Boston Scientific’s BSX Neuromodulation business develops and manufactures devices to treat various neurological movement disorders and manage chronic pain. This segment reflects the company’s long-term commitment to gain leadership through innovation and targeted acquisitions, along with strategies to sustain and accelerate growth across neuromodulation therapies.

In the first quarter of 2025, the Neuromodulation segment experienced 6.8% year-over-year operational sales growth, with the Brain franchise growing mid-single digits and the Pain franchise gaining high-single digits. Within the pain portfolio, the Intracept procedure (for chronic vertebrogenic low back pain) witnessed strong double-digit growth, backed by five-year clinical data showing long-term efficacy and cost-effectiveness of this treatment. Additionally, within deep brain stimulation (DBS), growth was driven by the launch of Cartesia leads and the rollout of the Lumina 3D programming algorithm in the United States.

Boston Scientific continues to invest in neuromodulation platforms and is strengthening commercial capabilities. The Neuromodulation segment is expected to show improvement as 2025 progresses, with organic contribution from recent acquisitions like Relievant and Axonics. Management expects the Neuromodulation business to grow above the market over time.

Progress of BSX’s Competitors in the Neuromodulation Field

In the first quarter of 2025, Abbott’s ABT Neuromodulation segment demonstrated strategic progress through innovation and clinical advancement. The company began treating patients in its TRANSCEND clinical trial, a first-of-its-kind study designed to evaluate the use of DBS to address treatment-resistant depression. This initiative positions Abbott at the forefront of expanding DBS applications beyond movement disorders into mental health. The trial supports Abbott's long-term vision of developing transformative therapies for hard-to-treat neurological and psychiatric conditions.

Medtronic's MDT Neuromodulation business grew low-double-digit year over year in the fiscal fourth quarter of 2025, significantly outperforming the market, driven by strong product launches and innovation. Within the Pain Stim business, the company experienced low double-digit growth, driven by the mid-teens United States growth, on the continued launch of the Inceptiv spinal cord stimulation (SCS) device. This device is the smallest and thinnest closed-loop SCS device available and offers best-in-class MRI compatibility. The other big driver of Neuromodulation growth was the brain modulation business, which grew mid-single digit globally on the continued launch of Percept RC with BrainSense technology.

BSX Stock Price Performance

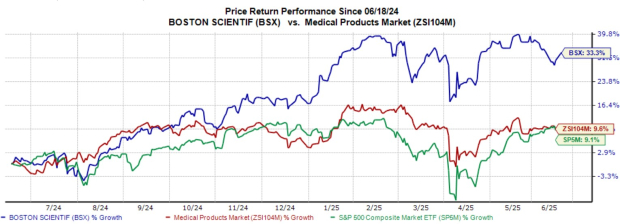

Shares of Boston Scientific have gained 33.3% in the past year compared with the industry’s growth of 9.6%. The S&P 500 composite has grown 9.1% in the same period.

Image Source: Zacks Investment Research

Boston Scientific’s Valuation

From a valuation standpoint, BSX trades at a forward 12-month price-to-earnings ratio (P/E) of 33.11X, above the industry’s 21.09X.

Image Source: Zacks Investment Research

BSX Stock Consensus Estimate Trend

The Zacks Consensus Estimate for BSX’s earnings has been on the rise over the past 60 days.

Image Source: Zacks Investment Research

BSX stock currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in the coming year. While not all picks can be winners, previous recommendations have soared +112%, +171%, +209% and +232%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Abbott Laboratories (ABT) : Free Stock Analysis Report

Boston Scientific Corporation (BSX) : Free Stock Analysis Report

Medtronic PLC (MDT) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.