C3.ai AI is known for its deep roots in the oil and gas industry, but recent results suggest the company’s pivot to broader enterprise markets may finally be gaining traction. In the fourth quarter of fiscal 2025, C3.ai reported revenues of $108.7 million, up 26% year over year, marking its third consecutive year of accelerating growth. While the renewed Baker Hughes BKR agreement underscores continued strength in energy, it’s the momentum beyond oil that’s generating fresh optimism.

Non-oil and gas revenue jumped 48% year over year in fiscal 2025, with C3.ai now serving 19 industries—including manufacturing, life sciences, and state and local government. Public sector sales more than doubled in fiscal 2025, with 71 contracts signed across 24 U.S. states. In manufacturing, C3.ai added blue-chip names like U.S. Steel and Ingersoll Rand, while healthcare customers such as Sanofi and Quest Diagnostics expanded AI deployments.

C3.ai’s strategy hinges on scaling these verticals through partnerships with hyperscalers like Microsoft, AWS, and Google Cloud. In the fiscal fourth quarter alone, 73% of deals were partner-driven, highlighting the growing importance of its indirect sales channel.

Despite a net loss of 16 cents per share, C3.ai maintained its robust cash balance near $750 million and generated positive free cash flow in the quarter. The company expects continued revenue growth into fiscal 2026, with guidance ranging from $447.5 to $484.5 million.

As C3.ai moves beyond its oil-based legacy, the key question is whether diversified traction can translate into durable, profitable growth. So far, the early signals look promising.

Facing the Competition: How Palantir and Veritone Compare

As C3.ai accelerates its diversification across verticals, competitors like Palantir Technologies PLTR and Veritone VERI are also vying for enterprise AI dominance. Palantir, best known for its government contracts, is making inroads in healthcare, manufacturing, and energy markets where C3.ai is also expanding. Palantir’s commercial revenue rose 27% year over year in its latest quarter, underscoring its own success in diversifying beyond public sector roots. Both Palantir and C3.ai are aggressively targeting predictive analytics and operational AI at scale.

Meanwhile, Veritone is carving a niche with AI solutions for media, law enforcement, and utilities. Though smaller in scale, Veritone’s expansion into energy and public safety mirrors C3.ai’s push into state and local government. Veritone’s aiWARE platform overlaps with C3.ai’s agentic AI solutions in terms of workflow automation and data synthesis.

As C3.ai builds out its multi-industry presence, both Palantir and Veritone will remain key rivals in its path to broader enterprise adoption.

AI Stock’s Price Performance & Valuation Trend

Shares of this enterprise AI application software company have surged 29.1% in the past three months, significantly outperforming the Zacks Computers - IT Services industry, the Zacks Computer and Technology sector and the S&P 500 index, as you can see below.

C3.ai Share Price Performance

Image Source: Zacks Investment Research

Despite the recent rally, AI stock is currently trading at a discount compared to its industry peers, with a forward 12-month price-to-sales (P/S) ratio of 7.98, as evidenced by the chart below. Meanwhile, Palantir and Veritone’s forward 12-month price-to-sales ratios are 80.41 and 1.1, respectively.

P/S (F12M)

Image Source: Zacks Investment Research

Earnings Estimate Trend of AI Stock

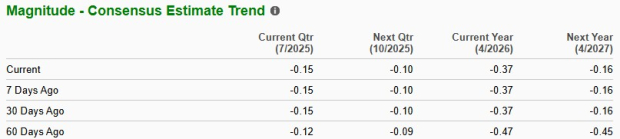

The Zacks Consensus Estimate for fiscal 2026 and 2027 loss per share has narrowed to 37 cents and 16 cents from a loss of 47 cents and 45 cents in the past 60 days, respectively.

The Zacks Consensus Estimate for fiscal 2026 and 2027 sales implies growth of 20.1% and 21.8%, respectively.

AI’s Earnings Estimate Revision

Image Source: Zacks Investment Research

AI stock currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers "Most Likely for Early Price Pops."

Since 1988, the full list has beaten the market more than 2X over with an average gain of +23.5% per year. So be sure to give these hand picked 7 your immediate attention.

See them now >>C3.ai, Inc. (AI) : Free Stock Analysis Report

Baker Hughes Company (BKR) : Free Stock Analysis Report

Veritone, Inc. (VERI) : Free Stock Analysis Report

Palantir Technologies Inc. (PLTR) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.