Cadence Design Systems Inc. (CDNS) is well-positioned to gain from the rising demand for its solutions, especially the AI-driven portfolio, amid robust design activity and strong customer spending on AI initiatives.

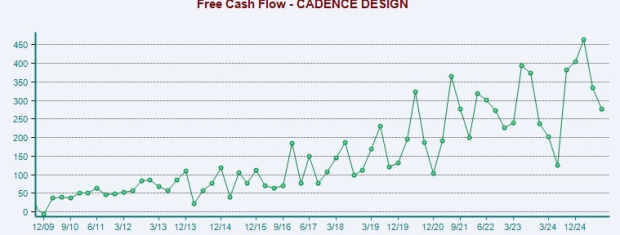

It is witnessing strong cash flow momentum as the top line expands. In the third quarter, revenues of $1.339 billion increased 10.2% year over year. The operating cash flow and the free cash flow stood at $311 million and $277 million, respectively. As of Sept. 30, 2025, Cadence had cash and cash equivalents of $2.753 billion, while long-term debt was $2.479 billion.

Strong balance sheet and free cash flow generation have allowed the company to sustain both M&A and an active share repurchase program.

Image Source: Zacks Investment Research

Cadence has leaned into a disciplined inorganic growth strategy, targeting technologies that accelerate organic growth. The buyouts this year include the Design & Engineering (D&E) division of Hexagon AB, including its renowned MSC Software business, Artisan foundation IP business from Arm Holdings and Secure-IC, a premium provider of embedded security IP platforms. Buyouts aid in obtaining synergies, leading to cost reduction and enhanced operational efficiency through the integration of resources.

Buybacks add a second layer of value creation. Buybacks are valuable as they signal a company’s focus on maximizing the value of the stock for current and future investors. CDNS repurchased its shares worth $200 million in the third quarter and expects another $200 million worth of buybacks in the fourth quarter. CDNS does not yet pay any dividend.

Going ahead, CDNS’ top-line expansion is expected to gain from secular trends like 5G, increasing use of hyperscale computing and autonomous driving, which are influencing design activity across semiconductor and systems companies. These trends should sustain healthy top-line growth, ensuring sound cash conversion, thereby maintaining M&A and shareholder returns.

For 2025, revenues are estimated to be $5.262-$5.292 billion, while the operating cash flow is expected between $1.65 billion and $1.75 billion. It plans to utilize at least 50% of its free cash flow to repurchase shares in 2025.

Nonetheless, volatile global macroeconomic conditions and substantial exposure to the semiconductor vertical are concerning for CDNS, which carries a Zacks Rank #3 (Hold) at present.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Image Source: Zacks Investment Research

Higher operating costs and stiff competition in the EDA/AI space from the likes of CEVA Inc. (CEVA), Keysight Technologies (KEYS) and Synopsys (SNPS) are additional headwinds. The acquisition of ANSYS by Synopsys is likely to intensify competition in the EDA space for all players.

Quick Look at FCF for Peers

Synopsys recently reported fourth-quarter fiscal 2025 results, wherein revenues jumped 37.8% year over year to $2.25 billion, with $640 million in operating cash flow. Apart from Ansys, the company has made no other acquisition this year. It also did not repurchase shares as it was focusing on the Ansys buyout. It has shares worth $194 million under its buyback plan. SNPS also does not pay out a dividend.

Keysight Technologies is a provider of electronic design and test instrumentation systems. In the last reported quarter, net sales improved to $1.42 billion from the year-ago quarter’s $1.29 billion, exceeding the high end of the guidance. Cash from operating activities was $225 million and free cash flow was $188 million. On the lastearnings call management highlighted that it repurchased more than $1.5 billion in shares or nearly 45% of the free cash flow since 2023. It also announced a new $1.5-billion buyback program. KEYS also does not pay out a dividend.

In October 2025, KEYS acquired Spirent Communications plc for £1.16 billion ($1.46 billion) on a fully diluted basis. Spirent offers automated test and assurance solutions for networks and cybersecurity. The buyout of PowerArtist business from Ansys and Optical Solutions Group from Synopsys has expanded the company’s design engineering software portfolio.

CEVA has not acquired any companies this year and is focused on organic expansion. It continues to scale its AI business, including the AI NPU portfolio (NeuPro-Nano and NeuPro-M). In the last reported quarter, CEVA noted that Microchip adopted its full NeuPro NPU portfolio for future product roadmaps. CEVA repurchased about 40,000 shares for $1 million in the third quarter, while year to date, it has purchased 340,000 shares for $7.2 million.

Zacks Naming Top 10 Stocks for 2026

Want to be tipped off early to our 10 top picks for the entirety of 2026? History suggests their performance could be sensational.

From 2012 (when our Director of Research Sheraz Mian assumed responsibility for the portfolio) through November, 2025, the Zacks Top 10 Stocks gained +2,530.8%, more than QUADRUPLING the S&P 500’s +570.3%.

Now Sheraz is combing through 4,400 companies to handpick the best 10 tickers to buy and hold in 2026. Don’t miss your chance to get in on these stocks when they’re released on January 5.

Be First to New Top 10 Stocks >>Synopsys, Inc. (SNPS) : Free Stock Analysis Report

Cadence Design Systems, Inc. (CDNS) : Free Stock Analysis Report

Ceva, Inc. (CEVA) : Free Stock Analysis Report

Keysight Technologies Inc. (KEYS) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.