C3.ai, Inc. (AI has been selected by the U.S. Army Rapid Capabilities and Critical Technologies Office (“RCCTO”) to enhance AI-powered logistics for Army formations operating in contested environments. The company’s technology will help improve forecasting for critical resources such as parts, fuel and munitions, strengthening operational efficiency and overall combat readiness.

RCCTO continues to accelerate innovation across the Army by rapidly deploying next-generation capabilities to close operational gaps and bolster battlefield readiness. The Army’s collaboration with C3.ai underscores the growing importance of enterprise-scale AI in defense operations. By integrating C3.ai’s technology into Brigade Command & Control networks, the Army seeks to provide more responsive, data-driven support to forward-deployed units in high-risk and dynamic environments.

AI stock gained 3.7% during trading hours yesterday.

Strong Engagement Across U.S. Government Institutions

C3.ai continued to expand its footprint across U.S. government and defense organizations, delivering another quarter of strong federal traction. Total bookings across Federal, Defense, and Aerospace increased 89% year over year and accounted for 45% of total bookings. The company signed agreements with major organizations, including HHS, the Department of War, the U.S. Intelligence Community, the U.S. Army, several Navy divisions, the Marine Corps, and Los Alamos National Laboratory.

The federal market remains a major growth driver, as agencies move from custom systems to commercial AI solutions under the administration’s AI action plan. During the second quarter of fiscal 2026, the Department of Health and Human Services selected C3.ai to build a unified and secure enterprise AI data foundation across NIH and CMS, helping improve data quality, enable new analytics, and automate complex administrative tasks.

Together, these collaborations are expanding C3.ai’s market reach, strengthening customer adoption, and positioning the company to benefit as enterprise and government organizations move toward commercial, off-the-shelf AI solutions at scale.

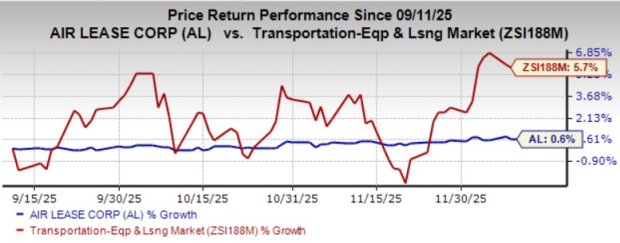

AI Stock’s Price Performance

In the past three months, shares of AI have lost 0.6%, underperforming the Zacks Computers - IT Services industry’s 5.7% decline.

The company’s performance was pressured by the government shutdown, weakening sales trends, and the high costs associated with initial production deployments, all of which continue to weigh on performance and margins. Even so, its strong partnership ecosystem, expanding customer base, and growing federal bookings provide a solid foundation to support long-term growth.

Image Source: Zacks Investment Research

AI’s Zacks Rank & Key Picks

Currently, C3.ai carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the Computer and Technology sector are:

NVIDIA Corporation NVDA sports a Zacks Rank of 1 (Strong Buy) at present. The company delivered a trailing four-quarter earnings surprise of 2.8%, on average. NVIDIA stock has gained 37.4% year to date. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for NVIDIA’s 2026 sales and earnings per share (EPS) indicates growth of 61.4% and 54.5%, respectively, from the prior-year levels.

Amphenol Corporation APH presently sports a Zacks Rank #1. The company delivered a trailing four-quarter earnings surprise of 17.9%, on average. Amphenol stock has surged 98.1% year to date.

The Zacks Consensus Estimate for Amphenol’s 2026 sales and EPS indicates growth of 12.4% and 20.7%, respectively, from the year-ago period’s levels.

Vertiv Holdings Co VRT flaunts a Zacks Rank of 1 at present. The company delivered a trailing four-quarter earnings surprise of 14.9%, on average. Vertiv stock has rallied 57% year to date.

The Zacks Consensus Estimate for Vertiv’s 2026 sales and EPS indicates growth of 20.8% and 26.6%, respectively, from the prior-year levels.

Zacks Naming Top 10 Stocks for 2026

Want to be tipped off early to our 10 top picks for the entirety of 2026? History suggests their performance could be sensational.

From 2012 (when our Director of Research Sheraz Mian assumed responsibility for the portfolio) through November, 2025, the Zacks Top 10 Stocks gained +2,530.8%, more than QUADRUPLING the S&P 500’s +570.3%.

Now Sheraz is combing through 4,400 companies to handpick the best 10 tickers to buy and hold in 2026. Don’t miss your chance to get in on these stocks when they’re released on January 5.

Be First to New Top 10 Stocks >>Amphenol Corporation (APH) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

C3.ai, Inc. (AI) : Free Stock Analysis Report

Vertiv Holdings Co. (VRT) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.