during periods of low prices and supplying it back to the grid when prices are higher.

AES’ L??wa??i Solar + Storage project in Hawai??i combines solar generation with battery storage to deliver reliable, low-carbon power and reduce reliance on fossil fuels. Bellefield Solar + Storage in Kern County, CA, is one of the largest planned projects in the United States, designed to deliver 1 GW of solar capacity, along with 1 GW of battery storage, strengthening grid resilience and supporting California’s clean energy goals.

The Luna and LAB Energy Storage projects in Los Angeles County are standalone lithium-ion battery systems with a combined capacity of about 227 MW and nearly 908 MWh, respectively, enabling energy shifting during peak demand and improving grid stability. The Delta Wind Farm in Mississippi is included in AES’ portfolio for its role in supporting renewable integration alongside energy storage solutions.

Battery Storage: A Key Driver of Grid Stability & Clean Energy

Companies like Duke Energy DUK and The Southern Company SO are also using battery storage to strengthen grid stability and optimize renewable integration.

Duke Energy is expanding battery and pumped-storage capacity to modernize its grid, integrate renewables, cut emissions and costs, and meet rising demand, targeting over 6,000 MW of energy storage by 2035 and about 30,000 MW by 2050. The Southern Company is applying the same approach to boost grid resilience, advance clean energy initiatives and deliver reliable, affordable electricity to its customers.

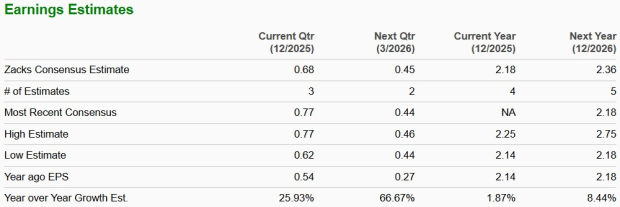

AES’ Earnings Estimates

The Zacks Consensus Estimate for 2026 EPS indicates an increase of 8.44% year over year.

Image Source: Zacks Investment Research

AES Stock Trading at a Discount

AES is trading at a discount relative to the industry, with a forward 12-month price-to-earnings of 5.92X compared with the industry average of 15.45X.

Image Source: Zacks Investment Research

AES Stock Price Performance

In the past six months, the company’s shares have risen 11.3% compared with the industry’s 8.1% growth.

Image Source: Zacks Investment Research

AES’ Zacks Rank

The company currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Names #1 Semiconductor Stock

This under-the-radar company specializes in semiconductor products that titans like NVIDIA don't build. It's uniquely positioned to take advantage of the next growth stage of this market. And it's just beginning to enter the spotlight, which is exactly where you want to be.

With strong earnings growth and an expanding customer base, it's positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $971 billion by 2028.

See This Stock Now for Free >>Southern Company (The) (SO) : Free Stock Analysis Report

Duke Energy Corporation (DUK) : Free Stock Analysis Report

The AES Corporation (AES) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.