The optimum stock market theory of “Buy Low, Sell High” may be apparent with RingCentral RNG shares, which are starting to glimmer at under $30. Amid recent market volatility, RNG has dropped further from its 52-week highs of over $40 but a sharp spike and an extended rebound looks likely.

Sporting a Zacks Rank #1 (Strong Buy), the bull case is starting to set in for RingCentral stock thanks to the company’s consistently effective operational performance, and AI initiatives.

RingCentral Overview

As a leading provider of contact center software-as-a-service (SaaS) solutions, RingCentral has a robust product line that caters to various communication and collaboration needs for businesses.

RingCentral Analytics, for instance, provides insight into communication usage, performance, and trends that help businesses optimize their marketing strategies to improve productivity. Furthermore, RingCentral Integration is available to streamline workflows by offering over 330 integrations with popular business applications such as Microsoft MSFT Teams, Salesforce CRM, and Alphabet’s GOOGL Google Workspace.

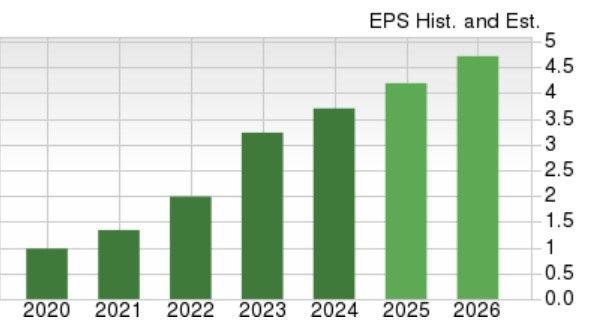

While there had been doubts that the company could succeed like other cloud-based communication platform providers such as Zoom Communications ZM, RingCentral has tripled its operating profit since 2021. Astonishingly, RingCentral has reached or exceeded the Zacks EPS Consensus in every quarter since the company went public in 2013. Exceeding Q4 top and bottom line expectations in February, RingCentral’s full-year adjusted EPS increased 14% to $3.70 with total revenue rising 9% to $2.4 billion.

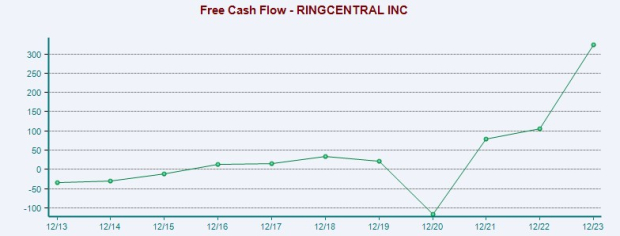

Strong Cash Flow

RingCentral's strong cash flow should also be highlighted as the company plans to supercharge its product portfolio with artificial intelligence. During Q4, RingCentral generated a quarterly record for free cash flow at $112 million. Full-year free cash flow spiked 20% to $403 million and has tripled since 2021. Notably, RingCentral expects to generate half a billion in free cash flow this year.

Image Source: Zacks Investment Research

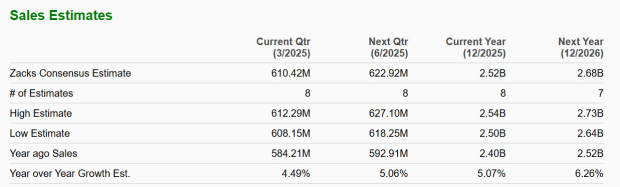

Positive Top & Bottom Line Guidance

RingCentral expects total revenue to grow by 4-6% in fiscal 2025 with the Zacks Consensus currently at $2.52 billion or 5% growth. Based on Zacks estimates, RingCentral’s top line is projected to expand another 6% in FY26 to $2.68 billion.

Image Source: Zacks Investment Research

RingCentral projects FY25 adjusted EPS at $4.13-$4.27, representing approximately 14% growth at the midpoint. Zacks projections call for RingCentral’s annual earnings to rise 13% in FY25 and climb another 12% next year to $4.71 per share.

Image Source: Zacks Investment Research

AI Initiatives

Aforementioned, what further argues the bull case for RingCentral stock is its AI initiatives. Stating its vision is to power every business with an AI-first platform, RingCentral has announced an AI Receptionist or AIR, an innovative generative AI phone agent that is integrated into the phone system. AIR is incorporated to act like a digital employee that will enable RingCentral customers to do more with less.

It’s also noteworthy that RingCentral’s native contact center AI-product, RingCX, has been a strong underlying catalyst to its expansion. RingCX is designed to enhance customer satisfaction and streamline customer support operations, seeing a 40% increase in users last quarter, from 500 company's to 700.

RingCentral’s Attractive Valuation

The icing on top that may draw more investor interest in RingCentral stock is that RNG trades at just 6.8X forward earnings. As a more loose but intriguing comparison, Zoom Communications' stock trades over $70 and at 13.6X forward earnings. Trading at a very sharp discount to the benchmark S&P 500’s forward P/É multiple, RingCentral also trades beneath its Zacks Internet-Software and Services Industry average of 12.7X forward earnings.

Keeping in mind that RingCentral’s growth narrative has become more appealing than a popular stock like Zoom Communications, the smart money could certainly shift to RNG.

Plus, RingCentral trades well under the optimum level of less than 2X sales, with many tech companies often trading at a high premium in this regard.

Image Source: Zacks Investment Research

Bottom Line

The cat may not be out of the bag yet, but RingCentral is a company that could benefit immensely from AI. Wait for it…. The rush into RNG as a pure AI-play may be coming soon, as RingCentral is starting to generate the free cash flow to enhance its internal AI efforts.

Either way it goes, the upside narrative is there, and in addition to its strong buy rating RingCentral stock has an overall “A” VGM Zacks Style Scores grade for the combination of Value, Growth, and Momentum.

Just Released: Zacks Top 10 Stocks for 2025

Hurry – you can still get in early on our 10 top tickers for 2025. Handpicked by Zacks Director of Research Sheraz Mian, this portfolio has been stunningly and consistently successful. From inception in 2012 through November, 2024, the Zacks Top 10 Stocks gained +2,112.6%, more than QUADRUPLING the S&P 500’s +475.6%. Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2025. You can still be among the first to see these just-released stocks with enormous potential.

Ringcentral, Inc. (RNG) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Salesforce Inc. (CRM) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Zoom Communications, Inc. (ZM) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.