On Nov. 19, retail giant Walmart (NYSE: WMT) reported financial results for its fiscal third quarter of 2025. Its revenue was only up 5.5% year over year, which might not seem like much. But Walmart is one of the largest businesses in the entire world with annualized revenue approaching $700 billion. When the numbers are this big, even a 5.5% jump is a big deal.

On the bottom line, Walmart's operating income increased by 8.2%, which was far better than revenue growth. Now the difference between 5.5% and 8.2% might seem inconsequential with only a cursory glance. But again, Walmart's massive scale makes this a big deal.

For perspective, Walmart earned operating income of $6.20 billion in last year's fiscal third quarter of 2024. If its operating income had only increased by 5.5% -- inline with revenue growth -- it would have had Q3 operating income of $6.54 billion. But with its actual 8.2% growth, it had Q3 operating income of nearly $6.71 billion, which is a difference of close to $170 million.

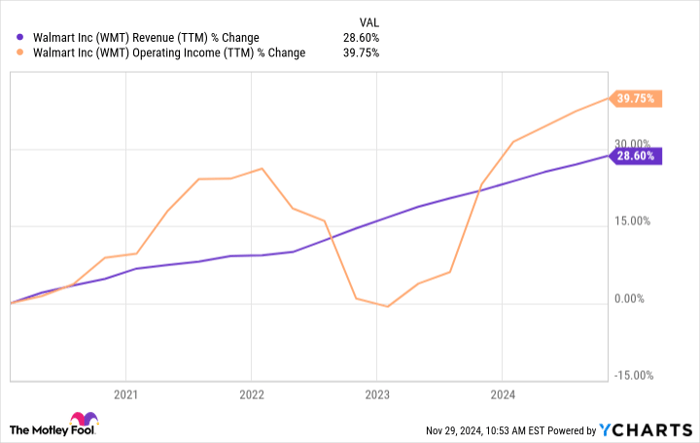

Keep in mind that this is just for a single quarter. This small difference between revenue growth and growth in operating income is nearly a $500 million difference annually. And Q3 numbers continued a trend in recent years, as the chart below shows.

WMT Revenue (TTM) data by YCharts

I'll state the obvious: Walmart's operating income is increasing faster than revenue because its operating profit margin is improving. The questions for investors, therefore, are first, what is driving the improvement? And second, can the improvement continue?

The answer to the second question is yes. Here's why.

How Walmart can keep boosting its profits

Even people who don't own Walmart stock know that it's a top dog in the brick-and-mortar space. But what many may not know is that the company is growing its digital capabilities, which is boosting profit margins.

For starters, Walmart is now one of the largest e-commerce platforms in the world. Not only does the company itself sell products online, but third-party merchants can also set up their own operations on Walmart's website, just as they can on Amazon. It's these third-party sales in particular that are much higher margin than its core brick-and-mortar operations.

Additionally, Walmart's membership program Walmart+ is growing at a strong rate. Management isn't sharing a lot of details, but in Q3, it did say that this is growing by double digits. And this benefits the company in multiple ways. First, it increases e-commerce penetration, which can boost margins. Second, membership programs can lower advertising spend since members already have incentive to shop at Walmart.

Finally, Walmart's digital push not only helps it cut down on advertising, it also allows it to benefit from advertising. Advertisers want to get in front of Walmart's massive audience and are willing to pay for it. Investors aren't privy to the exact number, but management did share that its global advertising business grew 28% year over year in Q3. Again, this is a higher-margin opportunity.

These digital initiatives are contributing to Walmart's improving profit margins. What's exciting for investors today is that the company is still in the early stages of its digital journey and the trends can seemingly continue for years to come. This can help its profit margins improve at a modestly faster pace than revenue in coming years.

But as I've explained, even just a modestly faster pace can result in hundreds of millions of dollars in profit. And that will undoubtedly be good for shareholders.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $358,460!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,946!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $478,249!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of November 25, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon and Walmart. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.