Build-A-Bear Workshop, Inc.’s BBW asset-light strategy is emerging as a key driver of its growth momentum. The company’s partner-operated retail model is enabling rapid international expansion without the heavy capital burden of corporate ownership. In the second quarter of fiscal 2025, Build-A-Bear added 14 net new global experience locations, of which nine were partner-operated. These stores now account for roughly 25% of the total location base.

CEO Sharon Price John emphasized that this model allows the brand to scale efficiently while leveraging partners’ local knowledge and operational capabilities. The company’s expansion to 32 countries demonstrates how the approach accelerates market penetration with minimal incremental investment. Partners such as Great Wolf Lodge and Girl Scouts in the United States, and international operators in emerging markets like Georgia and Uzbekistan, highlight the effectiveness of this framework.

The benefits are visible across several metrics. For the first half of fiscal 2025, Build-A-Bear’s EBITDA margin rate of nearly 17% had more than tripled the rate achieved in the first half of fiscal 2019. Pre-tax income surged 32.7% in the second quarter to a record $15.3 million, while the gross margin expanded 340 basis points to 57.6%.

The model also extends to wholesale distribution, with partner-operated toy stores driving additional sales of Build-A-Bear’s Mini Beans collection. By outsourcing capital-intensive retail buildouts, Build-A-Bear converts fixed costs into variable ones, strengthening margins and cash flow. The model’s scalability supports long-term brand growth and profitability, reinforcing its role as a sustainable engine of expansion.

What the Latest Metrics Say About Build-A-Bear

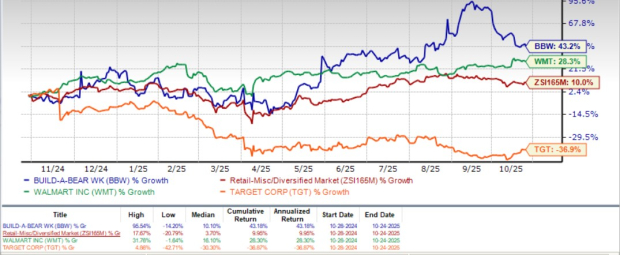

Build-A-Bear, which competes with Walmart Inc. WMT and Target Corporation TGT, has surged 43.2% over the past year, outperforming the industry’s growth of 10%. While Walmart shares have rallied 28.3%, Target has declined 36.9% in the aforementioned period.

Image Source: Zacks Investment Research

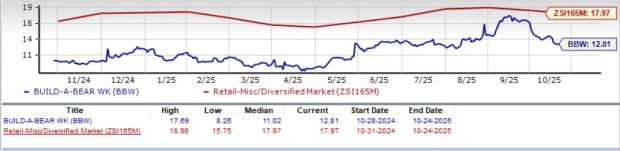

From a valuation standpoint, Build-A-Bear's forward 12-month price-to-earnings ratio stands at 12.81, lower than the industry’s ratio of 17.97. BBW carries a Value Score of A. Build-A-Bear is trading at a discount to Walmart (with a forward 12-month P/E ratio of 37.36) but at a premium to Target (11.90).

Image Source: Zacks Investment Research

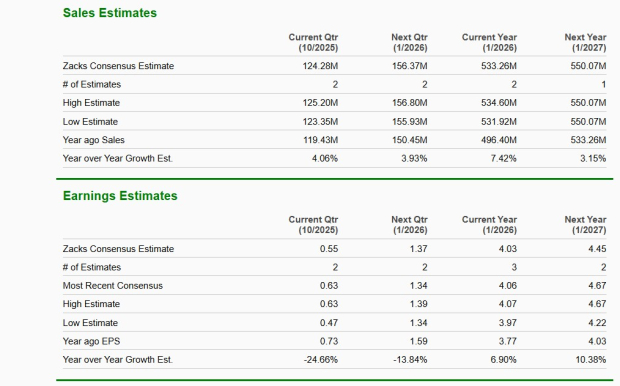

The Zacks Consensus Estimate for Build-A-Bear's current financial-year sales and earnings per share implies year-over-year growth of 7.4% and 6.9%, respectively.

Image Source: Zacks Investment Research

Build-A-Bear currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Beyond Nvidia: AI's Second Wave Is Here

The AI revolution has already minted millionaires. But the stocks everyone knows about aren't likely to keep delivering the biggest profits. Little-known AI firms tackling the world's biggest problems may be more lucrative in the coming months and years.

See "2nd Wave" AI stocks now >>Target Corporation (TGT) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

Build-A-Bear Workshop, Inc. (BBW) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.